Some of the most significant advancements of our day are cancer research, meat substitutes and innovative home technology.

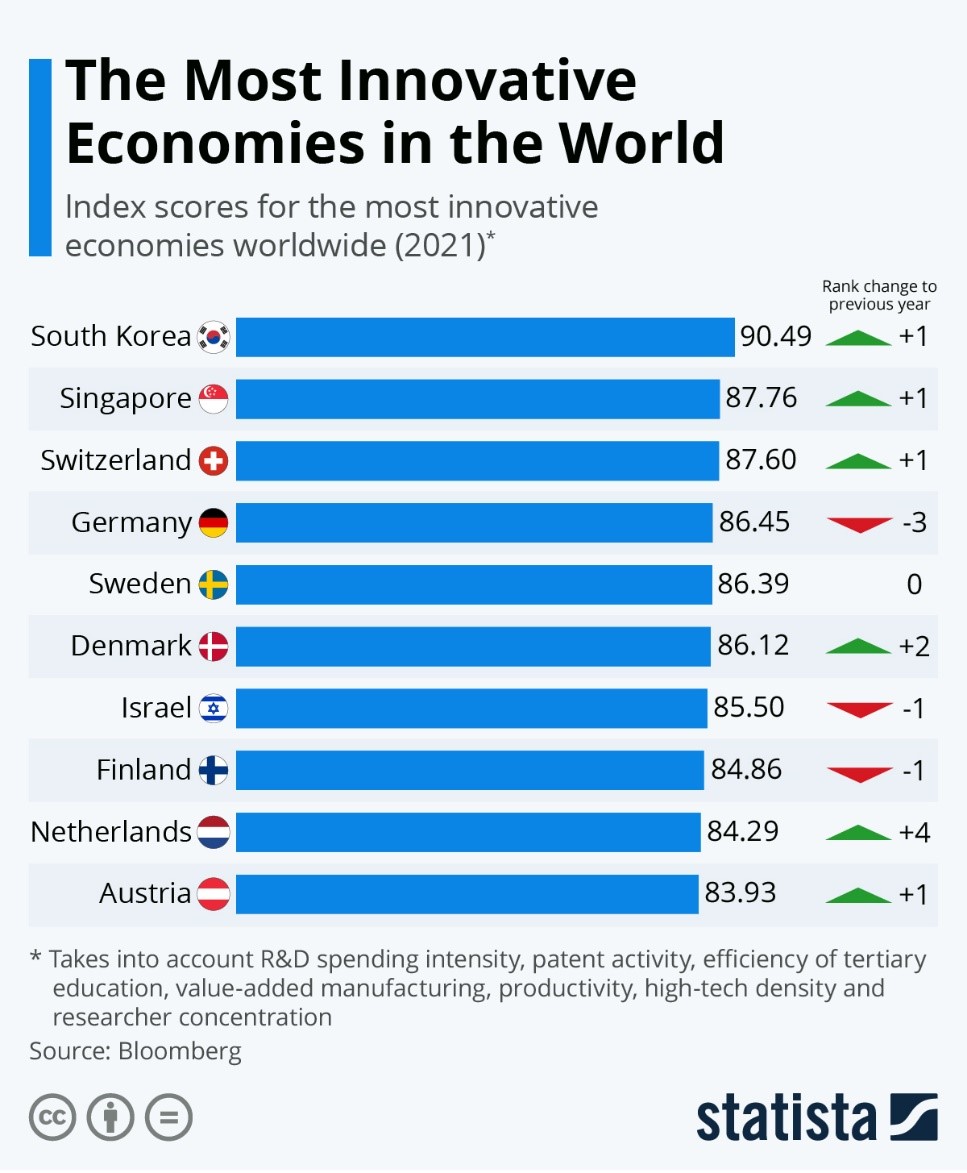

So, which nation tops the globe in R&D, patent activity, high-tech density and all other aspects of supporting innovation? The most inventive nations are listed above from a Bloomberg report in 2021. South Korea came in first place. Then, in 2022, Global Finance ranked South Korea as the world’s most technologically advanced country.

South Korea is a critical player in the global economy. They lead in fintech, while the country’s exports continue to grow at a healthy pace. Brand names like Samsung, Hyundai and Kia are international names associated with value and high tech.

South Korea’s automotive exports hit the highest in eight years in the first half of 2022 due to strong demand for eco-friendly vehicles. The production of eco-friendly cars, including electric and hydrogen-powered vehicles, surged 46% to hit a record high. Shipments to the United States, South Korea’s largest export market for cars, also gained ground on solid SUV demand. The U.S. car imports from South Korea in the January-June period jumped 30% from a year earlier to reach a record 520,133 units.

So, what does this mean for investors?

Get Exposure to Korea’s Cyclical Export Growth and Innovation

Concerning another avenue of innovation, South Korea’s population (some 51 million) estimates are that 15.1 million, or nearly 1/3, have cryptocurrency accounts.

The iShares EWY ETF provides broad exposure to large and mid-sized companies in South Korea. If you’re looking for a way to add some diversity to your investment portfolio, you may want to consider investing in EWY.

Currently EWY is back trading at pre-COVID levels, giving it historical support. The ETF has a P/E of 8.61, and 33% of the fund is in the tech sector. U.S. tech has a price-to-earnings multiple of 28.6 as of July 15, 2022, so you are buying global innovation at value levels.

This past week, EWY made a new multiyear low at 55.02. You can see from the price Bollinger bands that it had a mean reversion the same day it made the low. Subsequently, the real motion indicator did not make a new low, telling us that the momentum was not nearly as weak as the price.

As far as our triple play indicator, EWY is underperforming the benchmark at this time. Nonetheless, the reversal off the lows along with the gap up the following day to end the week looks compelling.

Tightening monetary policy, higher inflation and worsening financial conditions are global in nature. Korea is not immune from recessionary forces, but, with a diversified portfolio, you’ll be able to weather potential economic storms.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish presented the Friday, July 15 edition of StockCharts TV’s Your Daily Five, where she quiets the noise and give you 5 stock picks she is looking at, plus a bonus!

In this special edition of StockCharts TV’s Mish’s Market Minute, Mish covers two price levels that may well illustrate what’s to come during the second half of the year.

In this OANN video, Mish goes through the factors related to inflation and the Fed on what will determine the next trend.

Appearing on Business First AM, Mish talks about the High-Yield Bond ETF (HYG).

Read this week’s CMC Markets article from Mish: “Where’s the Market Heading? The 6 ETFs to Track”

In an earlier appearance on Business First AM, Mish talks about the big data week and what to watch for if the market is to bottom.

ETF Summary

- S&P 500 (SPY): 371-386 new trading range to watch.

- Russell 2000 (IWM): 167 support thru 170 maybe 177 on tap?

- Dow (DIA): 301 support and needs to clear 315.

- Nasdaq (QQQ): 277 to 294 range.

- KRE (Regional Banks): 56 the 200-WMA; 60 resistance.

- SMH (Semiconductors): Led the march with 210 now pivotal, and resistance up at 220.

- IYT (Transportation): A clutch close above 212 or the 200-WMA.

- IBB (Biotechnology): 129.50 resistance, 117 support.

- XRT (Retail): 60.75, the 200-WMA resistance, did not clear with 57.50 support.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education