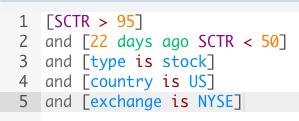

I ran a very simple scan, searching for companies that have been able to make the almost impossible jump in SCTR score from less than 50 to greater than 95 in just one month (22 trading days). Here’s the scan I ran:

There were 2 results:

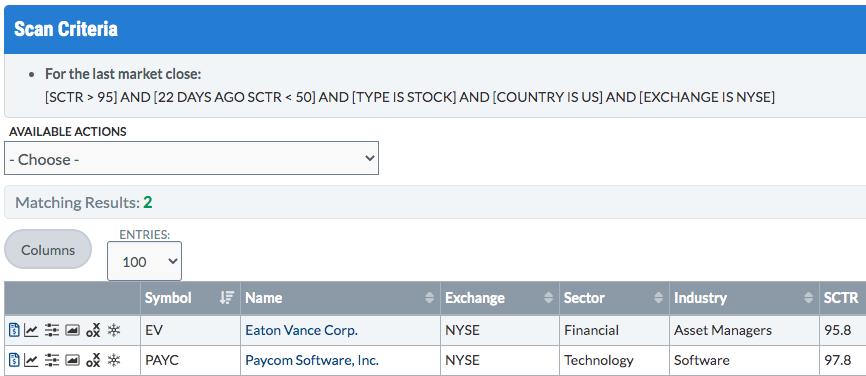

Eaton Vance (EV) doesn’t count since it was announced a little over a week ago that Morgan Stanley (MS) was acquiring EV for a big premium over its then stock price. Paycom Software (PAYC) has done it all on its own. But does the HUGE jump in SCTR score justify an investment? That’s a tough question. Before I look at PAYC’s chart, let me say that I also ran a scan of software stocks that had seen a jump in SCTR scores from less than 70 to greater than 95 over the past 22 trading days and PAYC was the only stock returned. Then I used less than 80 and greater than 95 and Cloudflare (NET) was the only other stock. Finally, I ran a scan showing SCTR scores less than 90 22 days ago and currently above 95 and ServiceNow (NOW) appeared and joined PAYC and NET.

Here’s the reason for this exercise (and it’s not because I’m odd, we all already know that). I know that software has been improving once again on a relative basis, so I wanted to see how many individual software names were making similar SCTR score jumps. As it turns out, not too many. So before I even look at a chart, I’m feeling a little more bullish about PAYC and the meteoric SCTR advance. We do need to keep in mind, however, that the SCTR is simply based on a mathematical formula taking ONLY price action into account. Volume is not considered. So my “price-volume” approach to the stock market still leaves me questioning PAYC to some degree.

Now the chart:

On the surface, a move like PAYC’s would have me quite bullish. But to be honest, we’ve seen this party twice before in the past year. The blue-dotted vertical lines highlight the huge SCTR spikes from below 50 to above 95 over one month periods. There have been 3 of them now! In each of the prior two examples, PAYC’s strength disappeared almost as quickly as it arrived. Given the history, I believe there are much better options in the software space. I’d certainly keep PAYC on a Watch List, but I’d have much more confidence trading one of the software leaders. Both NET and NOW are better options, in my opinion.

On Monday, I’ll unveil a favorite stock of mine in an exploding industry group. If you’re a FREE EB Digest subscriber, you’ll get access to that stock first thing Monday morning. If you’re not a current subscriber, it’s simple to register. CLICK HERE and enter your name and email address in the space provided. There is no credit card required and you may unsubscribe at any time.

Later on Monday, at 4:30pm ET, it’ll be time to DRAFT our favorite ETFs to fill out our inaugural Model ETF Portfolio. This will be a members-only event. You can attend, however, with a trial membership. SIGN UP for a fully-refundable $7 30-day trial and kick the EarningsBeats.com tires!

Happy trading!

Tom