SPX Monitoring Purposes: Long SPX on 5/31/22 at 4151.09.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

It’s a good sign for a rally in the SPX when both VVIX (top window) and VIX (bottom window) trade to new short-term lows. The third window up from the bottom is the VVIX/VIX ratio. This ratio helps to define the short term trend of the SPX. It turned up today and needs to continue higher for a bullish read. SPX could rally for the next couple of months or longer – see page two.

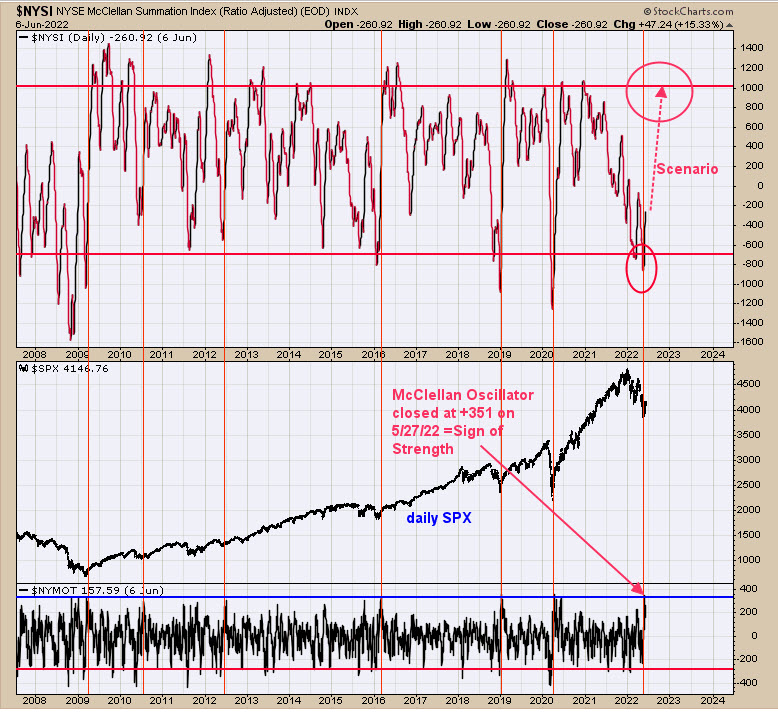

We updated this chart from yesterday. Today, we are just focusing on the bottom window, which is the NYSE McClellan Oscillator. Yesterday, we said “Initiation of a rally can begin when the Oscillator reaches +300; on May 27, the Oscillator closed at +351, which is a “Sign of Strength”. SPY has been trading sideways since 5/27/22, building cause for the next move, and with the “Sign of Strength” on 5/27/22, the odds favor the upside.” The chart above goes back to 2008, and the previous times the NYSE McClellan Oscillator reached +300 (identified with red vertical lines) marked the beginning of a rally that at least lasted a couple of months. It appears the +300 on the McClellan Oscillator is an intermediate-term bullish signal.

The middle window is the monthly HUI/Gold ratio and the window below that is the Bollinger Bandwidth. The Bollinger Bandwidth measures the distance between the upper and lower Bollinger Bands. When the upper and lower bands narrow, the Bollinger Bandwidth declines. The current Bollinger Bandwidth is at the lowest level going back to 2012. The pinching of the Bollinger Bands suggests a large move is coming; since they pinch on a monthly timeframe, a very large move is expected. This large move should be up, as the monthly momentum is up. The timeframe for the large move could start as early as now or later in the year. Our thinking it will start in the August-to-October timeframe, as that is when seasonality is favorable for gold.

Tim Ord,

Editor

www.ord-oracle.com. New Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable, there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.