This week, the liquid energy markets exhibited some serious stress. Oil surged in both $WTIC (North America benchmark) and $BRENT, an international benchmark to levels not expected even one or two months ago. Natural Gas also soared in some regions. The good news is that we were working down excess inventories that were built up during the pandemic.

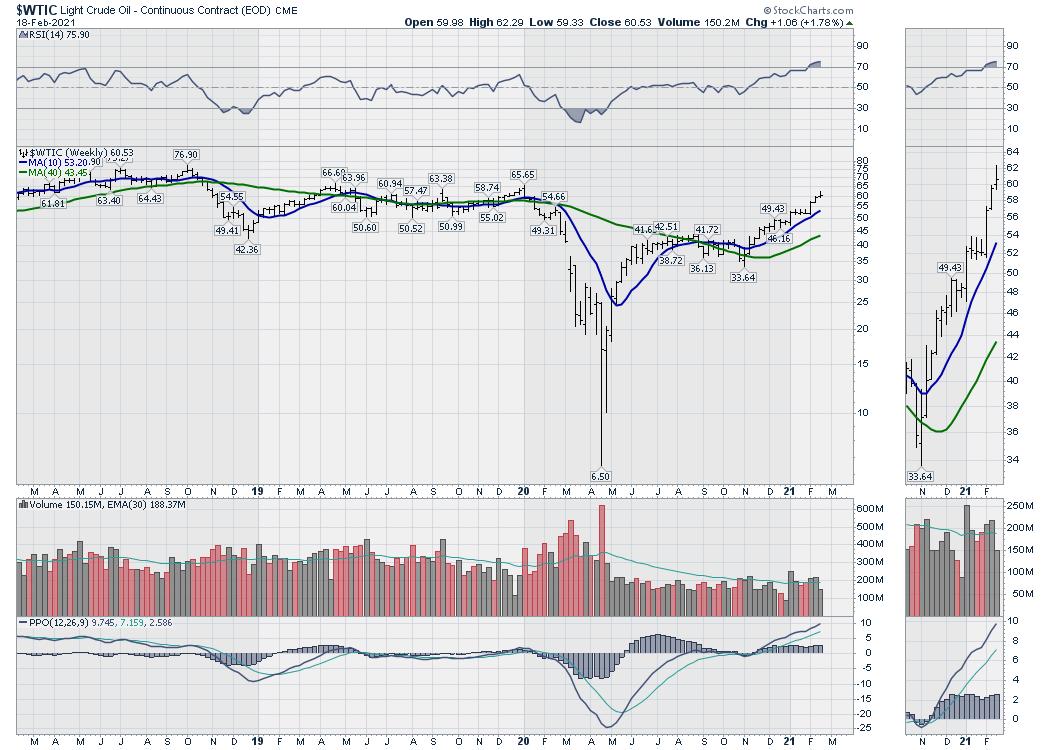

$WTIC – USA – West Texas Benchmark

This oil price chart has quickly accelerated since November, getting another push over the last week. Having oil back to the average of 2019 is a big surprise. Everyone just assumes it will stop near there.

