I wrote an update in 2014, and argued vehicle sales would “mostly move sideways” for the next few years.

Here is another update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through July 2022 – and gives a turnover ratio for the U.S. fleet (this doesn’t tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2021 and 2022.

The wild swings in 2009 were due to the “cash for clunkers” program.

The estimated ratio for July is close to 21 years – well above the normal level.

Note: in 2009, I argued the turnover ratio would “probably decline to 15 or so eventually” and that happened – and will likely happen again.

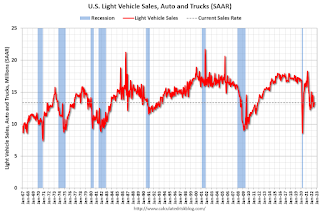

The second graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is current estimated sales rate.

Light vehicle sales were at a 13.35 million seasonally adjusted annual rate (SAAR) in July.

I expect vehicle sales to increase over the next couple of years.