From Matthew Graham at Mortgage News Daily: Lots at Stake With Important Inflation Data This Week

From Matthew Graham at Mortgage News Daily: Lots at Stake With Important Inflation Data This Week

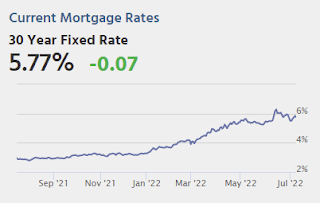

Ultimately, the week will depend on the outcome of several inflation reports. The first one, Wednesday’s CPI, is also by far the most important. Producer prices follow on Thursday and the inflation expectation component of the Consumer Sentiment data hit on Friday morning. If CPI hasn’t already sent a strong enough message by mid-week, this trifecta of reports should go a long way toward helping the market pick a winner between 50bps and 75bps for the next Fed rate hike. It should also offer a strong comment on how high or low the ceiling should be for the trading range in bond yields. [30 year fixed 5.77%]

emphasis added

Tuesday:

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago |

Goal | ||

| Percent fully Vaccinated | 67.0% | — | ≥70.0%1 | |

| Fully Vaccinated (millions) | 222.5 | — | ≥2321 | |

| New Cases per Day3 | 103,907 | 112,666 | ≤5,0002 | |

| Hospitalized3🚩 | 28,320 | 28,238 | ≤3,0002 | |

| Deaths per Day3 | 281 | 352 | ≤502 | |

| 1 Minimum to achieve “herd immunity” (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. |

||||

Click on graph for larger image.

Click on graph for larger image.

This graph shows the daily (columns) and 7-day average (line) of deaths reported.