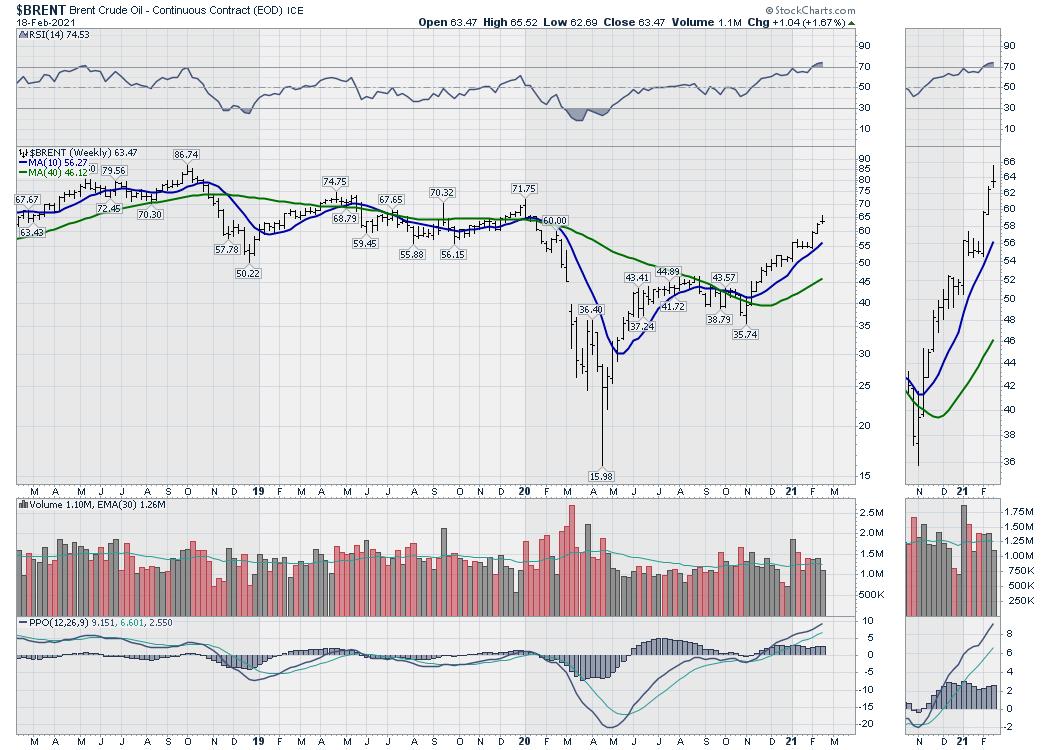

The International Benchmark $BRENT

The same is true for $BRENT. It is mid-range of the 2019 pricing now.

In December, everyone was hoping for a $50 average. I think OPEC+ has been successful in tightening inventories. Improving control by OPEC and a shortage of capital for liquid energy is muting the recovery of production for 2021. Oil reservoirs decline meaningfully each year and new wells have to replace old wells.

I noticed RBC bumped their estimates for crude to average over $60 this year. Notice the bump is just up to the current price.

Photo from Twitter: @Michael_Tran With RBC.

Photo from Twitter: @Michael_Tran With RBC.

It looks like the oil rally might moderate a bit in the short term. Saudi Arabia announced they are in favour of bumping up production to control some of the price surge occurring this week. Oil is down 1% as I write this. So what should an investor do now?

Climate Change

I still believe the lack of investment in liquid energy worldwide is a problem until the electrical grid grows rapidly. We could be well above these crude price numbers by year end. As the recent price surge gives way to a pullback -nothing goes up in a straight line – I want to use the opportunity to find the investments to carry me into the fall. Normally, I would be trophy hunting for oil names around the first Friday in July, as it is the start of the Calgary Stampede and just so happens to be a time to look for a low in oil names.

Recently, the date has lost some of its bottom-picking accuracy, but, as the vaccine starts to allow economies to return to some level of normal, I expect oil demand to be one of the most obvious surges due to normalization. I think it was JP Morgan’s analysis of Israel that, with 40% of the citizens vaccinated, they could drop the case count to zero by June. If, all of a sudden, this COVID-19 situation shrinks by the summertime, a lot of business plans will move forward rapidly. My July date would clearly be late.

USA oil inventories are migrating below the 5-year average suddenly, and countries like Brazil, India and China continue to use more than the prior years. We’ll need significant inputs from OPEC for global balance as these developing economies increase their thirst for oil. Just because OPEC adds a little doesn’t mean oil surpluses are continuing. It is widely believed OPEC has a 6-7% increase of global production volume available (6-7 Million barrels/day).

The longer-term global reduction in new oil production is probably in the range of 5% coming off the pandemic. (That is just my back-of-the-napkin guesstimate.) This is also due to the continued lack of investment in fossil fuels that the world is experiencing, not including the annual reservoir declines as we drain the oil out of existing wells. That doesn’t leave a lot of spare capacity should we have more issues with weather, geopolitics, the continued lack of investment, few new mega-projects, increased carbon taxes taking R&D money away from the industry and a lack of new grads entering the industry.

People Die without Energy

As we saw in Texas, we were hours from having a huge grid implosion. An 11-year-old died of hypothermia as the home was not heated. The utility companies keep operating the grids close to maximum draws. If I am not mistaken, Washington state, Oregon, California, Texas and New York have all suffered major power outages this year. Those are some large-population states. 14 states – from Montana to Texas – suffered major power outages, wiping out the centre of the nation with one recent storm. It was a big storm, but it was still one storm. Whether it is electrical power from solar, wind, natural gas or other sources, we need energy. Do we have to wipe out the energy grid simultaneously across America to see the fragility?

A long-term major breakdown could have killed thousands quickly. From my helicopter view, as we move closer and closer to “just in time” for -capital efficiency-, we risk being closer to the nightmare scenario.

Hoarding

The US is currently controlling vaccines shipping out of the country. This is a first response by governments when faced with shortfalls. A new rumour circulates every month that China is hoarding rare-earth metals. Within America, Texas just announced no shipping of Natural Gas to neighbouring states when shortages started to show up. It’s a natural reaction to keep it for your own voting residents, whatever the shortage is.

