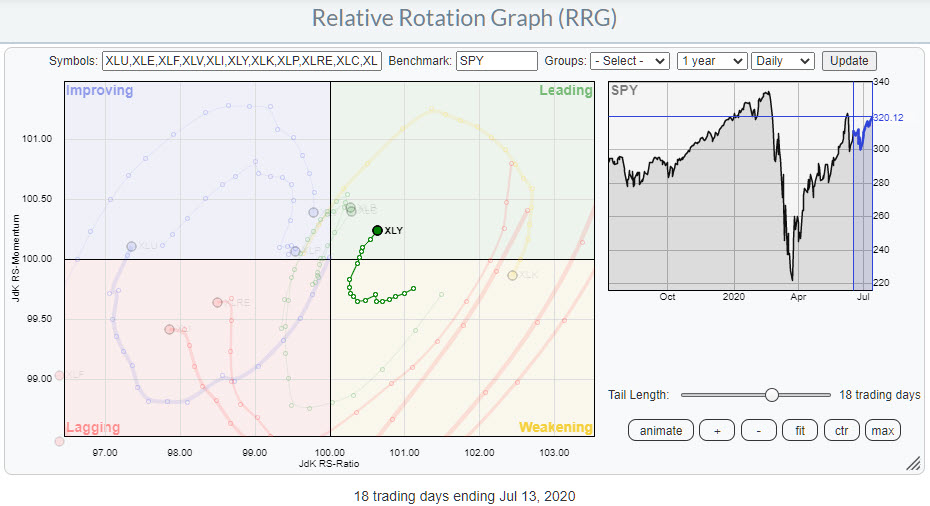

On the daily Relative Rotation Graph for US sectors, the Consumer Discretionary sector rotated back into the leading quadrant last week, coming from weakening. Generally this is a positive/strong rotation as it reflects the second (or third etc) leg within a relative up-trend that is already underway.

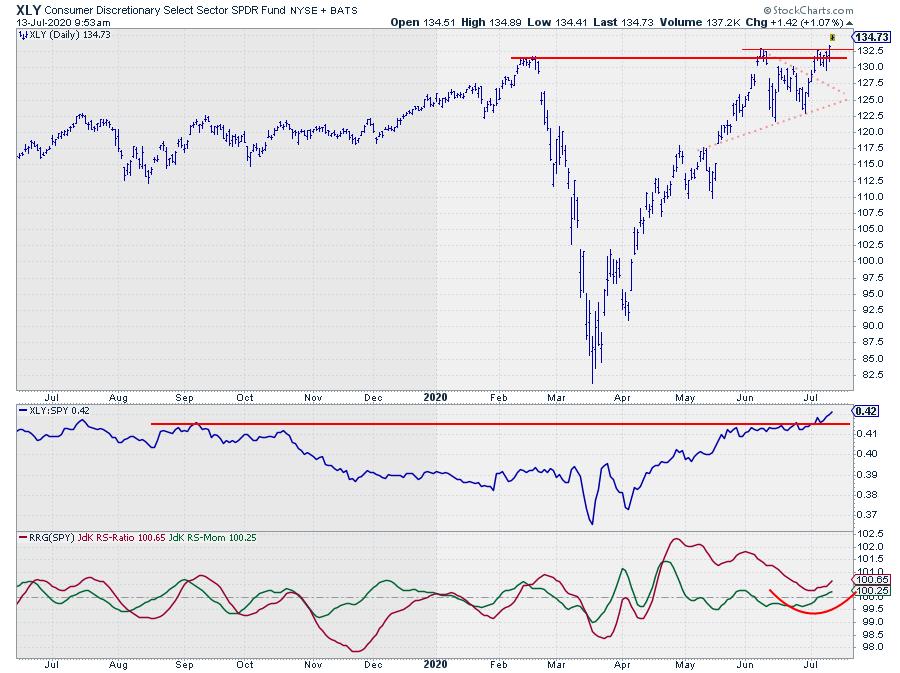

Looking at the underlying price chart for XLY we can see that the sector stalled against overhead resistance in the area between $130-$132.50 at the start of June and then consolidated sideways in a triangle like formation.

