Swish! It was another winning week for most of the stocks from my bi-weekly MEM Edge Report. In fact, over 74% of the Suggested Holdings from this report outperformed the broader markets, some doing so by a very wide margin.

Today, I’m going to share with you some of the common characteristics of these winning stocks and, more importantly, quick ways that you can potentially identify and get in front of their big moves. This information is based on a proven system that was developed by famed investor, William O’Neil. For those not familiar, O’Neil was the founder of Investor’s Business Daily and for 15 years, he was my boss as I traveled the globe advising top portfolio managers and analysts on this system.

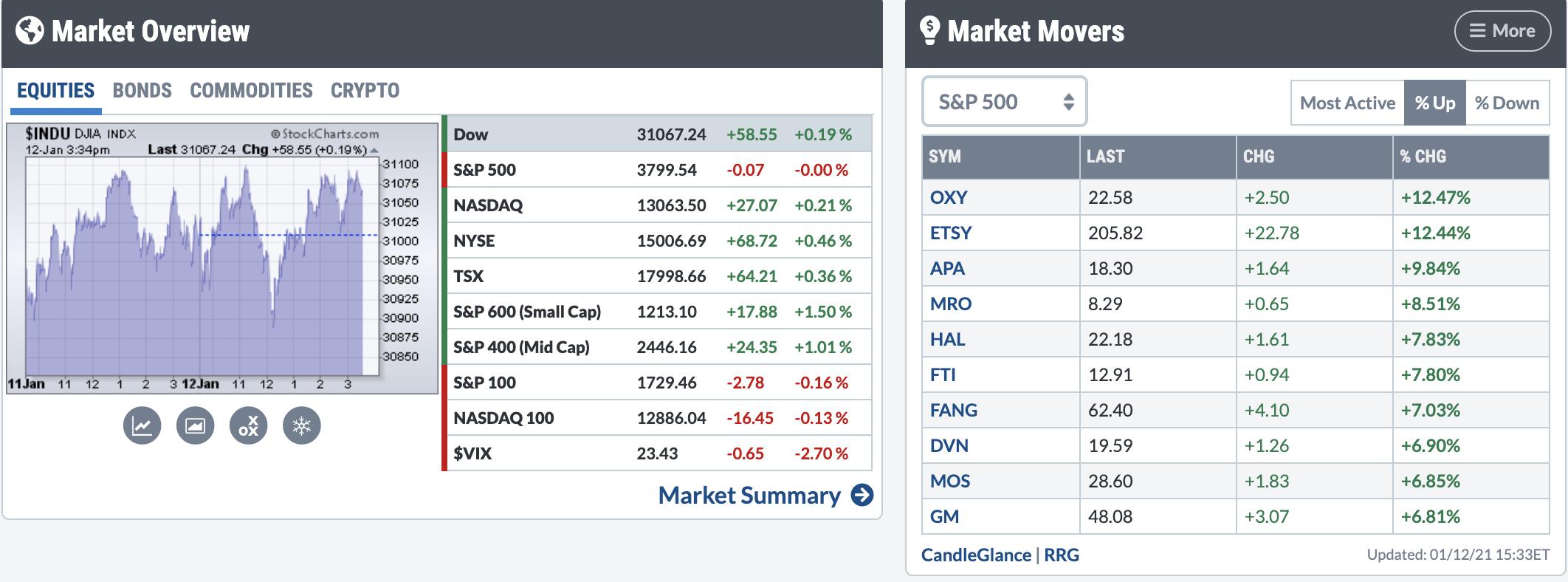

To begin, below I’d like to share an image of the biggest percent gainers in the S&P 500 from this past Tuesday, Jan. 12th, and while the S&P was flat for the day, these stocks gained anywhere from 6.8% to 12.5%.

Biggest Gainers From S&P 500 – January 12, 2021

Within this list, 4 stocks are on my MEM Edge Report’s Suggested Holdings List. The importance here is that these 4 stocks contain those characteristics common among winning stocks and, in addition, their upside potential remains very much in place.

