A theme is emerging in the energy space. Oddly, it is not a theme focused on green energy. At this point, it appears to be a theme focused on the energy squeeze that is right before us. This worldwide issue appears to be coming to a head.

A theme is emerging in the energy space. Oddly, it is not a theme focused on green energy. At this point, it appears to be a theme focused on the energy squeeze that is right before us. This worldwide issue appears to be coming to a head.

- California to Build Temporary Gas Plants to Avoid Blackouts

- Unplanned Outages Hit Texas

- Electricity Prices Spike in Alberta

- Bills Soar as Spain Approaches Record Electricity Prices

- Two UK Energy Suppliers Collapse

- UK Energy Bills to Rise After Record Wholesale Electricity Prices

- German Power, Carbon Rise to Record on Soaring Gas Prices

- Japan’s Surging Electricity Prices are a Warning For Asian Countries

- Australia Energy Prices – The Story Behind Rising Costs

- India – Spurt In Electricity Prices

- China’s Coal Supply Crisis Means High Prices, Blackouts

Type in the name of any country with the words “electricity price spike” into your Google search bar. A result pops up. Most countries are experiencing record demand for electricity, but utility companies are not building power stations to match demand. The governments worldwide are quick to mask the problem by announcing green plans. The real problem is the sun and wind are renewable, but the infrastructure to catch that power is not. These plants wear out as fast as a Samsung fridge.

All of a sudden, in the last few weeks, a major surge has shown up.

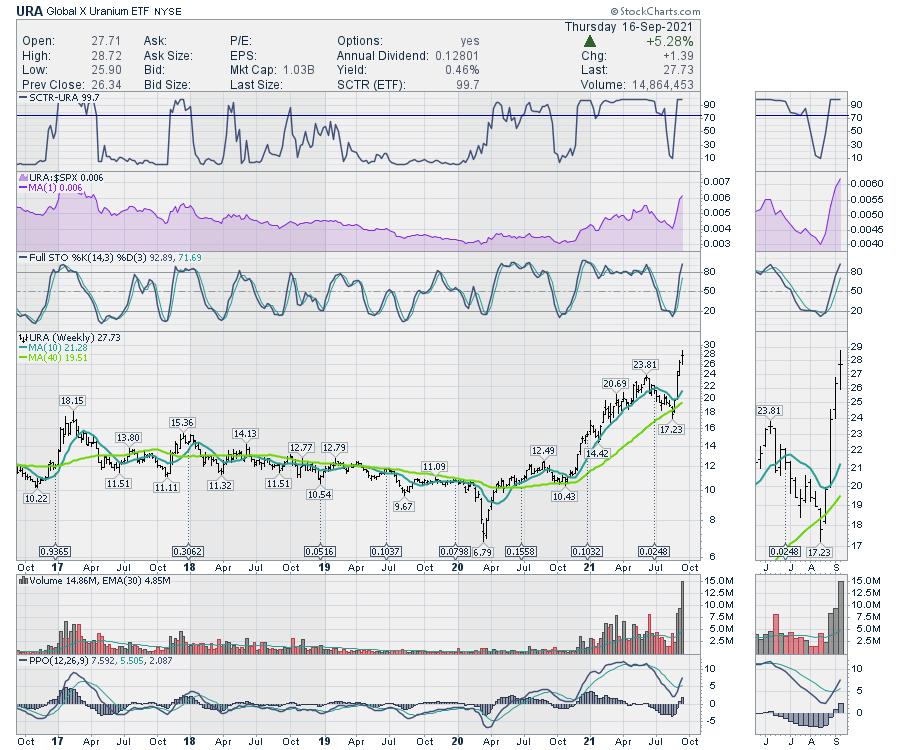

The Uranium ETF (URA) is soaring. Part of this is apparently due to ETFs, but the other part of it is the chart has been improving for a while. And the chart is on a rocket ship higher.

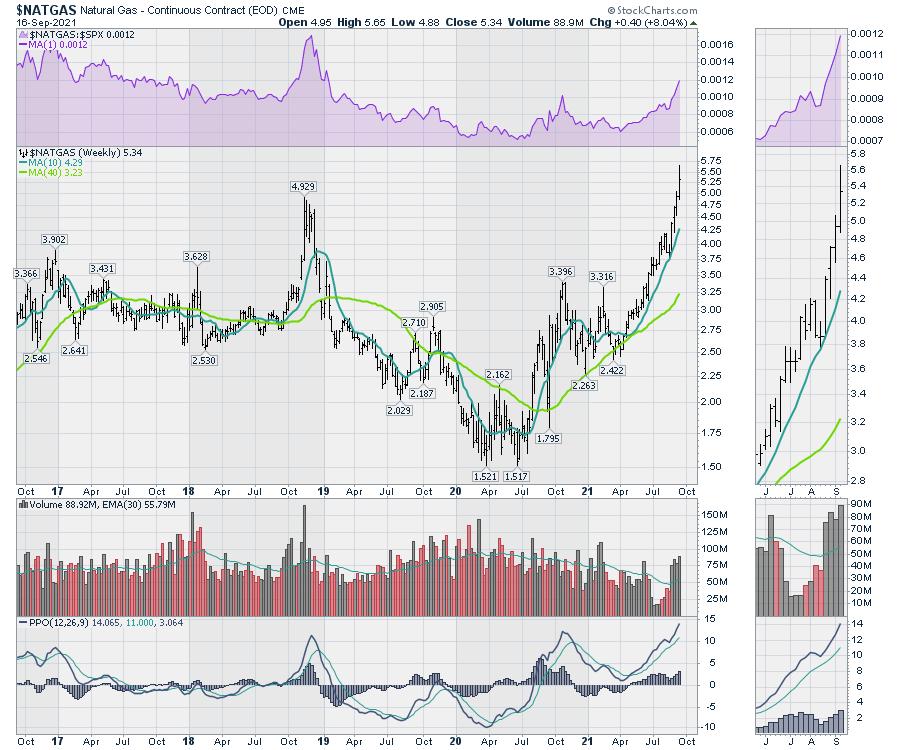

Natural Gas ($NATGAS) has been soaring worldwide as Europe is paying 4x more than North America. The price below is for North America.