At the start of July, XLY managed to get out of that consolidation to the upside and once again stalled around $132.50. After another few days of slightly declining consolidation (flag?) the price managed to close above resistance last Friday at $133.30. The opening, break away, gap this morning, confirms the underlying strength for the sector at the moment.

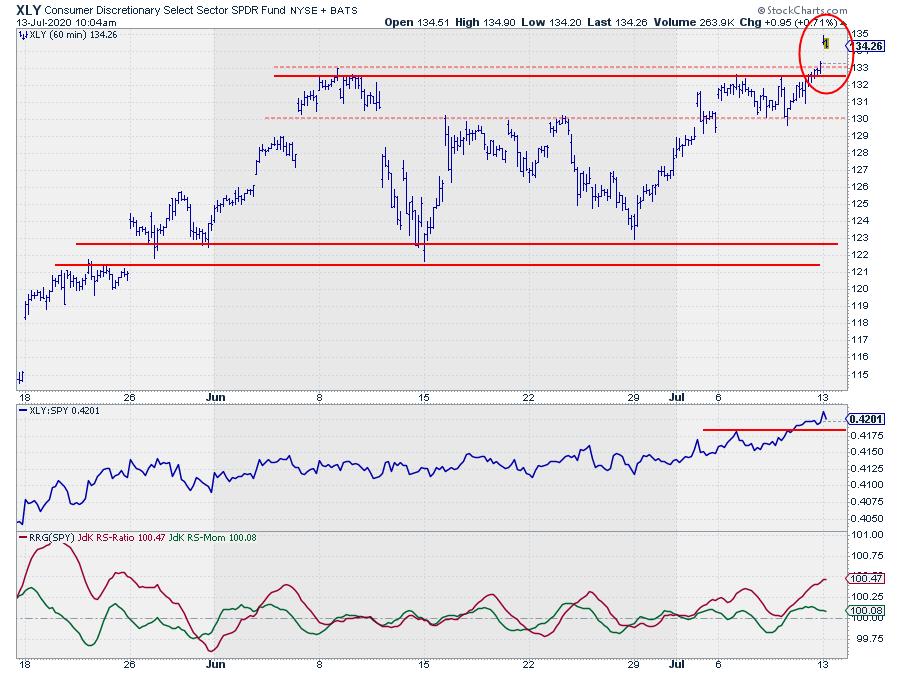

The hourly chart for XLY shows this price and relative action in more detail.

In order to keep up the current strength and maintain the positive rotation XLY should hold up above the breakout area which should start to act as support now in case of any setbacks. This goes for both price and Relative Strength.

