Investing isn’t easy and there are so many choices, even if you narrow your choices and are only looking at ETFs (Exchange-traded funds). The number of ETFs is staggering. How do you put a portfolio together to match your own personal investing style?

That’s a difficult question and, from questions that I receive, I don’t believe most investors customize their ETF strategies at all. They pick the latest “hot” ETF and then overweight their portfolios unknowingly. Don’t get me wrong, I’m a fan of relative strength in my selection process, but you need to temper your enthusiasm and ensure that your entire portfolio meets your overall investing strategy.

Know What You Own

Sometimes I have to chuckle when I hear folks unfamiliar with investing say, “I don’t buy individual stocks, I only buy ETFs.” Of course, many ETFs invest in individual stocks. So the truer statement would be that they don’t “select” the individual stocks, instead letting others do the picking for them. And that’s fine. I think the most important part is being invested, especially during a secular bull market. When you consider selecting ETFs for a portfolio, there are a few things I’d do up front:

- Review the long-term charts (minimum 5-year weekly chart)

- How diversified is each ETF? (sector specific? tracking a major index?)

- Identify the Top 10 holdings and review those charts

- Determine the cumulative % of the Top 10 holdings

- Evaluate your cumulative sector allocation of all ETFs chosen and compare to the benchmark S&P 500

That may not be ALL the steps you want to take, but it’s where I’d start. It’s exactly what we do at EarningsBeats.com for our members. We have an ETF research platform that considers only the best-performing ETFs (we organize those in a Strong ETF ChartList) and then we utilize our ETF Analyzer spreadsheet to determine exactly what the weighting is for each sector. We can then compare that weighting to the sector weighting of the S&P 500 to determine if we’re comfortable with the overall sector weighting of the ETF portfolio.

ETFs Are Not Created Equal

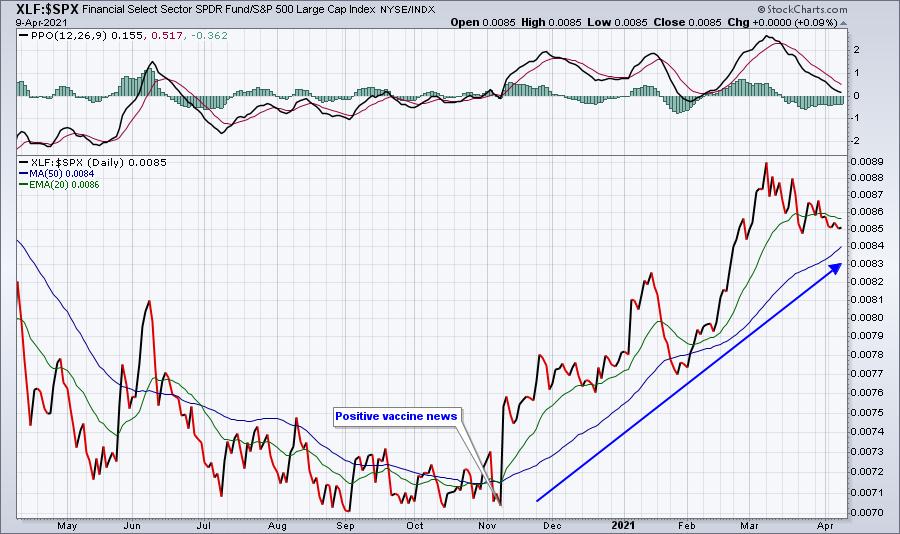

If you follow the stock market closely, then you probably realize that rising treasury yields have benefited financial stocks. Here’s a quick chart of the financial sector ETF (XLF) relative to the benchmark S&P 500 ($SPX). The price relative symbol necessary to create this chart is XLF:$SPX. You simply need to make sure you put a colon between the two symbols:

Based on this chart alone, you most likely should have exposure to financial stocks as they’re clearly outperforming the S&P 500. But which financial stocks? Which financial ETFs? Well, when I ran a scan of the best ETFs, I filtered using, among other criteria, a minimum SCTR score of 90 (excellent relative strength). This scan returned 29 ETFs, including 6 financial-related ETFs. Let me compare two of those for you.

