Every day’s action convinces me more that the bottom is in. I called it in mid-June and nothing has changed my mind. This morning we got the horrible inflation news (a bit of sarcasm). Here was a CNBC headline:

And if you’d like to spend some money for a little Monday morning quarterbacking, here’s another:

For a few hundred dollars, you can discover that market pros see higher risk of recession. Wow, breaking news!

Wall Street is looking past inflation and so should we. Listen, the news wasn’t good at all. I’m not downplaying the news. Headline CPI for June rose 1.3%, well ahead of the 1.1% estimate. If we strip out volatile food and energy, June Core CPI rose 0.7%, again well ahead of the 0.5% estimate. But don’t make the mistake of trading based on news or headlines. It’s much more important to see how Wall Street reacts.

I was fairly confident the selling this morning would not last. Check out the recovery in a few key ratios:

I don’t know what the rest of the day holds, but with awful inflation news, I’m seeing discretionary (XLY) soar vs. staples (XLP) since the opening bell. The same holds true for both the NASDAQ 100 vs. S&P 500 (QQQ:SPY) and growth vs. value (IWF:IWD). Ask yourself, why would money rotate INTO these areas if inflation is accelerating? Of course, we haven’t closed for the day and we know how quickly conditions can change on Wall Street, but the first 90 minutes of trading is rather encouraging, in my opinion.

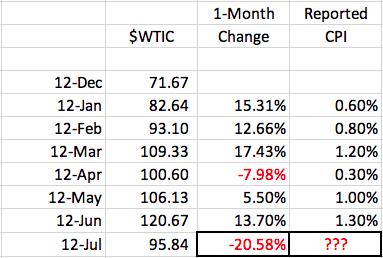

Oh, and wait until the July headline CPI hits in August. Look at this crude oil ($WTIC) chart and compare it to the headline CPI numbers:

The vertical black-dotted lines highlight the 12th of each calendar month. From prior studies, I recall that CPI cuts off as the 12th day of the month in its energy calculation in CPI. I have not verified that, but that’s what I recall. If true, then the following table highlights the correlation between rising/falling crude oil prices and the monthly CPI numbers for every month in 2022:

The April CPI reading was the lowest of the year and it corresponds with the worst 1-month performance in crude oil – not surprisingly. Take a look at the 20% drop in crude oil prices from June 12th to July 12th (yesterday). That will have a tremendous “deflationary” impact when the July CPI is released in August. The inflation narrative, while hot today, is going to cool considerably a month from now.

That’s one reason why Wall Street is using today’s news to scare traders out of their aggressive growth stocks. They’ve been happily buying them all morning. If it continues into the afternoon and close, that would be quite bullish market behavior.

Despite all the negative news that continues to pour out, fear is subsiding. That’s the absolute worst news for bears that believe we’re in 1929, 1974 or 2008. The Volatility Index ($VIX) hit an intraday high today of 29, but it quickly turned negative and is currently near the flat line. The VIX previously saw highs in the 38-39 range when fear ramped up. As fear subsides, so too does the panicked, impulsive selling.

I recently did an analysis of intraday trading of the QQQ for the months of April through July and realized how Wall Street has been accumulating positions, while simultaneously encouraging the investing public to sell. It was absolutely AMAZING and, if you’re a trader, you MUST be in the know. If you’d like to see what I’m talking about, CLICK HERE to sign up with your name and email address for our FREE EB Digest, and I will publish the data in the Friday, July 15th newsletter, at 8:30am ET. Trust me, you’ll be amazed like I was!

Happy trading!

Tom