Before I get into it, I have something to tell you…

You’re not alone.

The fact is, 90% of traders lose.

But you know what?

I’m not part of that group — and neither are my top students.

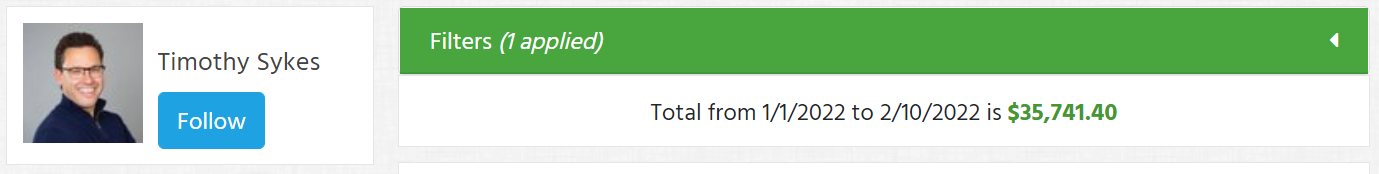

And even in this difficult market, I’ve been able to squeeze out more than $35K in trading profits in the first six weeks of the year.

Of course, this market isn’t as saucy as it was last year…

But that doesn’t mean there aren’t any opportunities.

Don’t believe me?

Take a look at these recent runners.

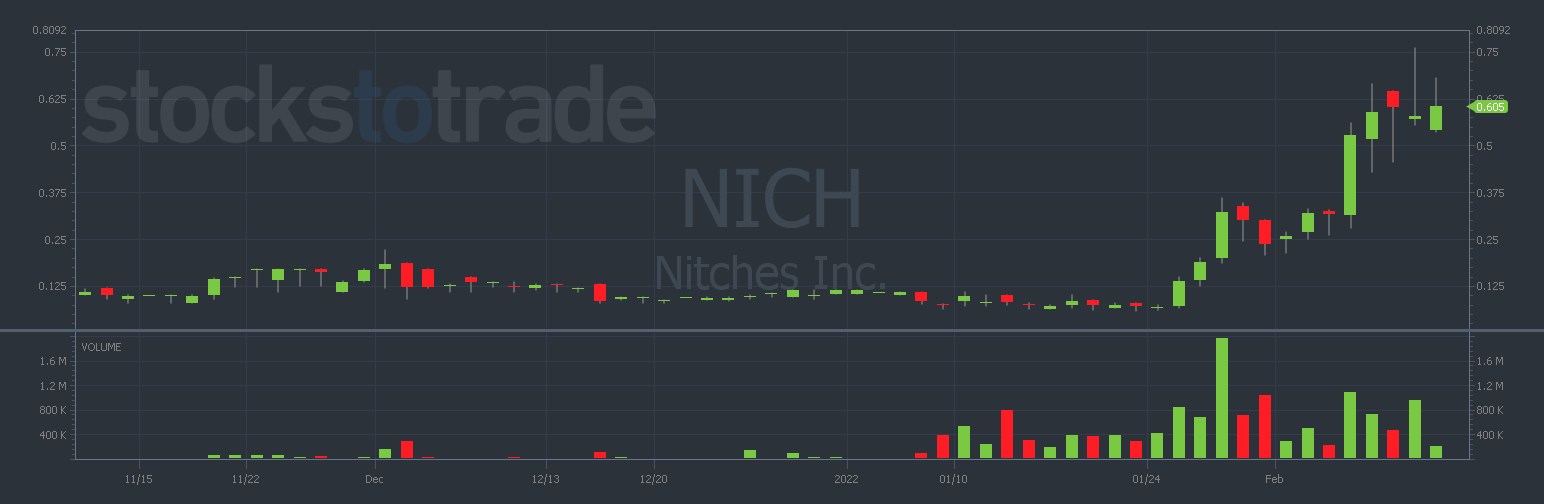

Nitches Inc. (OTCPK: NICH)

This stock ran from 10 cents to 75 cents in two and a half weeks. That’s a 650% gain!

Kaival Brands Innovations Group Inc. (NASDAQ: KAVL)

Here’s a runner from 75 cents that peaked at $2.25 in a week — a 200% spike!

