SPX Monitoring Purposes: Sold 10/4/21 at 4300.46=near breakeven; Long SPX 9/30/21 at 4307.54.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

The TRIN closed yesterday at 1.20 and today at 1.32, which adds up to 2.52; two-day readings that add up to 3.00 and higher appear near short-term lows. The TICK closed yesterday at +60 and today at +100; it is not at panic levels. The two-day TRIN leans bullish, but not at levels where reliable bottoms are formed, while the TICK is just neutral. Market bottoms form on panic and, so far, readings in the TRIN and TICK are not reaching levels where panic is present to the degree of what we like to see. Today’s volume increased from yesterday’s volume and suggests tomorrow could be another down day. If the market is down tomorrow, maybe the TRIN and TICK readings reach panic levels and setup a bullish signal. Staying neutral for now.

We’ve shown this chart in the past; it is here updated to current data. Above is the American Association of individual Investors Bull/Bear Ratio. Bullish intermediate term signal are triggered when this ratio falls below .75; the current reading is .69. This ratio has been below .75 since late September and, since then, market has moved sideways. According to this indicator, the market is building a base near current prices on the SPX.

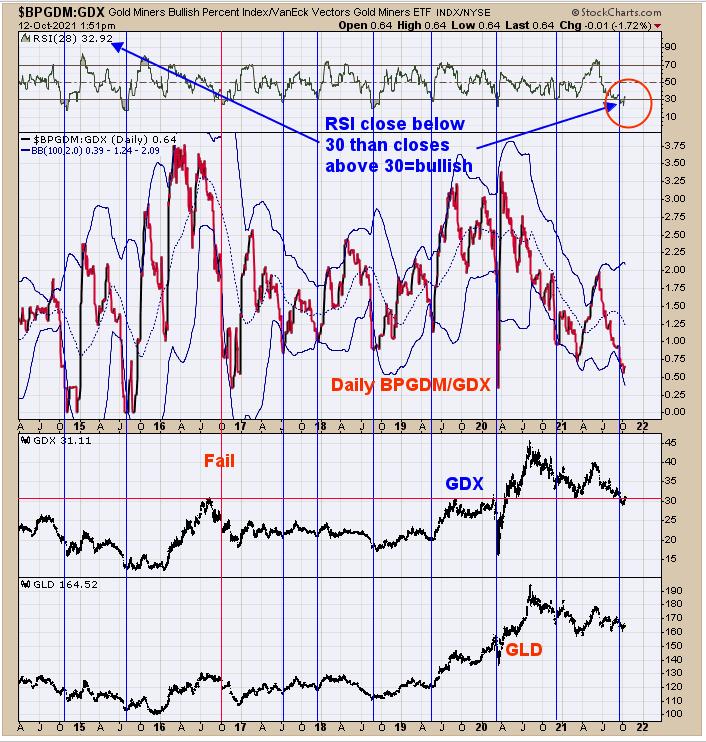

Yesterday, we showed a trade setup using the RSI for the Bullish Percent Index for the Gold Miner’s Index. In a nutshell, this method was a bullish setup when the RSI for the Bullish Percent Index fell below 10 and than closed above 30, which just occurred. Another intermediate-term bullish setup is on the chart above, which is the RSI for the Bullish Percent Index for the Gold Miners index/GDX. A bullish intermediate-term low is predicted when the RSI of this ratio falls below 30 and than closes above 30. This setup was also just triggered. The blue vertical lines show the previous signals triggered going back to mid-2014. There could be backing and filling short term, but, intermediate term, the picture appears to have turned bullish.

Tim Ord,

Editor

www.ord-oracle.com. New Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.