SPX Monitoring Purposes: Long SPX on 3/24/21 at 3889.14.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Sold long SPX on 1/15/21 at 3768.25= gain 10.80%; Long SPX on 10/26/20 at 3400.97.

In the past, we mentioned the possibility that a “Three Drives to Top” may be forming but, so far, we are not seeing any weakness to support that pattern, at least not yet. The bottom window is the Correlation (SPX, VVIX); readings above .50 have been a bearish sign. The current reading is -.72 and not near the bearish level. The next window up is the SPX/VIX ratio. This ratio normally shows weakness before the SP and right now it’s still acting strong. SPX is setting right near the highs and not backing away, which suggests the market may “eat through” the resistance and head higher. Long SPX on 3/24/21 at 3889.14.

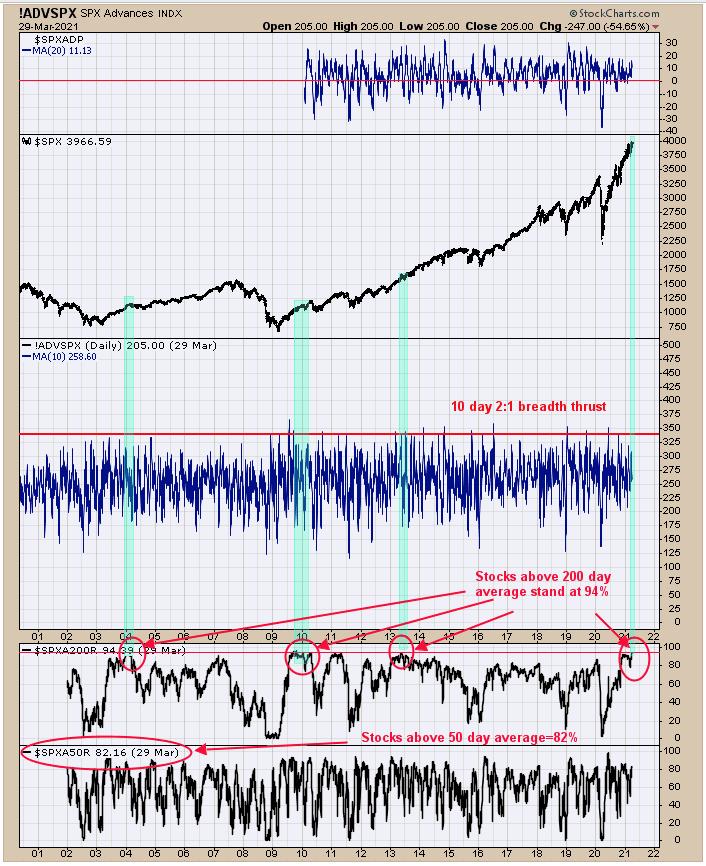

The market is in a strong position. The bottom window is the stocks above their 50-day average in the SPX, which stands at 82%. The next window higher is the stocks above their 200-day average in the SPX, which stands at 94%. Stocks usually weaken first before an intermediate-term top starts to form, which is not happening here. We can have a 3-5% pullback here, but a 10% or greater pullback is unlikely.

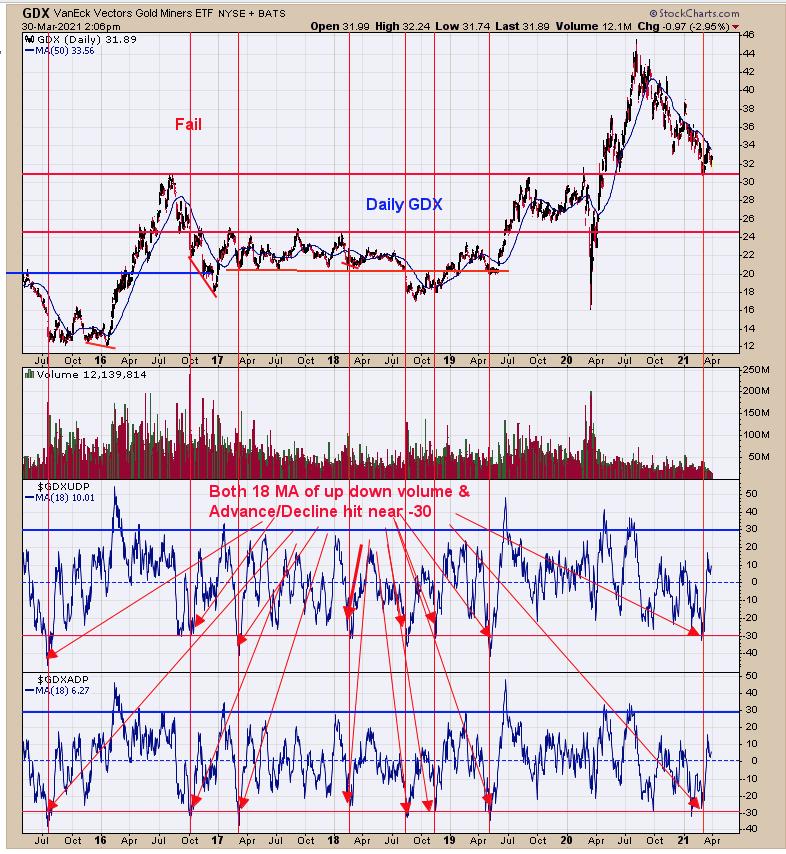

The bottom window is the 18-day average of the Advance/Decline percent for GDX, and the next window up is the 18-day average for Up Down Volume percent for GDX. The important lows were formed by GDX when both indicators close below -30. The chart above goes back to mid 2015 and the red arrows show when both indicators dropped below -30. Of the eight signals going back to 2015, there was one failure (October 2016) 87.5%. Some signals wiggled a bit lower or sideways before the rally started, and that may happen here. Both indicators suggest the market is close to or at a low. Long GDX (10/9/20 at 40.78).

Tim Ord,

Editor

www.ord-oracle.com. New Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.