All of the stocks and ETFs in our 5 current portfolios are “drafted” in real time during our members-only events that we hold quarterly. I don’t Monday Morning quarterback. I listen to what Wall Street is saying and stick with the themes that are driving big money. It’s almost counterintuitive, because leading stocks are almost always overbought. Our mental composition many times won’t allow us to pay more for a stock than we could have paid last week, month, or quarter. So we try to convince ourselves that a stock is not worth the price that it currently trades. And when it does finally pull back a bit, we convince ourselves that a bigger drop is imminent and we pass on the buying opportunity. It’s happened over and over and over again with our portfolio stocks. When we “draft” our stocks, we simply pay the current price for all 10 of our equal-weighted stocks in each portfolio. We don’t try to time it. That strategy isn’t for everyone and I get it. It’s hard to pull the trigger after a stock has already made a significant advance. When I announced our latest Model Portfolio stocks at EarningsBeats.com on November 19th and selected Tesla (TSLA), it had just closed at 499.27, its highest close in history. Many EarningsBeats.com members asked, “Should I wait for a pullback?” My answer is always the same. Members have to make decisions that are most comfortable for them. Everyone is different. We buy as of that day’s close, no exceptions, and we hold a full three months. I believe it’s important to be transparent and disciplined. It also makes it very easy for those members who simply don’t want to follow the market every single day, trying to make emotional decisions about when to buy or sell. For what it’s worth, TSLA never pulled back and it’s up 69% since our selection date.

All of the information that we share and produce at EarningsBeats.com is educational. I believe we have the best research and educational platform anywhere. Our members include those who trade, those who manage their investment portfolio/retirement assets, and plenty of professionals managing money for themselves and others. We offer stock services and, more recently, ETF services. The results in our portfolios have been stunning.

Our Objective: Beat the S&P 500

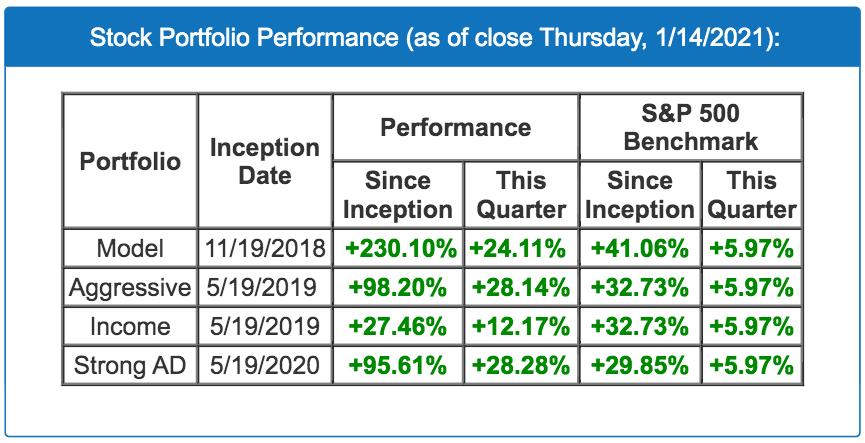

Everyone should have a goal, whether it’s investing, working your way up the corporate ladder, coaching a youth sports teams, whatever. Our goal is to provide a research and educational platform that helps our members beat the S&P 500. Our portfolios, which I consider to be an educational product, are designed utilizing the tools and strategies that we constantly strive to improve. For the current quarter and since their respective inceptions through Thursday’s close, here is the performance of each of our stock portfolios:

Model ETF Portfolio

Our Model ETF Portfolio commenced on October 19, 2020, and performance is not yet incorporated onto our website, but here’s the updated performance through Thursday’s close:

Current Quarter (10/19 – 1/14): +17.18% (S&P 500: +10.76%)

Outperforming the benchmark by more than 6 percentage points in less than 3 months by investing in 8 different ETFs is outstanding and, quite honestly, better than I would have expected.

The EarningsBeats.com Approach

We simply marry excellent fundamentals with stout technicals. Seems easy enough. Yet the results have been stunning. All of our stock portfolios contain 10 equal-weighted leading stocks (at the beginning of each quarter) in 10 different leading industries (most cases). Every stock MUST have beaten Wall Street estimates as to both revenues and EPS in its latest quarterly earnings report. The Strong AD Portfolio is the only portfolio where we allow any exceptions to this rule, but those exceptions are rare.

