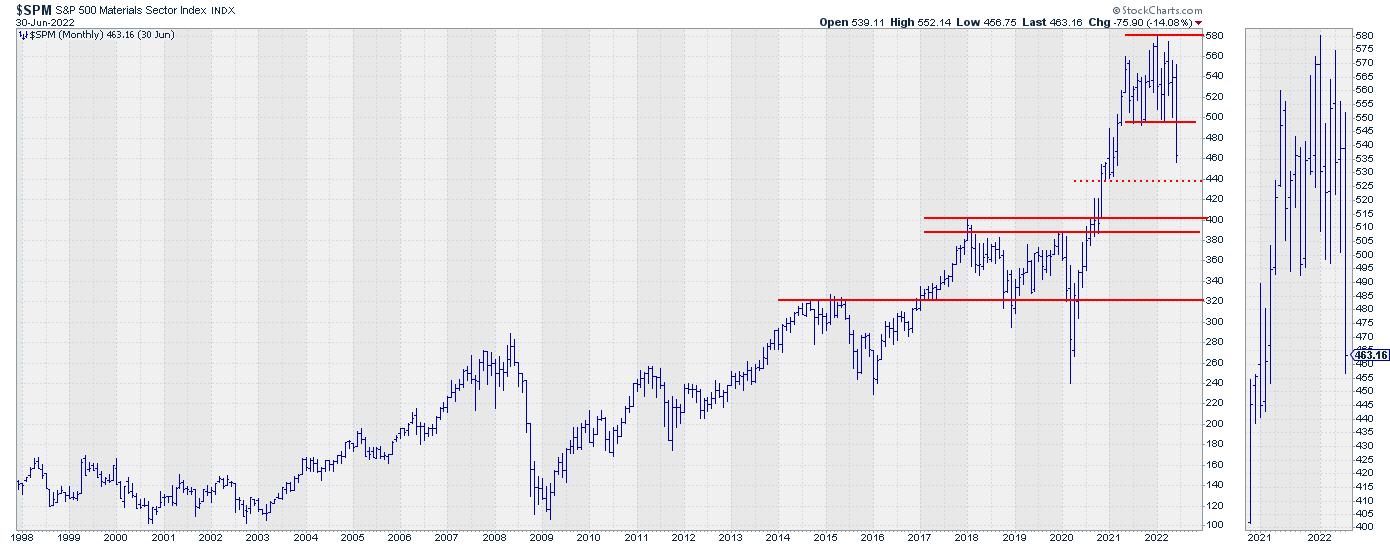

The chart above is the monthly chart for the materials sector $SPM, which I discussed in this week’s episode of Sector Spotlight while going through the completed monthly charts for June.

Materials Sector Completing Big Top Formation

This one especially stood out as the sector very clearly completed a large top-formation after a strong rally that started in 2020 and started stalling in the middle of 2021.

The break below the horizontal support level around 495 was the trigger for a further move lower.

The weekly chart for the materials sector above shows a more detailed picture. After breaking horizontal support the initial decline is underway with a low, so far, at 447.50. Given the speed and the steepness of the recent decline, it is very well possible that we will see a bounce back up in the near future. But as long as the horizontal resistance near 495 remains intact such rallies have to be judged as recoveries within a downtrend.