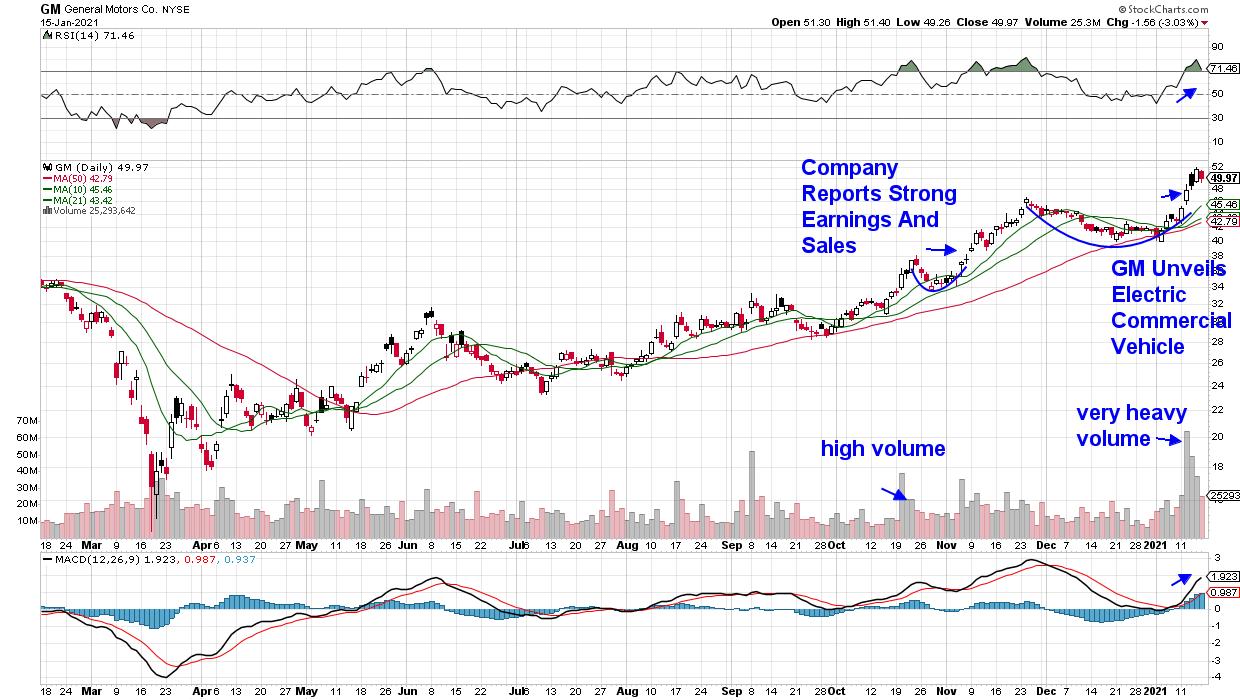

Let’s begin by taking a look at General Motors (GM), which gained 6.8% last Tuesday. GM hit our screens in November, following the company’s release of huge 3rd quarter earnings that were ahead of analysts’ estimates.

Strong earnings are the number one driver of a winning stock’s upward advance.

DAILY CHART OF GENERAL MOTORS CO. (GM)

And when a stock gaps up in price on volume in response to those strong earnings, that name needs to make it onto your list of candidates – especially if it breaks out of a base in the process. We added the stock to our Suggested Holdings List here, as shown above.

After a lengthy pullback to its 50-day moving average, where we advised subscribers to stay with the stock, GM hit our Strong Buy list on Jan. 10th as it broke back above its 10- and 21-day moving averages. This week’s gap up into a base breakout on tremendous volume will keep the stock on our high conviction list.

The reason for GM’s strong advance Tuesday was news that they have a pilot program with FedEx that will lead to the launch of an all-electric cargo van by the end of this year. The innovation that GM is showing is the second of a short list of common characteristics of a winning stock.

Innovation Will Drive Demand in a Company’s Products, Which is Another Characteristic of a Winning Stock.

DAILY CHART OF ETSY INC. (ETSY)

The next big gainer from last Tuesday is Etsy, Inc. (ETSY), which is also on our MEM Suggested Holdings List. The stock had been a big winner for us out of last year’s bear market before we removed it early November after its drop below its 50-day moving average.

ETSY’s 2nd and 3rd quarter earnings results were well north of 400% vs. 2019 as face mask and then home goods’ sales exploded. This innovative platform that connects inventive craftsman with loyal customers is expected to continue to be a winner as the shift to online sales takes hold.