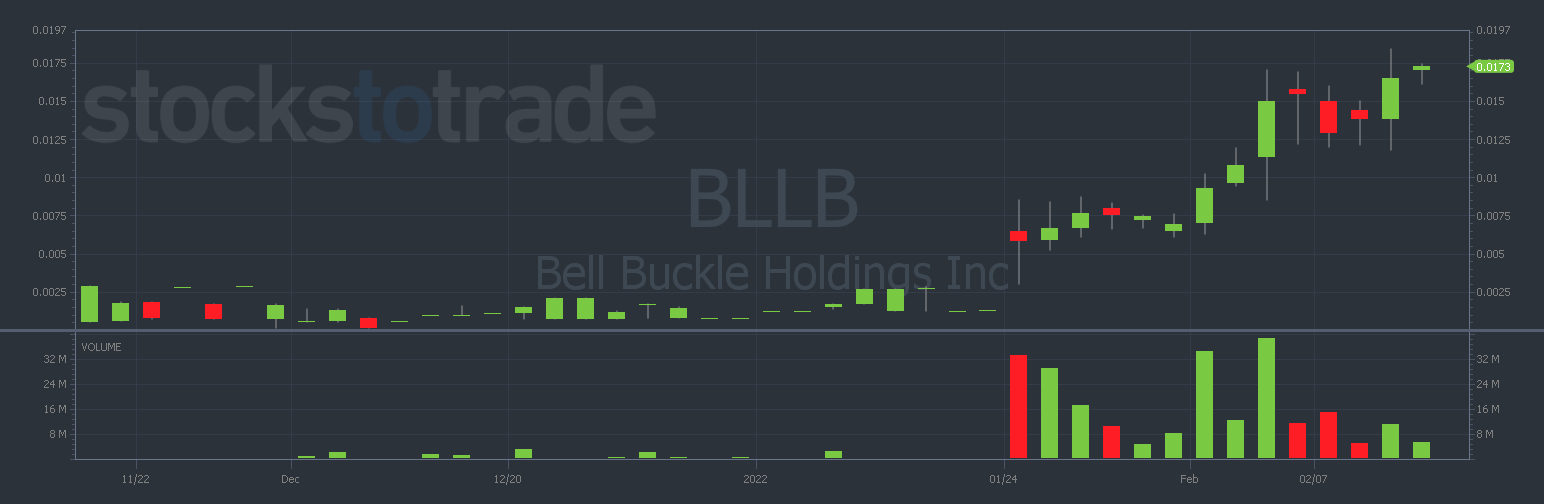

Bell Buckle Holdings Inc (OTCPK: BLLB)

Then there’s this three-week grinder. It’s up 200% so far and testing highs.

If you’re losing right now, want to know the #1 reason why? Listen up…

You’re not following the rules.

You probably treat trading like gambling. Like it’s a fun game you do to make some extra cash.

You’re wrong.

It’s life or death out here. The only reason why my millionaire students and I continue to profit is because we follow the rules.

Lucky for you, the rules aren’t hard to learn. I can even teach them to you right now…

Rule #1: Cut Losses Quickly

I’ve been in this industry for over 20 years. In that time, I’ve seen millionaires come and go.

Traders think they’ve figured it out. Then they lose it all when the market slows down and their patterns stop working.

Don’t be like those losers! Don’t ever get cocky. The market does what it wants and you can lose on any trade.

The key is controlling those losses to protect your profits.

You don’t know how many times I’ve heard traders talk about a big loss. They all say the same thing: “It’s gotta bounce, it’s gotta bounce.”

