The two bond ETFs we’ve highlighted suggest something is brewing in the corporate credit market. Keep an eye on these two corporate bonds ETFs to stay ahead of the curve in the stock market.

Maybe you’ve heard that the high-yield market is in trouble, but is that true? And if so, what does that mean for you and your bond and equity holdings?

Risk and return are two essential concepts for any investor to understand. When it comes to bonds, the risk is typically referred to as credit risk. This is the risk that the issuer will default on their obligations to bondholders. To compensate investors for this risk, junk bonds typically offer higher yields than investment-grade bonds.

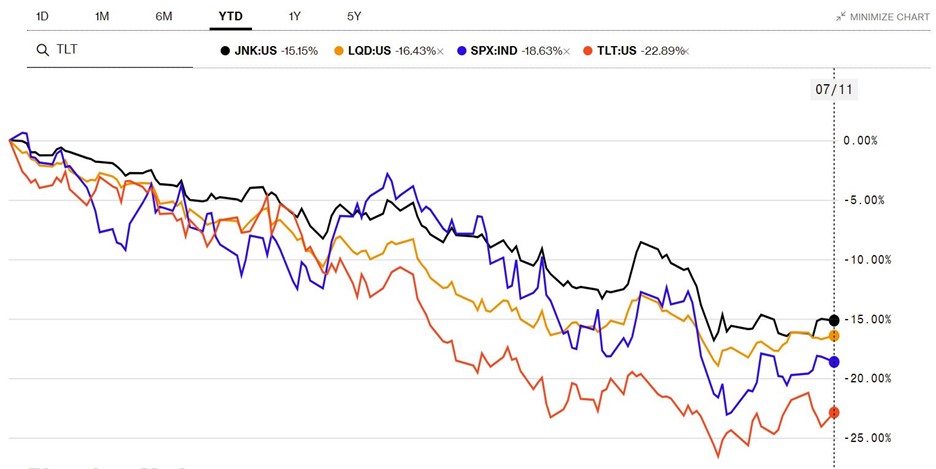

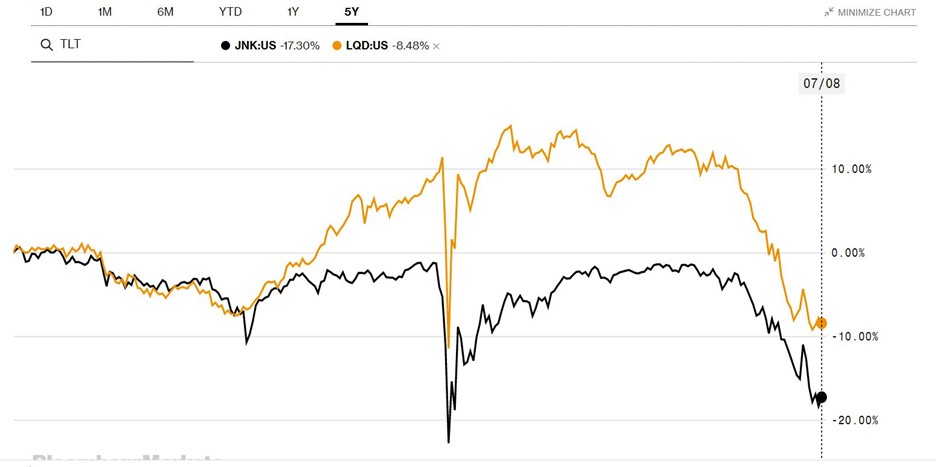

On one side is the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), which tracks investment-grade bonds. On the other side is the SPDR Bloomberg Barclays High Yield Bond ETF (JNK), which tracks junk bonds. Both ETFs have pros and cons.

So, what does all this mean for you? It means that now might be an excellent time to understand how these credit spreads telegraph and indicate what might happen.

There are specific macro indicators that can give us clues about which way the markets might be heading. One such indicator is the yield on corporate bonds and the spread between high yield and corporate grade. Currently, yields are down, while the credit spread, or difference, is decreasing.

One of the casualties of the Fed’s recent rate hikes has been the bond market. As rates have climbed, bond prices have fallen, and many investors have seen their portfolios take a hit. However, not all bonds are equally vulnerable to rising rates. Short-term bonds tend to be more resilient, and they may even offer some attractive opportunities for yield-seeking investors.

The current yield gap between corporate, junk bonds, and Treasuries is about four to five percentage points; ample, but not historically huge. Inflation is showing no sign of letting up, and investors are worried that the Federal Reserve’s plans to keep hiking interest rates could lead the economy into a recession next year, if not in 2022. With more rate hikes widely expected, short-term rates have climbed particularly fast, with the two-year Treasury yield exceeding the 10-year yield—a sign that bond investors have a gloomy outlook for the economy.

Is a Credit Collapse Imminent?

Investment-grade bonds are traditionally considered safer than junk bonds, but offer lower returns. Over the last five years, LQD has outperformed JNK by a significant margin.

When comparing two bonds, yield is not the only thing that matters. Credit quality is also an important consideration. Junk bonds are debt securities that have been rated as below investment grade by one or more rating agencies. This means that there is a higher risk of default, which, in turn, means that investors demand a higher rate of return. The underperformance of high-yield bonds relative to investment-grade corporates suggests that the market is pricing in a higher probability of defaults. If these trends continue, it could mean trouble for the stock market, as investors may start to sell stocks in favor of safer bond investments, such as two-year treasuries for 3.12%.

If you’re interested in learning more about macro indicators, like bond spreads and how to use them to make better investment decisions, I highly recommend subscribing to my newsletter. You’ll get exclusive access to my latest insights, analysis, and commentary. Click here to subscribe.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealthand a special bonus here.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealthand a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

See Mish as she joins MarketGauge’s Keith Schneider, DecisionPoint’s Erin Swenlin and StockCharts’ David Keller to discuss how they coped with past prolonged bearish periods in the new StockCharts TV special presentation “Survival of the Fittest: A Brief History of Bear Markets”.

Mish discusses the best investments now and what strategy traders should use on TD Ameritrade.

Mish explains how the Fed has been behind the curve and what can happen as a result on Yahoo! Finance.

Mish describes the difference between recession, growth and stagflation and the markets reaction on BNN Bloomberg.

See Mish explain how buyers’ remorse and hope are driving Musk’s negotiations with Twitter in this Fox Business appearance.

Mish walks thru some of the caveats of the jobs report and why stagflation is still a thing with Neil Cavuto on Fox Business.

Mish talks about China, ARKK, Staples and Commodities – regardless where the economy goes – in this appearance on Fox Business’s Making Money with Charles Payne.

Read Mish’s latest article for CMC Markets, “When Dr. Copper Speaks, We Listen“.

With newer fears of recession, Mish takes a walk back to the 1970s, when dislocation wreaked havoc by the end of the decade, in this video from Bloomberg TV.

ETF Summary

- S&P 500 (SPY): 383 now support with 397 best overhead resistance.

- Russell 2000 (IWM): 170 support and could not get a weekly close over 176.50.

- Dow (DIA): 307 support and needs to clear 315.

- Nasdaq (QQQ): 288 now support with 297.00 the overhead 50-DMA.

- KRE (Regional Banks): 56 the 200-WMA, 60 resistance.

- SMH (Semiconductors): 200 now interim support, 210 resistance.

- IYT (Transportation): 211.90 support with resistance at 220.

- IBB (Biotechnology): 129.50 big resistance.

- XRT (Retail): Back under 60.75, the 200-WMA.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education