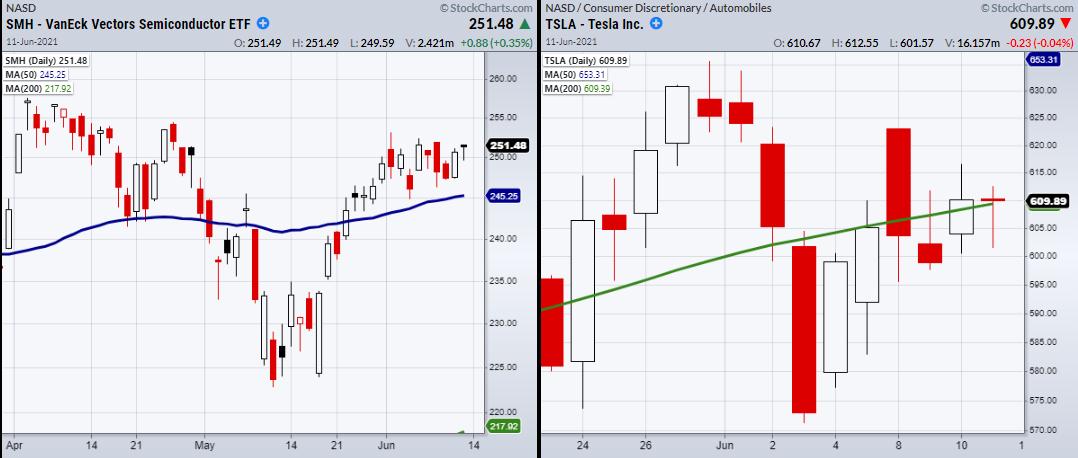

It is well known that supply chain disruptions in Taiwan and other leading countries, which produce semi-chips for computers/Electric Vehicles, have been struggling to keep up with demand. Therefore, if the EV space is looking to extend higher, it will need semiconductor supply companies to step up its game. Knowing how intertwined chips are to the EV space, we can keep a close watch on VanEck Vectors Semiconductor ETF (SMH) to gauge underlying support in the EV industry.

From a charting standpoint, SMH has been hovering over its 50-day moving average and is not far from new all-time highs, last seen in February.

If we expect SMH to pick up the pace, we can also watch for sentiment to improve in EV stocks, such as Tesla (TSLA), Nio (NIO), and Lucid Motors (CCIV). Specifically, TSLA is the most interesting of the three, as the others have begun to move up while TSLA has been consolidating around its 200-DMA. Additionally, if TSLA can grasp a consistent hold over its 200-DMA, while SMH heads towards or clears its high of $258.59, this could be a great setup in a company known to make large moves once it gets started.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Are you afraid to trade MEME stocks? Now you don’t have to be! Mish takes you through the top MEME stocks in this week’s edition of StockCharts TV’s Mish’s Market Minute. She shows you day trading and mini swing trading strategies so you can capitalize on the hottest trends going right now.

ETF Summary

- S&P 500 (SPY): 422.82 support to hold.

- Russell 2000 (IWM): 234.53 high to clear.

- Dow (DIA): 351 resistance. 342.43 support.

- Nasdaq (QQQ): 338.19 resistance area.

- KRE (Regional Banks): Doji day. 67.49 next support.

- SMH (Semiconductors): 245.25 support. 258.59 resistance.

- IYT (Transportation): Watching to clear the 50-DMA at 268.85.

- IBB (Biotechnology): 159.37 new support to hold.

- XRT (Retail): Needs to hold over 96.27.

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Trading Research and Education