My suggestion is be very careful shorting energy at all. As the electric grid comes under increased load by moving to electric transportation without building out the grid in advance, we are looking at the setup for a perfect storm. In Texas, it was a combination of renewable but predictably inconsistent supply due to little wind and frozen windmills, as well as snow on the solar panels. We understand that about renewable energy. They may not spin or shine on any given day. Fossil fuels waxed up as the temperature dropped and small amounts of water in the grid systems froze pipeline valves, disrupting supply (not the first time weather affected output). Refinery outages (power, freezing issues, preventative shutdowns) stopped refining liquid energy like gasoline and diesel, and we have seen shutdowns in hurricanes before. Various types of supplies failed this week in Texas, but the government was quick to block sharing some of these assets. As this energy grid comes under more pressure, don’t be surprised if that happens more and more.

If you google major power outages in 2021, we have already had 247 globally according to Wikipedia in 45 days.

All of this goes on behind the drive for capital efficiency, which is the opposite of reliability. It’s reliable on normal days. I realize everyone wants to invest in green energy. One green power company lost $80 million in a few days in Texas as their windmills froze. Everyone tries to make energy, but these situations happen. The last time a freeze lasted this many days in Texas was 90 years ago. That was long before the discussion of climate change. We still have to plan for that strange anomaly called weather, but the current methods don’t. It also suggests how quickly terrorism on a utility network can stall a country. That was a major strategy during wars. Take out infrastructure. Now it is more subtle. They use network viruses.

It’s not limited to grid construction or refinery utilization. In January, the reddit traders also came close to taking down the financial markets, according to Thomas Peterffy. That was a mood swing, or crowd mania, that caused that. But the fact that Robinhood’s backers had kept capital at a minimum requirement almost crushed the company. As Tenev said, they could not have come up with the $3 Billion.

I am reminded that Capital Efficiency Ratios were an issue in 2008 for the financials. At the time, US banks were pressuring US regulators. They were citing the low capital requirements for European and Asian banks. The extreme ratios the banks were using created stress when everything unwound. The systemically important banks now have this as a regular review. Somehow, grid infrastructure does not have this.

As we move to green energy, I would suggest investing in fossil fuel as a continued source of energy could be a real bridge we need. Either the power companies expand the grid rapidly and we pay huge increases in per kilowatt hour rates, or expect the grid to become a significant hurdle in business operations. An example is the semiconductor sector, which was already dealing with output shortages. They shut down chip facilities in Texas this week, due to power supplies and weather, when they already have an output shortage. The backdrop of reliable energy is fading quickly. We are getting less reliable energy.

Bill Gates’ new book estimates we have to double the grid by 2050 for transportation electrification. I’ve bought the book this week, but have not read it yet. Elon Musk also talks about doubling the grid.

We have been expanding the global suction of electrical use (cellphones, more appliances, heating/cooling, multiple TV’s, alarm systems, internet always on, ROKU, Apple, Google Chrome boxes, more decorative lighting in homes, backyard lighting, under counter, mood lighting, bitcoin farming) before cars. Now we want to charge 1000 horsepower Hummers, not 75 HP econoboxes. Just analyze the horsepower numbers these new electrical cars are coming out with. It would suggest that doubling claim is woefully inadequate. We also have the issue as developing economies need electricity. Even within the US, there are developing low-income micro-economies within the US economy. When the grid has expanded significantly, we might be able to transfer the load. Until the grid is ready, we are living with the possibility of multiple events occurring at the same time that crashes the current combination of infrastructure. A desire to create massive electricity demand before the money comes to expand the grid is a nightmare scenario.

Analysts are just starting to ramp up their oil price estimates. Some have moved 20% inside 60 days. Interestingly, they still see the 2021 average no higher than the current price. Rarely are they exaggerating coming out of the lowest level ever. Usually we see exaggeration at the top where the trend line is drawn to infinity.

Some analysts are having trouble believing 2019 prices hold and oil will fall back. An energy analyst with his own newsletter (full-time career) was expecting oil prices to plummet in December 2020/January 2021 as recently as December 2020. That is how scared analysts are for predicting higher oil prices. They have been kicked down for the last 10 years.

Some analysts are just waking up to the storm in front of us. Peter Lynch, Warren Buffett and David Tepper all like oil companies here. Jim Cramer calls it ‘un-investable’ now that he bought a Tesla.

My suggestion: Look for opportunities in energy. All kinds of energy.