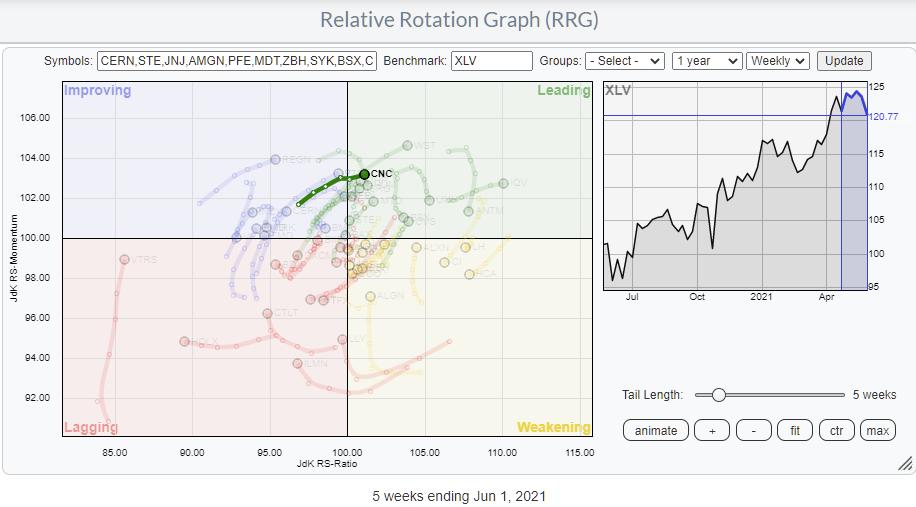

In this week’s episode of Sector Spotlight, I discussed the outlook for the Health Care sector based on the current alignment of the rotation on the Relative Rotation Graph and the seasonal expectation for the sector.

Over the last 20 years, the Health Care sector outperformed the S&P 500 in 70% of the occasions, and the average return for the sector in June is 0.8% over SPY.

Enough reason to zoom in on the individual stocks inside this sector.

On the RRG for this sector, the rotation and the heading on the tail of CNC are interesting. It moves into the leading quadrant from improving, and the RRG-Heading is between 0-90 degrees, which means that this stock is still gaining on both axes.

The chart at the top of the article confirms this bullish outlook from the RRG.

Since its low back in 2019, CNC has put in four important higher lows. Over that same period, the rallies stalled around the level of the major 2018 peak, just below $75.

The big difference between the current rally and the rallies that stalled since early 2020 is that now relative strength has managed to break above its falling resistance line, which is pulling the RRG-Lines higher.

We are not there yet, but a break above $75 for CNC, preferably holding up at a Friday close, would unlock a lot of fresh upside potential.

Any follow-through rally after such a break would make CNCX one of the more interesting stocks inside the Health Care sector.

My regular blog is the RRG Charts blog. If you would like to receive a notification when a new article is published there, “Subscribe” with your email address.