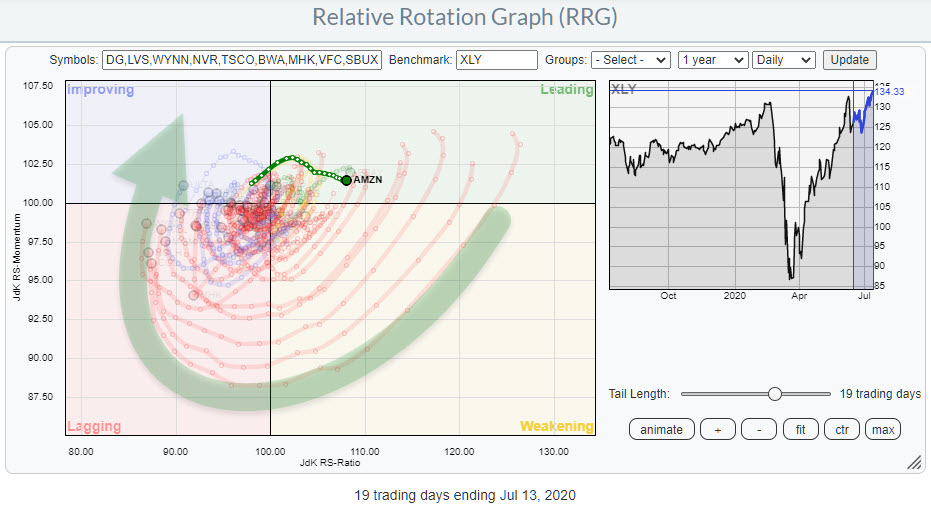

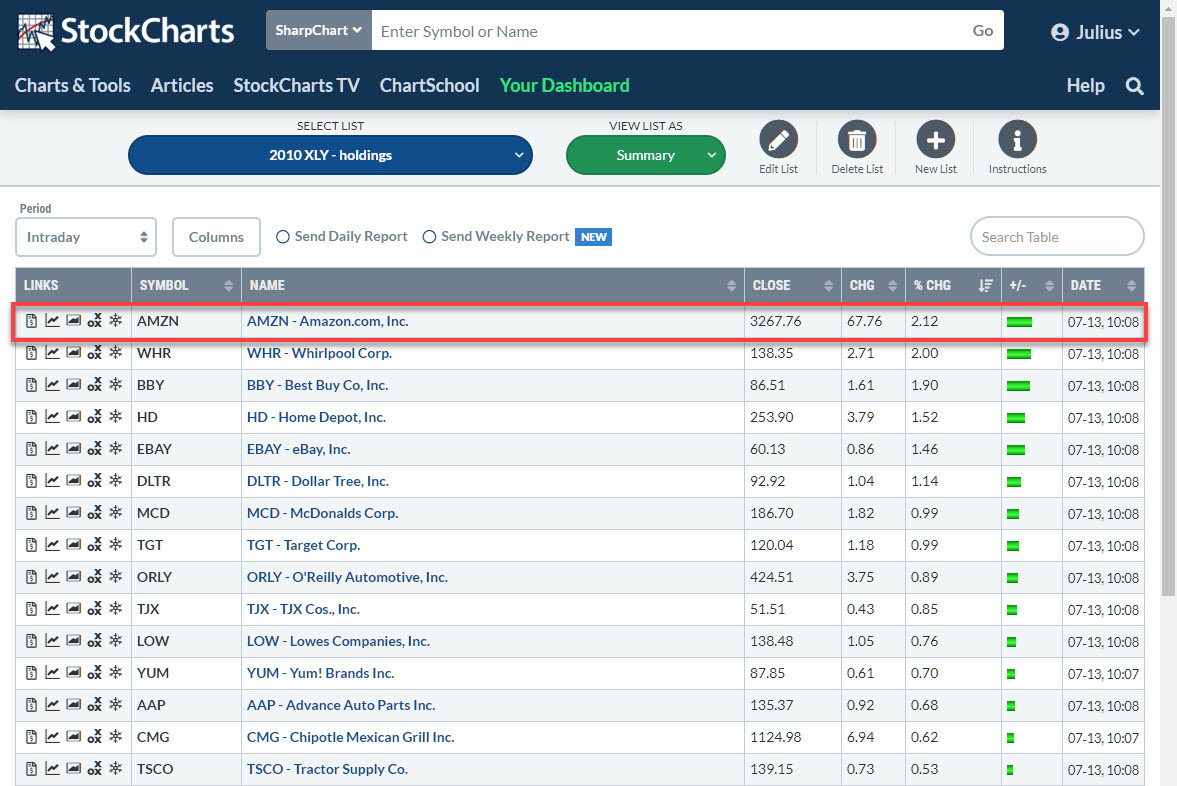

As you can see in the table below (snap-shot 7/13 10:10 am ET), Once again the driver for this rally is AMZN, the Consumer Discretionary Heavy weight.

However, an inspection of the (daily ) RRG for the members of the Discretionary sector shows a rotational picture where AMZN is inside the leading quadrant but slowly dropping on the JdK RS-Momentum scale while still adding a bit of relative strength.

Opposite the AMZN tail there is a whole heap of stocks that have started to curl upward and move up towards the improving quadrant. This is where the momentum is building/picking up while AMZN is still strong, don’t get me wrong, but others are rapidly catching up and possible overtaking in coming weeks.

That is also the subject of an article that I wrote recently on the rotation of AMZN and the impact on the Consumer Discretionary sector and making a comparison with RCD, its equal weight counterpart.

AMZN Move Over Please … Coming Through

All in all the outlook for the Consumer Discretionary sector (XLY), including AMZN, is positive.

#StaySafe, –Julius