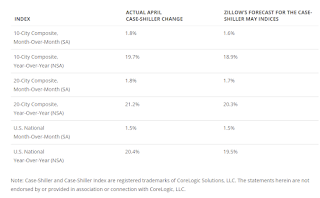

Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow Research: April 2022 Case-Shiller Results & Forecast: Putting on the Brakes

With rates continuing their steep ascent and inventory picking up in months since, April is likely the first month of this deceleration as buyers balked at the cost of purchasing a home and pulled out of the market, leading to slower price growth. While inventory is improving, there is still plenty of room to go before it reaches its pre-pandemic trend. Still, coupled with relatively strong demand, that will continue to be a driver for sustained high prices even as sales volume is dropping in response to affordability constraints. As a result, more buyers will take a step to the sidelines in the coming months, which will help inventory to recover and price growth to slow from its peak, leading the market back to a more balanced stable state in the long run and providing more future opportunities for homeownership for those priced out today.

Annual home price growth as reported by Case-Shiller are expected to slow in all three indices. Monthly appreciation in May is expected to decelerate from April in both city indices, and hold in the national index. S&P Dow Jones Indices is expected to release data for the May S&P CoreLogic Case-Shiller Indices on Tuesday, July 26.

emphasis added