I recently made $942 in a matter of minutes…

Trading a morning spiker that was already up 200%.

Usually, when a stock’s already up that much, people avoid it.

But I still believed it could run higher.

Turns out the stock surged by 380% that day.

Now, you’re probably wondering: lucky trade or did I do something?

After all, most traders wouldn’t buy a stock that’s already up 200%

How’d I know it was a smart trade versus a desperate chase?

Three reasons…

The Right Time to Buy Morning Spikers Vs. Chasing

New traders have trouble understanding the difference between a smart trade and chasing. Here are the three reasons why I felt confident entering this trade.

1. Continued Volume After News

On Tuesday morning, Trading Cyber Enviro Tech (OTCPK: CETI) announced the launch of a pilot oil production and water filtration technology program. The press release said it could be a $4 billion opportunity.

New technology excites people, and a number like that is enough to bring in buyers … even if it doesn’t happen.

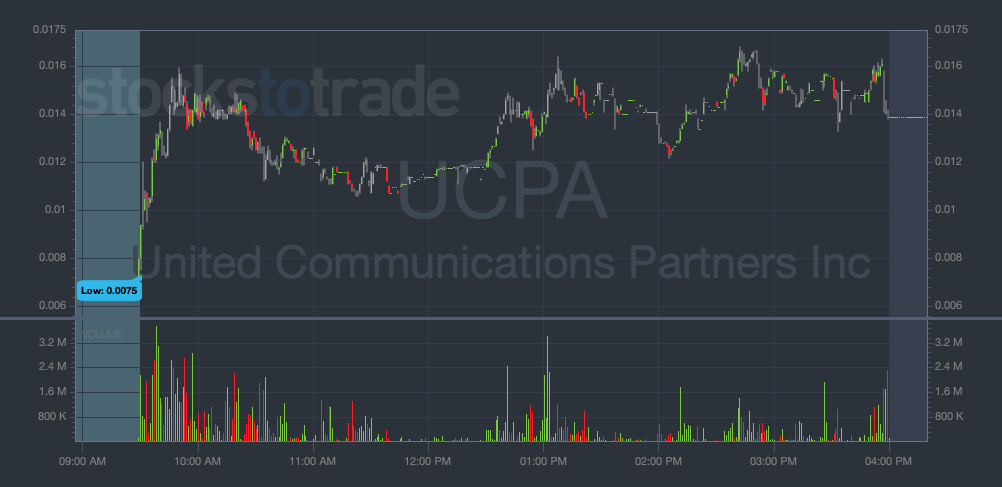

STT’s Breaking News Chat alerted the news on CETI in the premarket. If I’d seen it right away, I could have traded sooner. But I was busy trading United Communications Partners Inc. (OTCPK: UCPA) for a $726 profit.

By the time I saw CETI, it was already up 200%.

Sometimes, news like this can create a quick spike then it’s all over. But CETI continued to trade on strong volume after the news — it didn’t crash and burn.

But that wasn’t all…

2. I’ve Seen This Pattern Before

I always say that I’m a glorified history teacher. I want traders to understand — you’ve gotta study the past to be prepared!

There’s NO excuse to not be prepared. My Trading Challenge students have access to a massive video library … My YouTube channel is full of free videos, too.

The more that you study trades in real time and from the past, the more you’ll be prepared to capitalize.

If you act fast, you’ve got a chance to trade live with me and get some serious market experience — grab your spot NOW for my all-day live trading event coming soon!

I’ve seen plays like this over and over. Just last week, UCPA spiked on news. Like CETI, I found it through a Breaking News alert. Also like CETI, I didn’t get in right away. But I still made a $472 profit.

When I see runners with price action like these, I see the potential.

But even so, it’s never a sure thing. Which leads to the next reason…

3. I Had a Plan

CETI went up over 380% — the biggest percent gainer we’ve seen in weeks.

I didn’t know it would go up that much — it was already up 200% when I bought it.

I saw the news. I saw the price action. I saw the potential…

But I still wasn’t sure.

So why did I still enter the trade?

Because I knew that I could take a small position. I knew that if I was wrong, I could cut losses quickly.

It’s not rocket science. If you’re not sure, you can take a small position. You can paper trade on StocksToTrade.

It doesn’t have to be all or nothing. And you don’t always have to be right.

I actually traded CETI three more times over the course of the next 24 hours. I had one more $211 profit…

But I also had two losses — a $248 loss in the late morning and a $180 loss on an overnight hold.

But because I cut losses quickly, my wins were bigger than my losses.

You don’t have to be right all the time to grow your account. Small wins can snowball over time … here’s how!

Keep Learning…

Whenever I have a trade like this, I get a ton of questions…

- How did I see the news?

- How did I know to buy?

- How did I figure out position size?

- How did I know when to exit?

I made a video to answer all of these questions. Watch it and learn!

You might have missed CETI … But you can still learn from this trade and be prepared next time we see a massive runner like this.

Do you think I was crazy to enter CETI when it was already up? Do you understand the difference between having a plan and chasing? Leave a comment … I love hearing from you!

The post The BEST Time to Buy Morning Spikers (Without Chasing) appeared first on Timothy Sykes.