A summary of COVID cases and demographics by Greg Presseau Of Perennial Capital

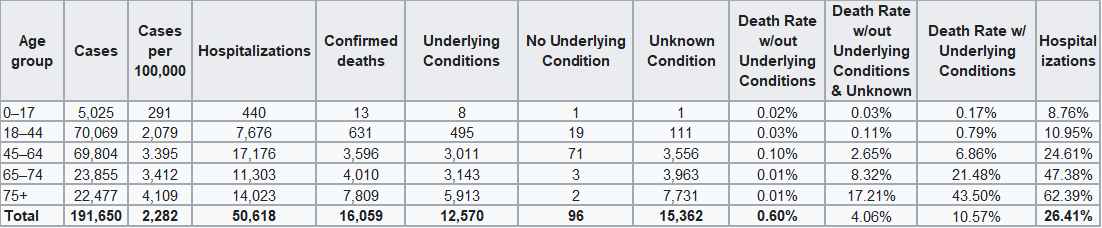

Having successfully averted disaster by imposing economically-debilitating lockdowns, we have seemingly ceased the spread of coronavirus for the time being. Ultimately we want to figure out the probability of a second lockdown and calculate its economic cost. But first, let’s look at the best data we have from the largest Petri dish in the world: NYC. Below is a summary of COVID cases and demographics:

Q1 2020 hedge fund letters, conferences and more

Source: www1.nyc.gov

COVID-19 Demographics

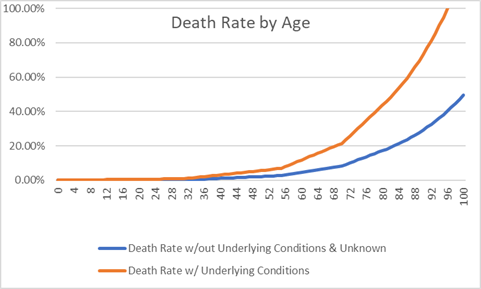

The first piece of data we need to reconcile is the “Unknown Condition” column. Going through an old Cigna survey, just 45% of Americans get check-ups. Rounding this off to 50% and assuming check-ups raise awareness of an underlying condition, we can split the “Unknown Condition” into “Underlying Conditions” and “No Underlying Conditions”. From there we can calculate the death rate by age group. Lastly, using a bit of interpolation and extrapolation, we can create the below curves of death rate by age and health:

Source: CP Capital

What we see above is that over 55 years of age, the death rate climbs exponentially.

The economic toll, measured by gasoline demand was roughly 50% at the peak of lockdowns. The social fabric of society cannot handle that again. Therefore, we believe there is a 16% chance that we go into lockdown again (80% chance of the second wave, 20% chance of quarantine).

The Aftermath Of COVID-19

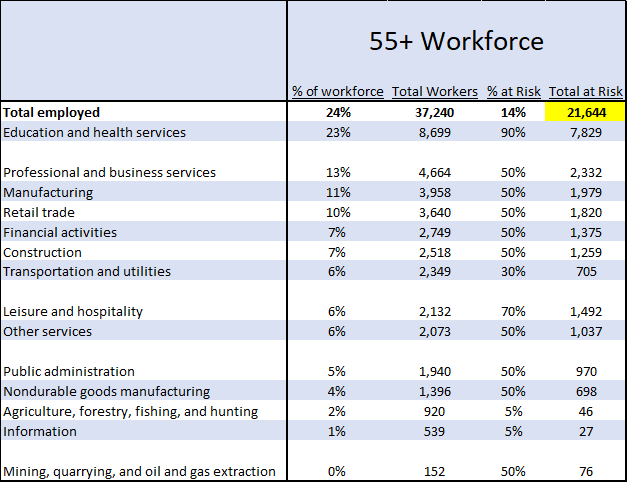

With an 84% chance that we go back to work and try to forge forward, it’s worth looking at what the 55+ workforce looks like and which jobs are at risk:

Source: BLS

About 14% of the total workforce is in ‘high risk’ environments. Most notably in education.

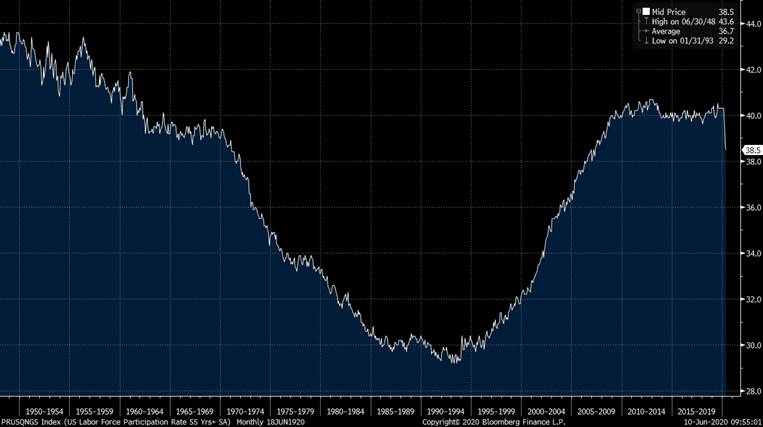

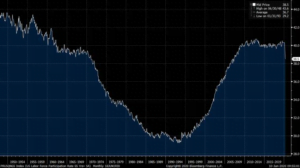

The rest of the older workers is distributed across the workforce. One solution to keep the economy going is to hire younger workers. Before COVID-19 55+ workforce participation rate was approaching the post WWII levels:

Source: BLS, Bloomberg

Due to the likelihood that older workers will have to exercise more caution, we believe wage inflation would go up due to the geographical dislocation of pools of younger labor vs. location of job openings.

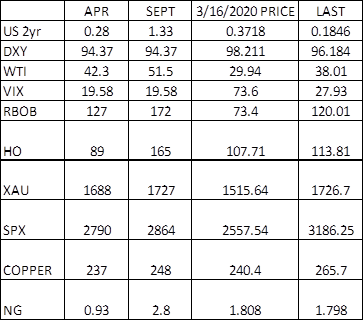

While we are still in the camp that there is a 65% chance of 150m vaccines by Sept, it is unclear how that distribution would work. Therefore, we believe the younger workers may become more permanent and displace older workers. We are in a fluid situation and forecasting out further than a few months remains difficult. For now, we will use the above as a baseline. There is little to update on price targets as most markets have reached our price model targets from our March 16 update and adding the latest prices:

One risk remains interest rates. If we go back to work, stop stimulus and start lending, there should be upward pressure on the price of money, i.e. interest rates.

The post Coronavirus and the Aftermath appeared first on ValueWalk.