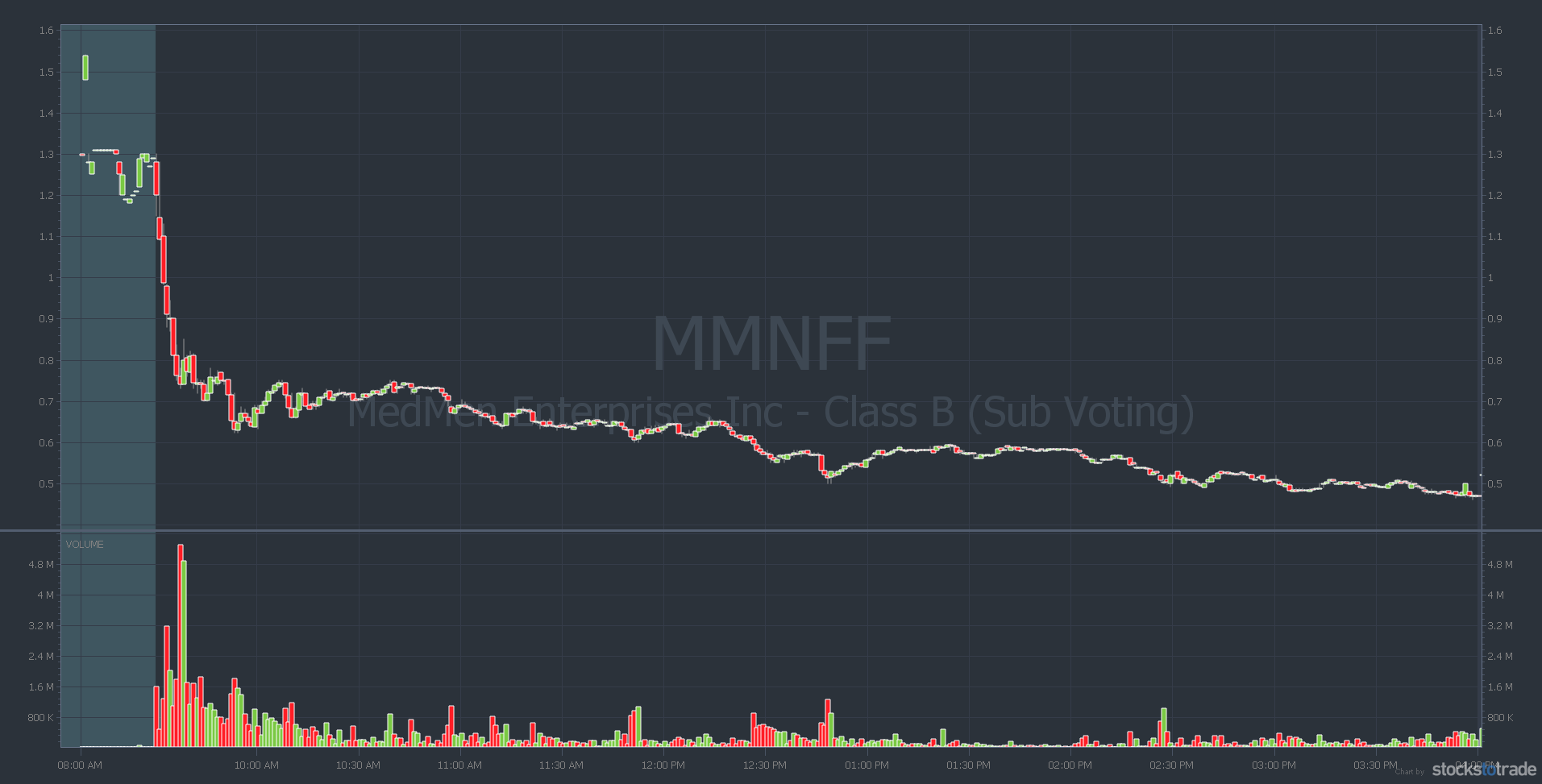

Take a look at this chart of MedMen Enterprises Inc (OTCQX: MMNFF)…

A falling stock doesn’t have to bounce.

Protect your account and live to trade another day.

If you’re not convinced yet, take a look at this video I made about it…

Rule #2: Take Singles

Wall Street laughs at tiny profits. But not me. Quick singles are the bedrock of my trading strategy.

I can’t take more than the market gives me. So I get out before the price switches direction.

Things can move really fast in the day trading world. So learn to take profits without getting greedy.