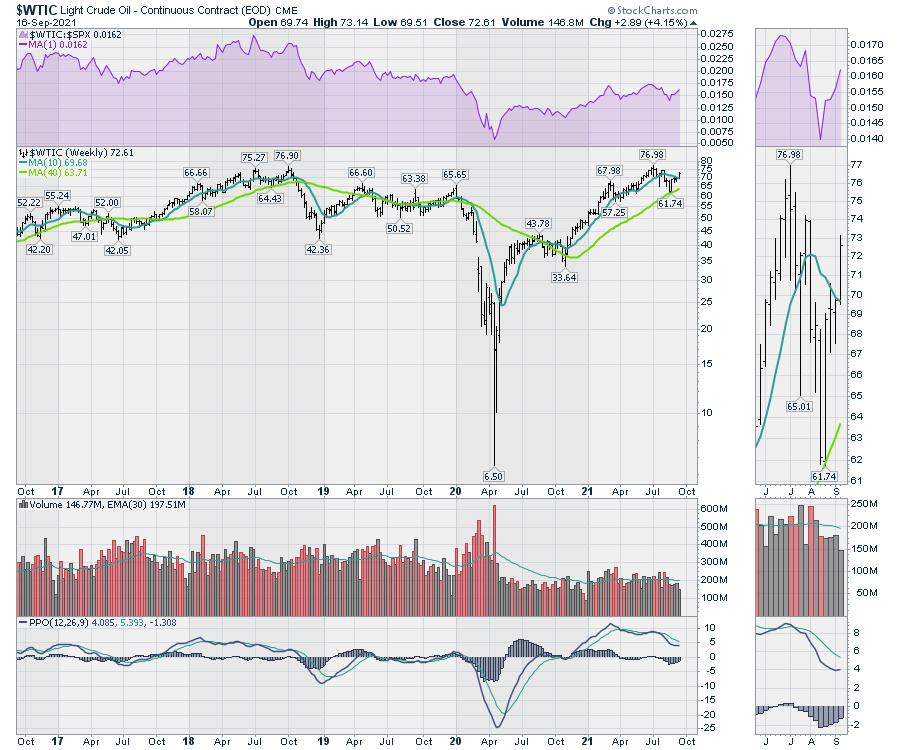

West Texas Crude ($WTIC) pricing appears to be ready to break out this week, moving back above the 10-week moving average. This looks set to challenge the 5-year highs.

What has not broken out yet is the Solar ETF (TAN).

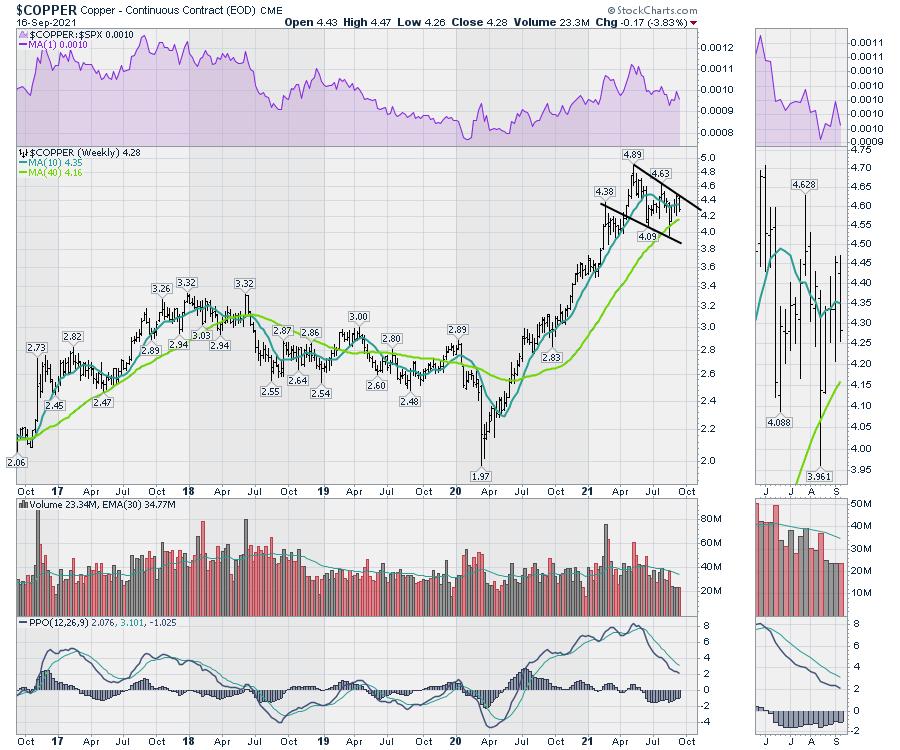

Copper ($COPPER) is all lined up to break out.

As winter approaches, be ready for massive issues in power supply. We continue to have government inaction to approve new power generation, but we keep increasing demand worldwide.

This entire sector looks like the pressure relief valve is about to blow on these charts. Stay tuned! Here is an article I wrote on Monday about the Copper linkage: Green Energy – All Aboard?!

For more information on following my recommendations for investing on this energy crisis, visit Gregschnell.com/explore. It might be the best $500 you’ve spent this year! I cover energy every week in my newsletter extensively.