I first published this article in March, 2019 and believe the message then is the same as for today. As a retired money manager I want to share some thoughts on that profession and investors in general. Portfolio management is as much about managing emotions as it is about correlations, standard deviations and Sharpe ratios. Over the decades much has been written about the “math” of portfolio management but the emotional aspect of the investment decision making process does not receive nearly the attention or research. However, Behavioral Finance is a relatively new field that seeks to combine behavioral and cognitive psychology theory with conventional economics and finance to provide explanations for why and how people make investment decisions.

I first published this article in March, 2019 and believe the message then is the same as for today. As a retired money manager I want to share some thoughts on that profession and investors in general. Portfolio management is as much about managing emotions as it is about correlations, standard deviations and Sharpe ratios. Over the decades much has been written about the “math” of portfolio management but the emotional aspect of the investment decision making process does not receive nearly the attention or research. However, Behavioral Finance is a relatively new field that seeks to combine behavioral and cognitive psychology theory with conventional economics and finance to provide explanations for why and how people make investment decisions.

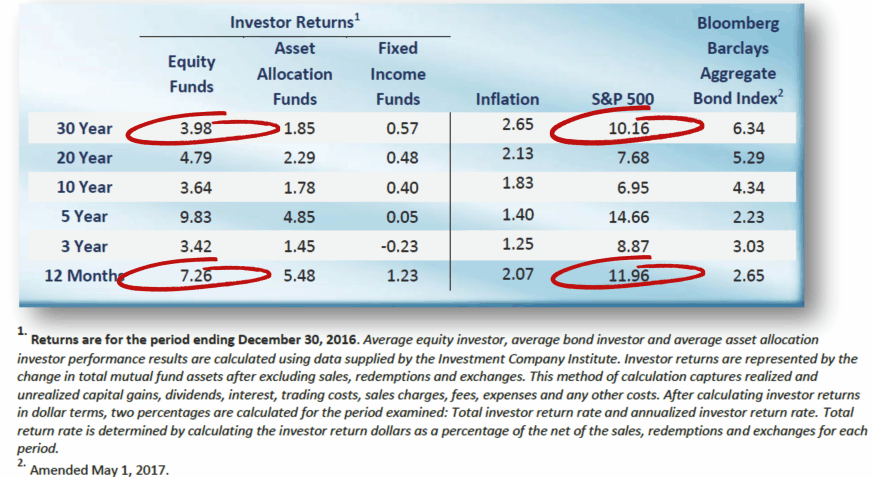

There is a great deal of research demonstrating that investors consistently underperform the S&P 500. The most frequently cited research comes from Dalbar, Inc. The Dalbar research shows that investors have underperformed S&P 500 index by over 6 percentage points per year over past 30 years.

Table A Source: Dalbar, Inc.

Table A Source: Dalbar, Inc.

Even with some of the brightest, most well educated, and well-intentioned professionals, about 70% of money managers also underperform their benchmarks. Is there something taking place in our brains that impairs our ability to make rational investment decisions? These same abilities that helped in making us smart at so many things make us not so smart when it comes to investing.

Behavioral Finance has uncovered a surprising number of subconscious idiosyncrasies that can prevent investors from achieving their long-term goals as they fall prey to potential traps. This article will shed light on—and help address—some of the more common idiosyncrasies that often impact the investment decision making process and lead to poor decision making, as well as provide some knowledge to overcome common behavioral traps.

Data has shown that investors as a whole continue to buy and sell at exactly the wrong time. While we cannot possibly know the specific reasons, a shallow understanding of the human psyche will offer some answers. Investors tend to react to news without doing any analysis, and it doesn’t matter if it is considered good news or bad. Investors become mesmerized by long running bull markets and absolutely unnerved by bear markets. Investors try to match the investment acumen of their relatives, neighbors, friends, business associates, and even complete strangers, if anyone in that group have claimed, even casually, that they have done well in the market.

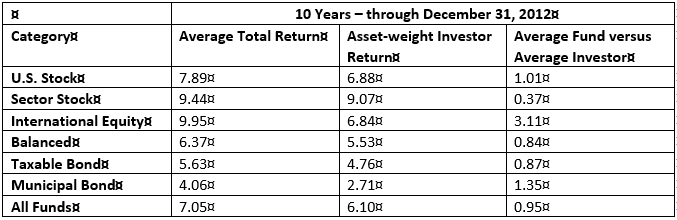

Another study put out by Morningstar’s Russell Kinnel on 2/4/2013, shows the same problem with investors; investors as a whole do quite poorly compared to indices. Based upon all funds, the average investor lagged the average fund by 0.95% annualized over the last ten years.

Table B

Table B

The bottom line is that most investors fail to have the discipline to follow a systematic approach which will assist them on detaching their emotions from their decisions. Here is a list of investor faults when it comes to investing. Books are filled with much more and with much more detail, I just wanted to include the ones that I have experienced, with the Lack of Discipline being the one that can cause the most pain.

Lack of Discipline

Impatience

Greed

Refusal to Accept the Truth

No Objectivity

Impulse Behavior

Avoid False Parallels

Your human brain will play tricks on you. If you take an escalator or moving sidewalk when going to work and do so frequently, you will understand. Your brain will cause an automatic (involuntary) action to assist you as you step onto the escalator or moving sidewalk. You might not even realize it. However, if one day the escalator is stopped, and you notice that it is stopped, you will almost stumble as you step onto it because your brain is programmed to assist, and this time that assistance is not helpful, even though you knew it was not moving prior to stepping on it.

One critical solution to overcoming flawed investor behavior is having a proven, disciplined and repeatable process that guides decision-making absent emotion. Discipline keeps your emotions in check and your perceptions clear. But discipline requires intellectually identifying a process you trust, then sticking with it in good times and bad, even when your emotional biases begin railing against it. No strategy is always perfect.

January of 2013 a study was released entitled “Head and Shoulders above the Rest? The Performance of Institutional Portfolio Managers who use Technical Analysis.” The study looked at more than 10,000 institutional portfolios; about one-third of actively managed equity and balanced funds use technical analysis. The study compared the investment performance of funds that use a technical approach versus those that do not. The Funds using technical analysis appeared to have provided a meaningful advantage to portfolios that do not use a technical approach.

The bottom line is that it is critical for all investors to acknowledge the possibility that deep-seated behavioral flaws can negatively impact investment decision making, and that in proportion to the absence of discipline, the investment process may be doomed to fail. I have written a number of articles entitled “Know Thyself,” in which I cover many of the human failings and heuristics. Below are links to those articles.

Dance with the Trend,

Greg Morris