SPX Monitoring Purposes: Long SPX on 5/31/22 at 4151.09.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

Yesterday, we said “There is panic everywhere in the TRIN, TICK, VVIX, VIX and McClellan Oscillator. We like TRIN in that it uses up down Volume and Advance/Decline statistic and is probably one of the best panic indicators. There are different levels of panic; the larger degree of panic, the higher degree of a bottom. Current levels of panic suggest an intermediate-term low is nearing, which would suggest the 460 SPY target is still a possibility. The bottom window is the 3-day average of the TRIN; readings above 2.10 have formed at intermediate-term lows. The FOMC meeting is Wednesday and market could wait tell then for the potential rebound. Markets that have “rip your face off declines” (of which this is one) have rebounds that ‘Put your face back on’.”

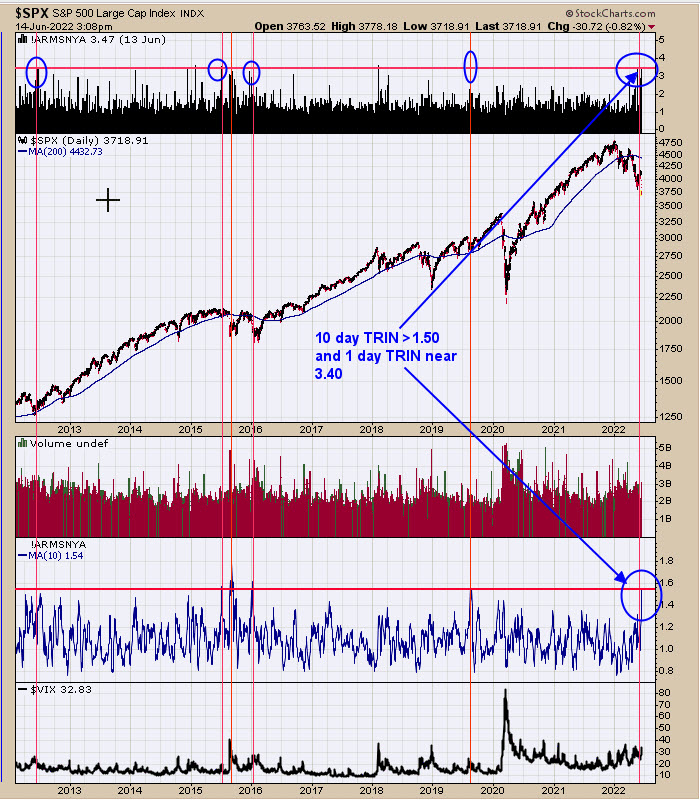

The second window up from bottom is the 10-day average of the TRIN and top window is the one-day TRIN. It’s rare for the 10-day TRIN to reach >1.50 (currently 1.54) and the one day to close near 3.40. We marked with red vertical lines the times when both reached current readings. One marked a short-term low while the rest marked intermediate-term lows. Yesterday, the TRIN closed at 3.39 and tick at -748, the most bullish combination in the last five years.

Yesterday, we said “[the] FOMC meeting announcement is Wednesday of this week and the market may hold off on the ‘up part’ after the announcement on Wednesday.” We don’t have it shown, but volume decreased on today’s new low. Both VIX and VVIX were down today, turning the VVIX/VIX ratio up. This ratio helps to define the trend for the SPX, and it turning up today is a bullish short-term sign.

Today, the GDX tested the previous low of May 20 on lighter volume suggesting support. Yesterday, we noted “the FOMC meeting announcement is this Wednesday and market could wait for the reversal until then. Market bottoms form on panic and we have panic in the TRIN, TICK, VVIX and VIX. It would be a worrisome sign if panic was not present. Its important to remember the higher degree of panic, the stronger the degree of the next rally.”

Tim Ord,

Editor

www.ord-oracle.com. New Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable, there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.