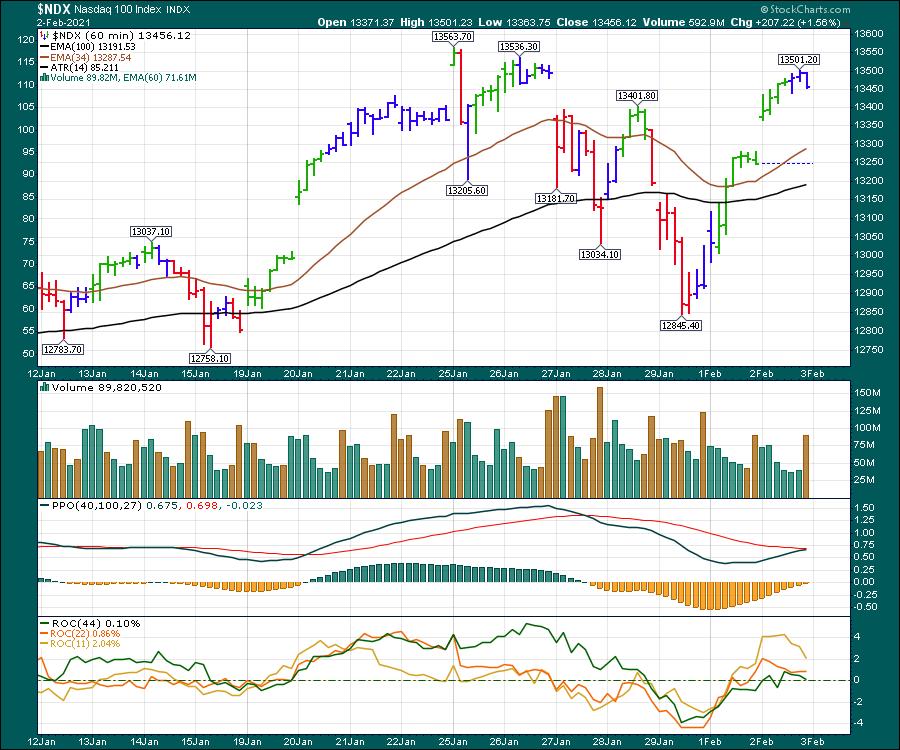

The Nasdaq 100 is testing the prior highs to kick off Thursday. There is an interesting sequence of index price action over the last few weeks. The Nasdaq 100 is right up near the prior high. The bounce last Thursday was unable to take out the prior high. However, the bounce this week has gone above Thursday and now looks set to break out as we have positive earnings from Amazon and Alphabet to spark it tomorrow morning.

The next chart is the $SPX. The second lower high is a little weaker than the Nasdaq price action. The rally on the $SPX is a little lower than last weeks high. The PPO momentum wave dropped below zero and is now trying to rally above. A rollover here over the next few days would be a typical intermediate topping pattern. The price action of Wednesday and Thursday sets up to be interesting with the $SPX momentum right near zero.

The Dow index is a group of thirty major name stocks. In a unique way, it is odd how it is another step down from the Nasdaq or the $SPX. The high was two weeks ago, and a few bounces back. The PPO (showing momentum) is a distinct amount lower on each one of these charts. So far it is a sequence of lower highs.

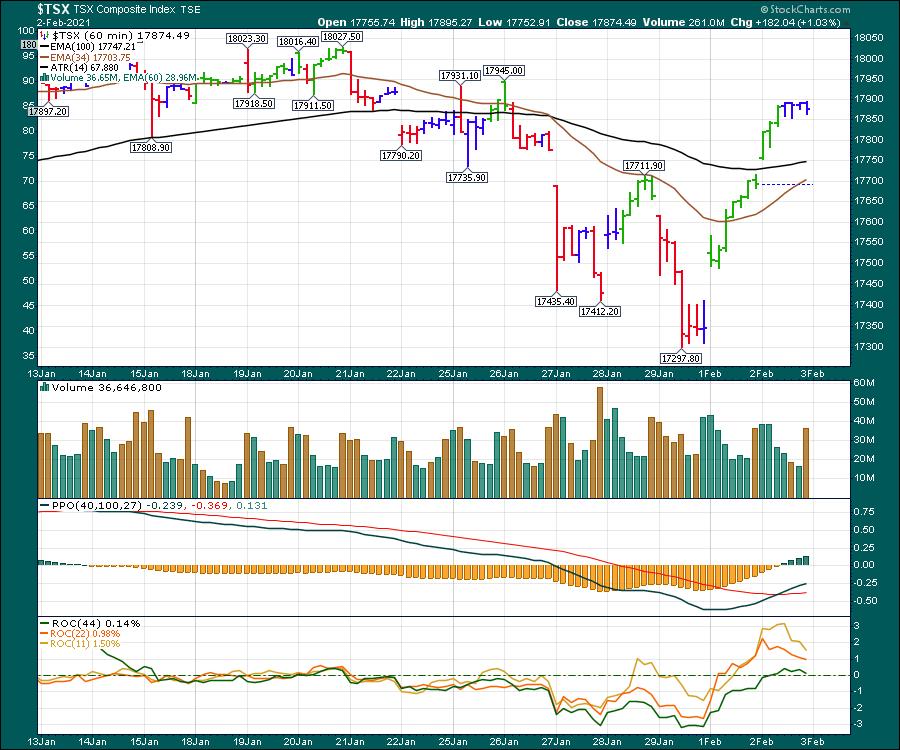

There is one more chart that is also making lower highs and it typically breaks down before the US market does. The Canadian market is smaller and less tech heavy. In this case the $TSX has a couple of unique twists. It’s most recent high is a few weeks ago, the same time the $INDU did. However, today it made a bounce higher than the most recent wave of last Thursday, unlike the Dow. This sets up an interesting debate. Are we about to revert and all these markets start making higher highs, or does the $TSX start to rollover again and lead us lower? What is it hinting at?

My personal strength indexes suggest the market is too weak to go higher here, but perhaps the rally can continue. While the Nasdaq top few stocks could extend, like it did in September, I am focused on what the broader array of stocks does. The next few trading days will give us some larger clues.

For me, it a close spot to watch.