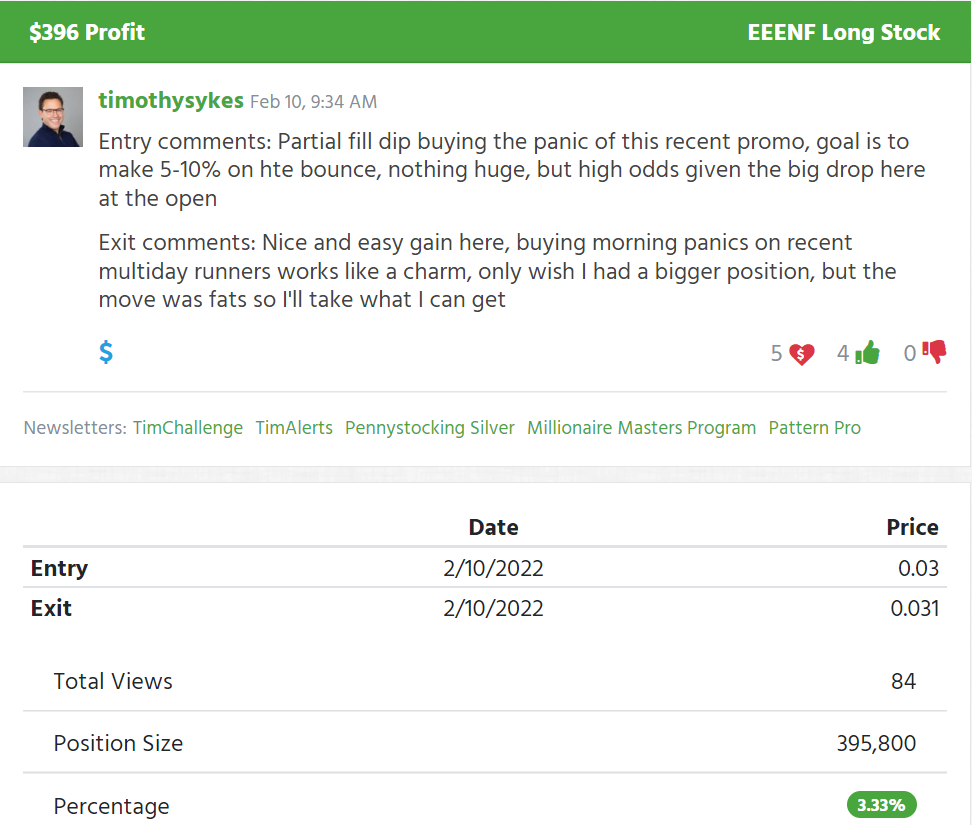

Look at this trade I made recently. It was a panic dip buy on 88 Energy Limited (OTCQB: EEENF).

Profiting 3% is a small gain for me. But I’m perfectly happy with it. Remember that 90% of traders lose … this trade puts me in the top 10%.

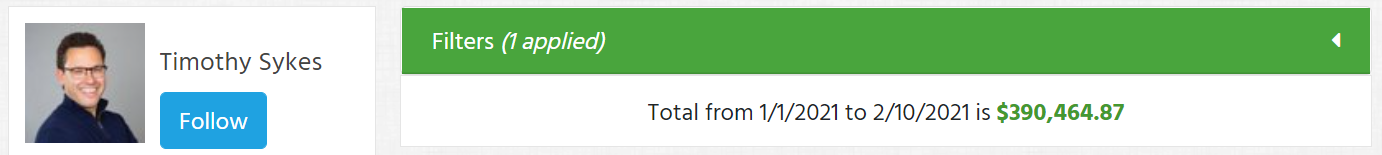

Another thing to remember is, we’re in a choppy market right now. This time last year the market was hotter and I made more money. Check out my Profit.ly screenshot below of my profits from this time last year…

I’ve adjusted my expectations this year because there’s less opportunity.

Rule #3: Find the Best Plays

If you watch the wrong stocks, you’ll lose. End of story.

Don’t waste time with useless crappers. Find stocks that have…

- High volume. High volume means the stock’s popular. That increases demand AND liquidity. Demand pushes the price up and liquidity ensures my trades get filled.

- Percent gain. Stocks that spike can continue to spike. Instead of trying to find the next spiker, try and latch onto a spiker that’s about to go higher.

- Clean chart. Traders rely on chart patterns. If I can’t see a pattern, there’s no way for me to trade it.

- Hot catalyst. This is a spiker’s bread and butter. There needs to be a reason for the move. Don’t watch a stock unless it has a good reason to run.

The key is figuring out which catalysts will spike stocks and which won’t.

Over the years I’ve managed to figure out which news will lead to a probable spike. And often, I get there before the initial move.

If you’re serious about stock trading …

Learn how I use breaking news analysis to profit off penny stock volatility.

This isn’t a game to me. It’s my life. And it could be yours…

Have you figured out why you’re losing? What rule do you need to work on the most? Leave a comment, I want to see that you’re studying!

The post Failed Trades? Here’s Why You’re Losing appeared first on Timothy Sykes.