If you’re looking to invest in a commodity with high trading potential, sugar has seen significant price fluctuations in recent years.

Sugar prices have been rising due to increased demand in countries like China and India, which is likely to continue. Many factors affect the global sugar market, ranging from political and economic factors to environmental and health concerns. Sugar prices also have a historically low correlation with the overall U.S. equity market, making sugar an attractive option, as represented by the CANE ETF shown above.

Sugar remains a profitable commodity for those who understand the market risk.

Sugar futures are one way to invest in sugar. A select few ETFs, like CANE shown above, provide access to sugar futures through an ETF. The Teucrium Sugar Fund (CANE) provides investors with an easy way to gain exposure to the price of sugar futures.

On the daily chart, our proprietary Real Motion Indicator displays that CANE’S price can continue higher. CANE is above the 200-day moving average, and our Triple Play Indicator exhibits new leadership performance. CANE is attempting to overtake the SPY, indicating a possible change in leadership.

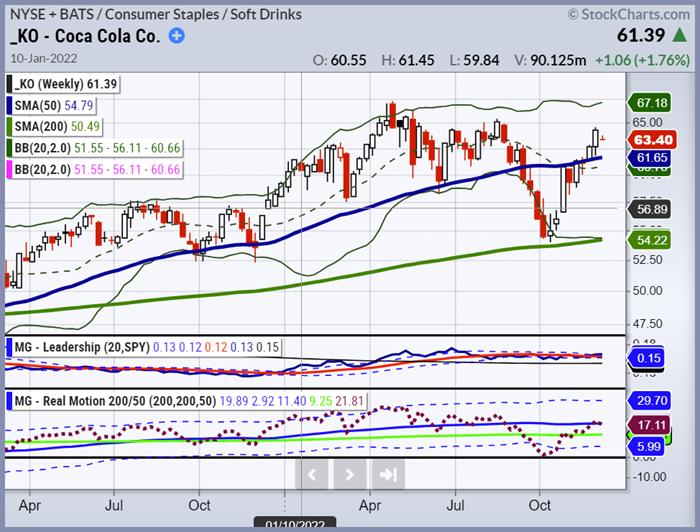

Another way to get exposure to sugar is by purchasing stock in a company that makes foods or drinks with sugar. This strategy does put all your eggs in one company, for example, Coca-Cola (KO), which is up 6.8% year-to-date. Coke is an excellent example of a company with a premium product and pricing power. Coca-Cola is in a bullish phase and can raise the price of its products.

Our platform offers trading ideas, like CANE and Coca-Cola, with real-time alerts for buys and stops – so investors can make informed trading decisions, such as when to buy or sell. In addition, we also offer live trading analysis of markets, including the sugar market, and provide our analysis available on private video demand so investors can understand and review what’s driving the market and the pricing of specific commodities.

If you are looking for a sweet trade with the potential for significant returns and vol, sugar may be just what you’re after. Please remember that when it comes to higher sugar prices, turmoil and chaos are often around the corner – so stay alert and manage your risk.

Rob Quinn, our Chief Strategy Consultant, can provide more information about our commodity trading and Mish’s Premium Trading Service. Click here to learn more about Mish’s Premium trading service with a complimentary one-on-one consultation.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Read Mish’s latest article for CMC Markets, titled “Can the Commodity Super-Cycle Persist into 2023?“.

Mish talks stagflation in her interview by Dale Pinkert during the F.A.C.E. webinar.

Watch Mish’s appearance on Business First AM here.

Mish hosted the Monday, November 28 edition of StockCharts TV’s Your Daily Five, where she covered some of the Modern Family. She also discusses the long bonds and gold with levels to clear or, fail.

ETF Summary

- S&P 500 (SPY): 396 support, 404 resistance.

- Russell 2000 (IWM): 179 support, 185 resistance.

- Dow (DIA): 337 support, 343 support.

- Nasdaq (QQQ): 284 support, 290 resistance.

- KRE (Regional Banks): 58 support, 63 resistance.

- SMH (Semiconductors): 218 support, 224 resistance.

- IYT (Transportation): 222 support, 229 resistance.

- IBB (Biotechnology): 133 support, 138 resistance.

- XRT (Retail): 62 support; 68 resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Wade Dawson

MarketGauge.com

Portfolio Manager