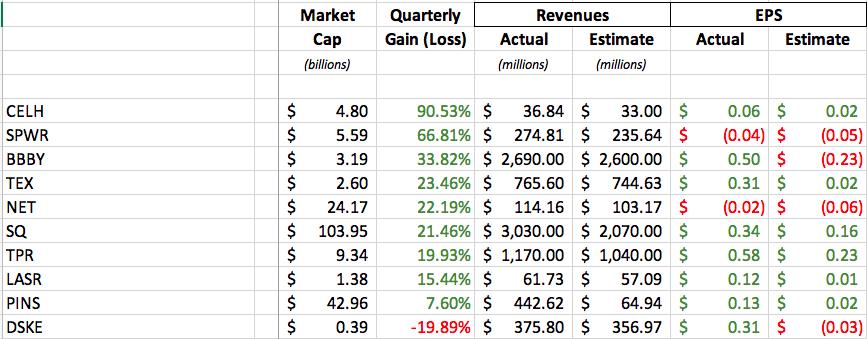

The following stocks are the 10 stocks that make up our current Aggressive Portfolio, which is beating the S&P 500 by more than 22 percentage points in just under two months:

Several points to consider:

- 7 of the 10 stocks are either small-cap or mid-cap stocks

- All 10 stocks beat Wall Street estimates, several by very wide margins

- The stocks are ranked in order of quarterly gains (to date)

- SPWR and BBBY are both on our Short Squeeze ChartList, indicative of extremely high short % of float

- Just one stock, like CELH and its 90% gain, can carry a portfolio

Recognizing Themes

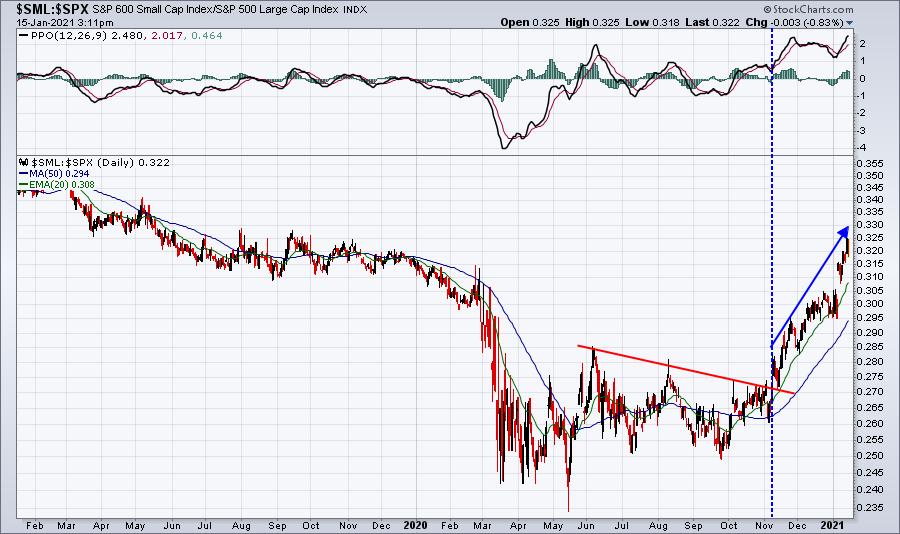

Just before our last portfolio “draft”, we had two major positive vaccine announcements, which changed the market’s focus and rotation. One of those changes was the emerging leadership of small caps. Check out this relative performance chart of the S&P 600 Small Cap Index ($SML) vs. the benchmark S&P 500 Index ($SPX):

Small caps broke out relative to their large cap counterparts just before our last draft. As a result, we wanted our Aggressive Portfolio to hold a majority of small- and mid-cap stocks. It was a very deliberate change to our strategy based on market conditions at that time. The four best performers in our portfolio are small caps.

Perhaps the most critical element in understanding the current secular bull market is that rapid expansion of earnings will be handsomely-rewarded in a historically-low interest rate environment. If you want to compare PE ratios now to prior market tops, go ahead and do so…..at your own peril. From my background in public accounting, I can tell you that rising earnings combined with lower interest rates will trigger massive increases in market value. The most important thing to understand is there are NO investing alternatives that compare to equities. Everyone will bid shares higher, because there’s nothing else to do with your money.

