For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

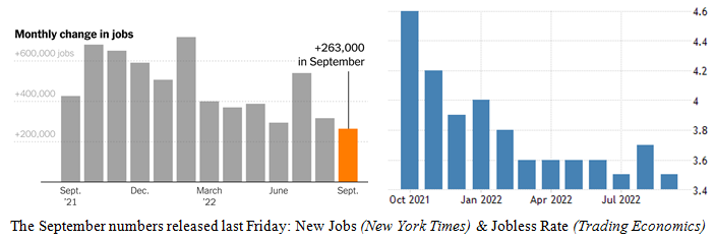

Last week, the ritual event happened. The stock market waited with grim anticipation for the September jobs report, since the first Friday of every month brings us the new unemployment data, focusing on two headline numbers – the total “new hires” (specifically, non-farm payroll growth) for the last month, and the new “unemployment rate,” both of which impact the market greatly.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

September’s 263,000 jobs marked the “coolest” (lowest) rise in 12 months, but it wasn’t “cool” enough.

Apparently, it was the low (3.5%) unemployment rate that spooked the market, since the stock market, gold, bonds, and the whole broad dashboard of price signals turned red, reacting to Friday’s jobs data:

- For the first four days of October, the S&P 500 rose 4.43%, but on Friday the S&P fell -2.80%.

- The Dow rose 1,548 points on the first three days of October, but it fell 631 points on Friday.

- The 10-year Treasury note dipped to 3.6% on Tuesday but it returned to 3.9% on Friday.

But let’s stop to ask if the number of new hires or the unemployment rate is that important in light of the reality that nearly every business is begging for more workers? Take an inventory, if you go on the road.

This week, I was on my way to the ferry dock in the San Juan Islands of Washington State to catch a boat on a long drive to the Seattle airport for a trip to the New Orleans Investment Conference that started on Wednesday.

I usually leave a day early since I can’t rely on the State-monopoly ferry system being on time, or even sailing at all, since they laid off their unvaccinated workers last year and haven’t hired them back. In addition, most of the ferries are 40+ years old and break down a lot, and they can’t find enough new workers to man the ships.

Then, when I get to the mainland, most of my favorite diners are closed for lack of staff, so I shop around to find anything open. The Seattle airport TSA lines are sometimes backed up into the parking lot (photo).

When (if) I finally get to the New Orleans hotel (or any hotel), there is no maid service. Many local shops are boarded up, out of business, and most others have prominent Help Wanted signs. Many shops are out of goods, and goods I order on the Internet for “overnight” delivery often take a week to arrive.

So, a more important question is: Where have all the workers gone, and how big is the real Jobless Army?

Millions of Working-Age Americans Are Quietly “On Strike”

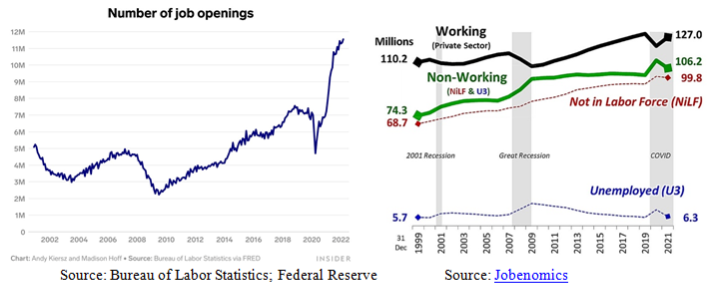

Tens of millions of Americans seem to be staging the quietest strike in history. There are few news stories about this massive walkout, but there are now nearly 12 million job openings, many offering good pay and signing bonuses for those sticking around 90 days, and there are plenty of healthy bodies available to do the work, but we have a massive army of adults in prime working age Not in the Labor Force (NILFs), by choice.

They are not counted in the unemployment rate, which only counts those looking for a job and (by their own report) not finding one. In 2021, there were 6.3 million unemployed but 99+ million NILFs.

The NILFs outnumber the unemployed by 15-to-1. Since the dawn of Y2K, there has been a 600,000 rise in unemployed (+10.5%), a trivial rise, and a 16.8 million rise (+15.2%) in employed workers, about in line with population growth, but a 31.1 million rise (+45.3%) in dropouts – those not in the labor force.

In his new book, “Men Without Work: Post Pandemic Edition” (published on September 19, 2022), Nicholas Eberstadt cites all the data from his 2016 book of the same title, then updates the much worse totals since COVID struck. During the lockdown, and well after, Eberstadt writes (on page 21):

“…a windfall nest egg of more than $2.5 trillion in borrowed public funds was bestowed on private households. This was money that could supplement earned income – or substitute for it. And Covid-19 payments also provided cash to keep people out of work more directly.

Though meant to contain economic distress and keep vulnerable families in their homes, some programs displaced people from the labor market more or less by design. One was the $600-a-week ‘unemployment’ benefit available almost unconditionally in 2020 and 2021 (when it was lowered to $300), never limited only to the technically unemployed.

Pandemic unemployment insurance benefits went to tens of millions of Americans. At the peak of the program, recipients outnumbered the unemployed by 17 million, almost 150 percent. Wittingly or not, Washington stumbled into a dress rehearsal for the universal basic income, a pet project of enlightened dirigistes at academies and aid agencies around the world.”

There are too many causes to generalize one or two main sources for this strike, but those over 55 tended to retire early, partly due to this extra cash windfall and profits from their stock-oriented 401 (k) retirement plans, and rising real estate values.

The poor got wealthier even faster, says Eberstadt: “…in just two years, between the end of 2019 and the end of 2021, the net worth of the bottom half rocketed up by almost $1.8 trillion, nearly doubling. In effect, the 64 million homes in the bottom half of the wealth curve won a Covid-19 policy lottery,” by being paid benefits far above their salary levels at the time.

Eberstadt also points to the mental shift of men no longer being the main “breadwinner” in the family, of losing or forsaking the responsibility of providing for a family. It casts men “into the role of dependents – on their wives or girlfriends, on their aging parents, or on government welfare.”

Instead of “shouldering the burdens of civic responsibilities, it instead encourages sloth, idleness and vices.” You may know some men (even relatives) that fit this description too closely for comfort. This has also led to the “deaths of despair” which have risen so rapidly, from suicide, opioid abuse, obesity or diabetes, and alcoholism.

Not all the blame falls on unwilling workers. Federal regulations and overly bureaucratic working conditions have pushed a lot of creative workers into private off-the-book work. Who wants to wear a mask all day anymore? Who wants to have a government or company insist on vaccinations just to work?

Entrepreneur Vivek Ramaswamy describes how the New Left has invaded corporate America, from Wall Street to Silicon Valley, with an array of silly exercises in trendy group-think, reminiscent of totalitarian state schools.

Who wants to submit to mandatory indoctrination in “implicit bias,” scolding sessions from some overpaid consultant mandated by the company or the state, as happened to a nurse with 39 years training? I’m not sure I would want to work in such a toxic environment, in his new “Woke, Inc.” era.

This analysis may seem to be off the focus of economic growth, but not really, since a nation can’t grow in this world if the cream of its youth is not motivated to work and grow in skills and education enough to compete in a world facing a multitude of hard challenges.

If we don’t work hard to solve these challenges, other nations will. If we don’t work hard and smart, China, for one, will surpass us in the coming century.