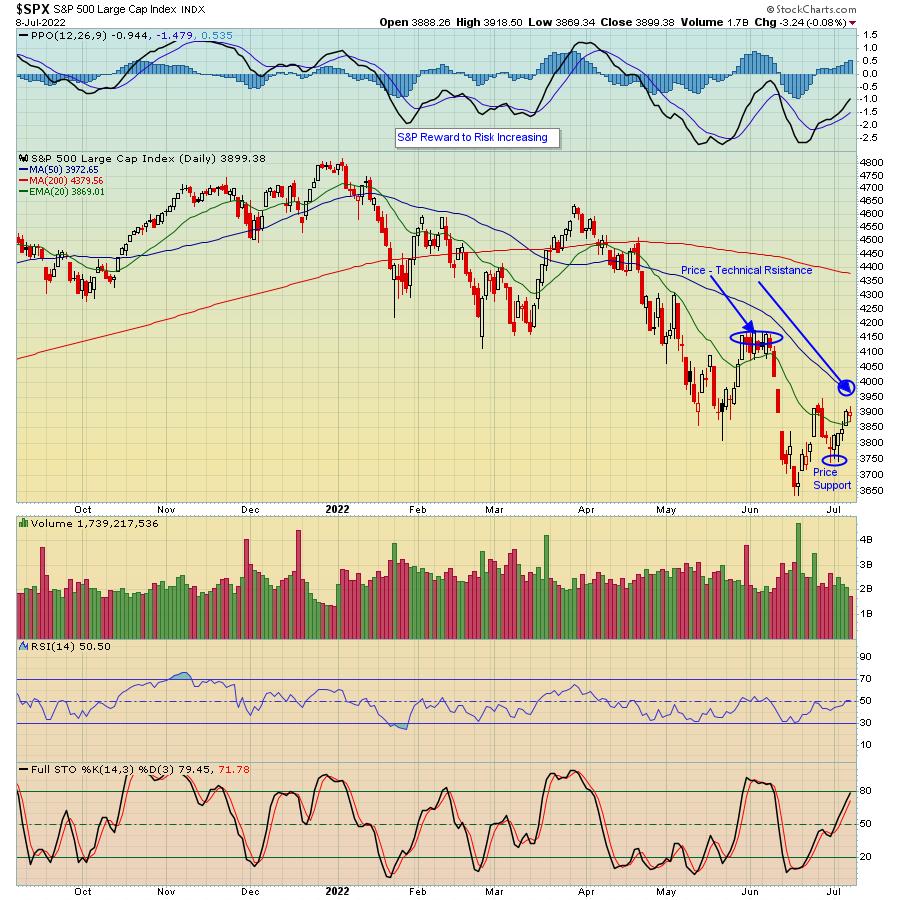

When the S&P hit a low of 3636 on June 17 (what I refer to as the “Bowley Bottom”), it had fallen almost 25% from its January 4 high of 4818. Since that June 17 low, the S&P rose 7.7%, touching 3918 on Friday. And even though the market initially sold off sharply on Friday’s employment numbers, that didn’t last long, as we saw buying interest on the pullback with higher lows throughout the week.

If you look at the chart above, at this point, the first key level of technical support is the 20-day moving average, currently at 3869. Then, there should be strong price support in the 3740 level, which, I think, will hold on any near-term pullbacks, with that 3636 level being the final important level of support, To the upside, the first key level of technical resistance is 3972, the 50-day moving average, with key price resistance near the 4175 level. So, based on my analysis, if the S&P holds 3740, that would represent a move lower from here of roughly 4%. However, if the S&P challenges that 4175 level, that would represent a move higher of 7%, so greater upside to downside risk.

Of course, an awful lot of price movement could be determined over the next few weeks when earnings start coming out in droves. And all you hear these days is that the market hasn’t factored in a recession, which may or may not be true. However, it’s hard to buy the argument many analysts are making, that we are already in a recession, when you look at Friday’s employment report showing such a strong jobs picture.

The bottom line is that it looks like we’ve seen a near-term bottom, as pointed out by our Chief Market Strategist Tom Bowley when the S&P hit that 3636 low. Of course, we could see renewed selling, especially if earnings do indeed come up short. However, I still like the reward-to-risk, which, I believe, is currently to the upside. In the meantime, mark your calendar for Monday, July 18, when Tom will conduct a FREE webinar, our “Q2 Earnings: Sneak Preview” where he will be providing in-depth analysis of upcoming earnings — potential beats and misses — invaluable, timely information. And if you want to be kept up to date on key market and earnings information, just click here to get Tom’s EarningsBeats Digest that comes out every M, W and F.

At your service,

John Hopkins

EarningsBeats.com