Strategizing to Select the Right ETFs

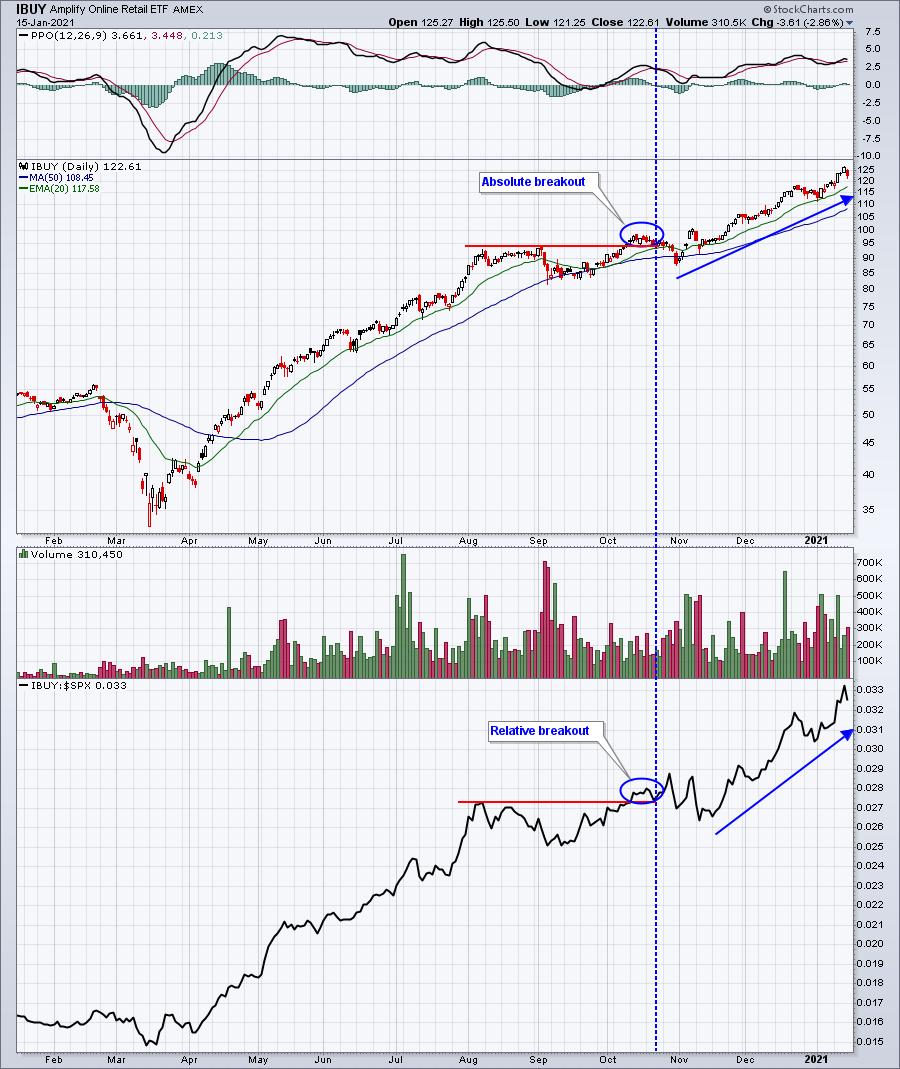

Exchange-traded funds (ETFs) are a bit different story in that we don’t have any control over the stocks that we invest in. We’re relying entirely on the fund. But we can still control the makeup of our ETF portfolio, ensuring that we have exposure in the areas we want. For instance, back in October 2020, when we started the Model ETF Portfolio, one theme that really stood out was the online retail area. The Amplify Online Retail ETF (IBUY) chart is shown below:

The absolute and relative breakouts were a primary reason that the IBUY was our most heavily-weighted ETF for the current quarter.

On Tuesday, January 19th, I’ll be hosting our next Model ETF Portfolio “Draft”, announcing the next group of ETFs that we’ll have in our portfolio for the next 3 months. On Monday, I’ll discuss a very strong ETF in our free EB Digest newsletter that I may end up including in our Model ETF Portfolio. CLICK HERE to subscribe and receive Monday’s article.

By the way, if you prefer trading ETFs over individual stocks, you’ll likely be very interested in an event that we had last week, “Building an ETF Portfolio the Right Way.” We recorded the event and it’s free at YouTube. Various topics are time-stamped for your convenience. Be sure to subscribe to our channel while you’re there.

Happy trading!

Tom