Fidelity MSCI Financials Index ETF (FNCL):

Let’s start with a 1-year daily chart to look at the technical picture:

First Trust Financials AlphaDEX Fund (FXO):

Again, let’s start with a 1-year daily chart to look at the technical picture:

Both of these financial ETFs look strong and could be a part of any ETF investing strategy. As their names would imply, however, they are not diversified. They only own financial-related stocks, 1 of the 11 sectors that make up the S&P 500. So they could be a part of your overall ETF portfolio, but picking between the two likely comes down to a comfortability factor. Their ETF composition is entirely different. Let’s get back to my earlier discussion of ETF selection strategy (points 3 and 4). When you look “under the hood”, you’ll note these differences:

- FNCL’s Top 10 holdings represent 41% of the entire ETF; FXO’s Top 10 holdings total just 18%

- FNCL’s Top 3 holdings are JPM, BRK/B, and BAC. They total roughly 24% of the ETF

- FXO’s largest holding is AGO, just 2% of the entire ETF; it is MUCH more diversified within the financial sector

The bottom panel in both of the charts above (FNCL and FXO) is interesting. It shows the price relative of each ETF vs. the financial sector. One possible differentiator between the two is that FNCL seems to be losing relative strength faster vs. its financial peers, moving to a 3-month relative low. FXO seems to be holding up better during the recent weakness in financial stocks (the XLF has trailed the S&P 500 over the past month).

Putting Together A Plan

I believe relative strength is always a critical factor in trying to outperform the S&P 500. Over the past few years, we’ve leaned heavily on relative strength in crushing the S&P 500 with our stock portfolios at EarningsBeats.com. Here is how each of our stock portfolios have performed since their respective inception dates (dates in parenthesis are those inception dates):

- Model Portfolio (11/19/18): +243.65% (vs. S&P 500 return of +53.45% over same period)

- Aggressive Portfolio (5/19/19): +110.44% (vs. S&P 500 return of +44.39%)

- Income Portfolio (5/19/19): +42.03% (vs. S&P 500 return of +44.39%)

- Strong AD Portfolio (5/19/20): +105.38% (vs. S&P 500 return of +41.26%)

That’s staggering outperformance and, quite honestly, it has as much to do with investing in leading stocks in leading industry groups than anything else. I just listen to what Wall Street is telling us.

We created our Model ETF Portfolio 6 months ago in an attempt to outperform the S&P 500 – with modest results thus far. In our very first quarter, we crushed the S&P 500, +16.92% vs. +11.02%. However, the struggles of growth stocks have impacted us in the latest quarter as we trail the S&P 500 this quarter by a similar amount. Cumulatively, our Model ETF Portfolio (inception date – 10/19/20) is +18.86%, slightly trailing the S&P 500’s return of +20.48% over the same time period. I’m confident that we’ll regain that lead, however, as we move into our 3rd quarter of performance in a little over a week.

FREE Monday Event

If you’d like to see the ETFs that we’re considering in our Model ETF Portfolio, which will be announced on April 19th, our “Sneak Preview – Model ETF Portfolio” event is for you. I’ll show you how to construct a sound ETF portfolio using our ETF Analyzer that we provide to our EarningsBeats.com members. It’s a cool and unique way to invest more intelligently by “knowing what you own”. We do all the work and you benefit.

The event will be held on Monday, April 12th at 4:30pm ET and is free to everyone. If nothing else, I believe it will provide you with a different way to look at your own ETF investing strategies, possibly enhancing it. To learn more about this event and our Max Pain event, which I’ll be hosting on Tuesday, April 13th at 4:30pm ET, you can CLICK HERE.

Happy trading!

Tom