SPX Monitoring Purposes: Sold 8/24/21 at 4486.23=gain 1.83%; Long SPX on 8/19/21 at 4405.80.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Long Term SPX Monitor Purposes: Neutral.

Today marks four days in a row where the SPY is up; can it make to five? If so, that points to this conclusion: the market will be higher within five days 85% of the time for an average gain is .8%. Lets see what tomorrow brings. Volume was relatively low today, along with light volume yesterday, which suggests market is near a stall area. The Nasdaq Composite closed above 15000 the first time ever and around numbers can stall the market. We are not bearish here, but market could consolidate around this level. We sold our long SPX position today on the close for a 1.83% gain. As far as the SPX is concerned, according to our records, we haven’t had a losing trade since mid-March, having six winning trades in a row with a gain of 12.75%.

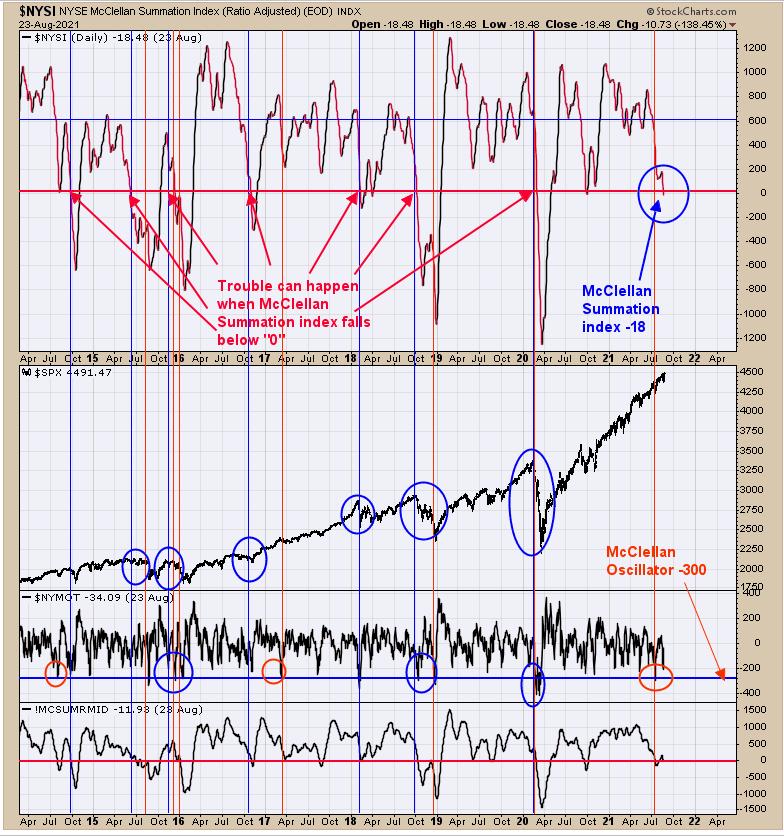

The above chart in the top window is the NYSE McClellan Summation index. We have shown this chart below and it is helpful in identifying times when a large decline can occur. Large declines in the market can occur when the NYSE summation index falls below “0”. The red arrows point to the times when the NYSE Summation index fell below 0. Yesterday’s close came in at -18.48 and below 0. Today’s strong Advance/Decline may have pushed the Summation index back above 0, but, over the last couple of months, the Summation index has shown weakness. Third quarters of the year are also the weakest quarters of the year of which we are in. We are favoring a more sideways market than a declining market going into October, but that may change.

There is evidence the sector leadership may be changing in the coming months and Gold could be one of the new sectors taking the lead. The middle window above is the monthly Gold/NDX ratio. This ratio is near matching the low of the year 2000, where Gold starting to outperform NDX. This ratio hasn’t turned up yet to where gold is outperforming NDX, but it may in the coming months. When and if this ratio does turn up (at some point it will), doesn’t mean that NDX will turn down, but rather that Gold will increase faster than NDX. There are other sectors that may outperform compared to the SPX in the coming months, which are XLB, XLI, XLF and XOP.

Tim Ord,

Editor

www.ord-oracle.com. New Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.