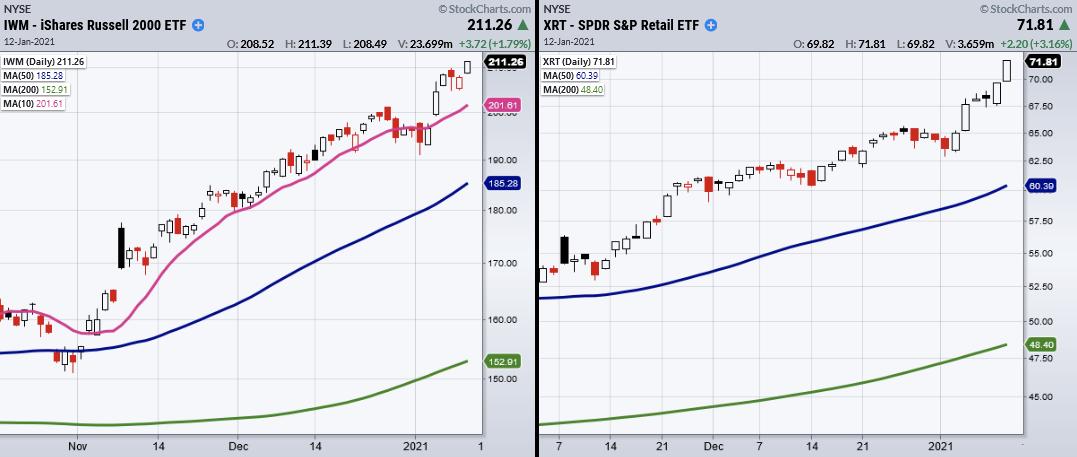

Grandad Russell 2000 (IWM) and Granny Retail (XRT) make the Perfect Power Couple.

The Russell 2000 (IWM) followed his wife (XRT) Retail, to new highs today while major indices sit under their recent highs. Granny’s enthusiasm has not only encouraged Grandad to get back up since his recent pause under the 10-DMA, but it can also be seen spreading to other members of the Economic Modern Family. Transportation (IYT) broke to new all-time highs. Regional Banks (KRE) shot to new multi-month highs after breaking key resistance from the 200-week moving average at 52.63.

Regardless of headlines, our “inside” sectors of the Economic Modern Family are telling us to stay the course.

However, we also like to remind you to stay the course with rules-based trading. That means having stops, trailing stops, and profit targets. It means thinking about timeframe and risk/reward before adding anything new from the long side. And it also means that, in spite of the recent optimism, it is overbought on the monthly relative strength indicators.

Therefore, continue to watch the risk-on junk bonds (JNK). It is very simple, really. The appetite to buy high-yield, riskier companies means risk-on, which is good for the market. Should those investors head for the exits – watch IYT, IWM and XRT.

Many believe the market is a house of cards – only if you do not understand the hand you are dealt!

Whenever you’re ready, here are 3 ways I can help you reach your trading goals…

- Stay one step ahead of the market with my daily market analysis, Mish’s Daily.

- Get the foundational building blocks of my trading strategies from my book Plant Your Money Tree: A Guide to Building Your Wealth, andaccompanying bonus training.

- Trade with me and take your trading the next level by following my real-time trading ideas as a member of my premium services.

- S&P 500 (SPY): 375 support

- Russell 2000 (IWM): New all time highs. 200 support

- Dow (DIA): Support 306.66. Resistance 312.07 high of monthly Bollinger band

- Nasdaq (QQQ): 310 support

- KRE (Regional Banks): Broke 58.47 2020 highs

- SMH (Semiconductors): 221.79 support

- IYT (Transportation): 223 support

- IBB (Biotechnology): Like to see 158 keep holding

- XRT (Retail) New all-time highs

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Trading Research and Education