Labor-related plant shutdowns in the U.S. that covered the latter half of September and most of October negatively impacted deliveries in November. Combined sales of the vehicles impacted by shutdowns fell 15% year-over-year in November. If those vehicles had matched year-ago results, sales would have totaled a 15.9 million-unit SAAR. While CUVs accounted for over half the market for the second time ever, vehicles impacted by the strikes were largely behind weakness in pickups, SUVs and vans.

Click on graph for larger image.

Click on graph for larger image.

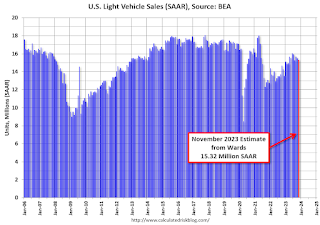

This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto’s estimate for November (red).

The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic). However, sales decreased in 2021 due to supply issues. The “supply chain bottom” was in September 2021.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.

Sales in November were below the consensus forecast due to the impact of the strikes.