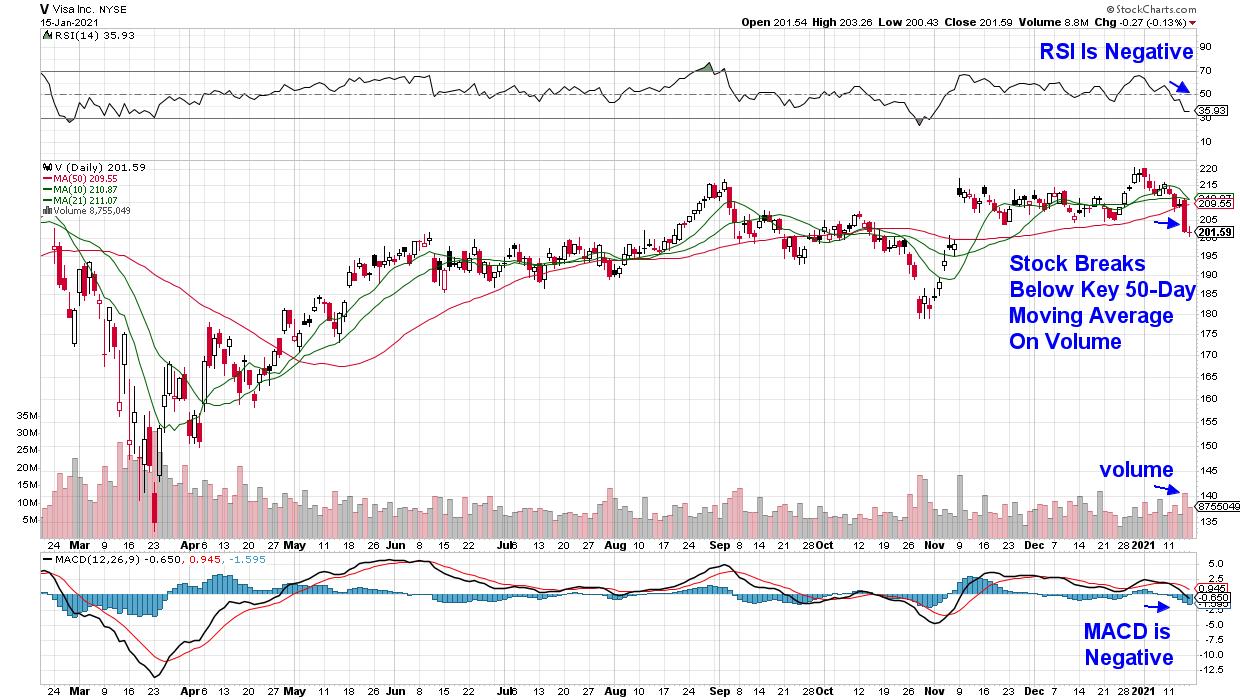

Not every stock that makes it through our strict screening goes on to become a big winner, however, as recent addition Visa (V) can attest to. The good news is that we’re quick to remove stocks when they break below key support, so that potential losses are kept to a minimum.

DAILY CHART OF VISA (V)

One of the more simple ways to begin screening for big winners is to scan the percent gainers on the S&P 500 on a regular basis. A quick view of the charts can be accessed by clicking the word CandleGlance below the list. From there, you can check the health of each stock’s chart to quickly see if it warrants a closer look.

Big Upside Moves on Volume Can Often Signal a Shift to Bullish Sentiment

Industry group strength, which is also very important, will also be revealed such as when a number of Semiconductor stocks appear or Healthcare stocks begin to advance.

If you’d like to be alerted to top candidates that have these and other common characteristics of winning stocks, trial my bi-weekly MEM Edge Report for 4 weeks at a nominal fee. In addition to broader market and sector insights, you’ll also receive precise entry points for the many top performers from this report. Use the link above to check out a sample report!

I hope you take advantage of this special offer!

In this week’s episode of The MEM Edge, I shared 2 groups that are turning after the stimulus plan announcement. I also discuss how to successfully trade stocks going into earnings season, as well as 1 major pocket of strength and how to capitalize. Watch now!

Warmly,

Mary Ellen McGonagle, MEM Investment Research