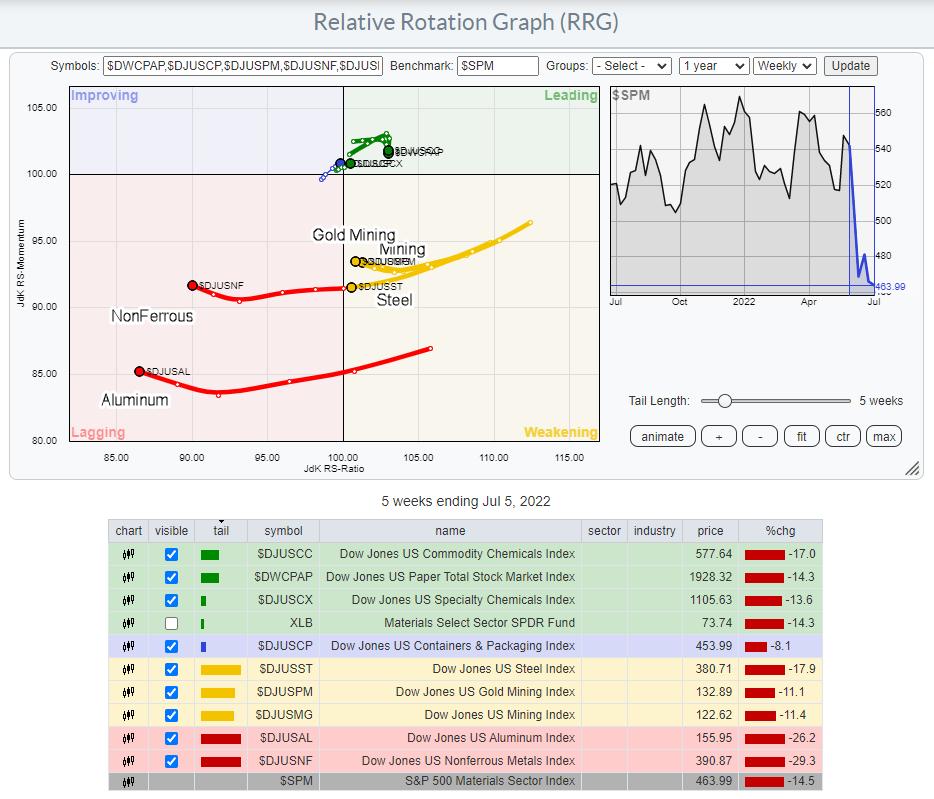

All Metals Groups Showing Weak Rotation On RRG

From a relative perspective, the materials sector has tested resistance in the area of the 2021 relative peak from which it started declining. This has caused the RRG-Lines to roll over and JdK RS-Momentum has already pushed below 100, causing the tail to rotate into the weakening quadrant.

Breaking down the Materials sector into its sub-groups gives the rotational picture in the RRG below.

This Relative Rotation Graph shows the groups inside the sector and it is providing an interesting picture.

Basically, the sector is split into two groups. All groups related to metals and the others (Chemicals, Paper).

The groups related to metals are catching the attention. All of them are inside weakening or lagging, but more importantly, they are all heading lower on the RS-Ratio scale suggesting more weakness lies ahead.

These metals-related groups are also far away from the benchmark (center of the chart) compared to the other groups which are concentrated close(r) to the benchmark and all but one inside the leading quadrant. This means that the current weakness of the sector can largely be attributed to the weakness in the metals groups and less so to the others.

Aluminum

Going over the individual charts for the group, the Aluminum index attracted my attention.

At the start of this year, Aluminum broke above resistance coming off multi-year highs near 180 and then shot up to a high around 320 before coming back down to 180 and breaking below it again a few weeks ago. The price behavior above that 180 level looks like an H&S top-formation.

Applying basic TA rules I get a target price of around 40 which is seriously lower than where we currently are.

These are the situations that make me go hmmm. And I start questioning myself. Am I missing something, does it make sense, does it fit in the context, etc., etc? I am quite reluctant to blatantly scream that Aluminum could drop $ 100 or ~65% from current levels… At least I want to dig a little deeper.

In this case, that means pulling up a real long-term chart to figure out where we are in terms of all-time-high levels, etc.

And that chart is very interesting IMHO. First of all the parabolic rise from 2020-2022 (25 to 325) did NOT bring Aluminum to a new all-time high. $DJUSAL traded around 375 in 2002, 2007 (spiked), and 2008. But the projected target area, somewhere around 50 is also not strange as it traded there numerous times since the sharp drop in 2009.

The way I read this chart is there there are two big ranges that offer support or resistance. The first is at the top between roughly 330-375. The most recent peak was formed against the bottom of that range. The second important range is between 145-185. As we speak Aluminum is testing the lower boundary of that support range.

In the near term, this area may provide enough support for Aluminum to bounce a little but the large H&S is expected to start weighing in sooner or later and push $DJUSAL below 145 which will open up a huge downward risk.

Based on the historical performance and technical behaviour $50 for Aluminum is absolutely possible!

No matter what happens, at the moment Aluminum has very limited upside and a huge downside risk making it a very risky investment. With more metals-related groups in the Materials sector, it is very difficult to see $SPM turning around and start moving significantly higher in the coming weeks.

#StaySafe and Have a Great Weekend, –Julius