The key reports this week are June Housing Starts and Existing Home Sales.

—– Monday, July 18th —–

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 66, down from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.—– Tuesday, July 19th —–

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June.

—– Wednesday, July 20th —–

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.—– Thursday, July 21st —–

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand down from 244 thousand last week.—– Friday, July 22nd —–

10:00 AM: State Employment and Unemployment (Monthly) for June 2022

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 66, down from 67. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June.

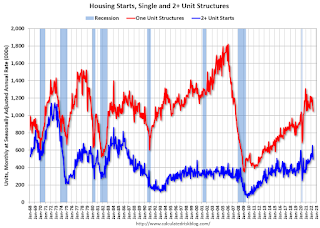

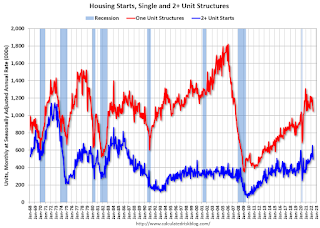

This graph shows single and total housing starts since 1968.

The consensus is for 1.586 million SAAR, up from 1.549 million SAAR in May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

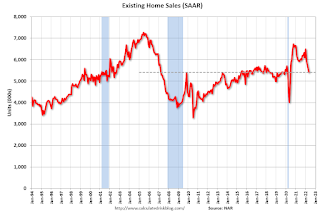

The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.12 million SAAR for June.

During the day: The AIA’s Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand down from 244 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 5.5, up from -3.1.

10:00 AM: State Employment and Unemployment (Monthly) for June 2022