Summer Fields Investments commentary for the second quarter ended June 2020, discussing that we might have moved to a new bull market.

Q2 2020 hedge fund letters, conferences and more

Dear Friends,

We Might Have Moved To A New Bull Market

The last client-wide letter sent was titled “Bear Market Playbook”, and logically, I feel obliged to provide a market update, because we might have moved from the fastest bear market in history, to a possibly new bull market.

It is not simple to pinpoint exactly where we are now in the market cycle. Ed Yardeni, a respected analyst, mused recently that because of the speed of the bear market and ensuing recovery, the March lows may not have been a real bear market, but merely an extreme “correction”, and we might still be in the prior bull market. The fact that prior market leadership (Big Tech) is still leading the market supports this view.

Some pundits think that we are due for a pullback here, and some actually predict poor equity returns for the next decade.

Other economists believe that we are now in a new bull market, in the early stages of a new economic recovery.

Both Jeffrey Gundlach and Ray Dalio, among other financial analysts and pundits, have predicted that in the coming decade, the S&P 500 will provide low returns.

I recently attended an excellent presentation online about the energy sector by Warren Pies, a Ned Davis Research analyst in the energy sector. The setup to his talk, in my view, was important.

He discussed that because bond yields and interest rates are currently so low, it effects the intrinsic current view, and thus valuations, of the entire market. Applying a bond term to equities, the market currently looks at some stocks as “long/high duration” instruments, and some stocks as “short duration” instruments. This view becomes more exaggerated as interest rates creep lower and lower.

Duration is a measure of sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates. In general, the higher the duration, the more a bond’s price will drop as interest rates rise (and the greater the interest rate risk). As a general rule, for every 1% change in interest rates (increase or decrease), a bond’s price will change approximately 1% in the opposite direction, for every year of duration.

It has been easy to see that the market consistently shows short term thinking in extrapolating current events and conditions far into the future. We have seen this often, as it is part of the human condition. When we feel good, we sometimes think it will always feel this way. When the mood turns less pleasant, it sometimes seems it will always feel this way.

In that way, it appears that the market has been lulled into a feeling that interest rates will always be this low or lower. Indeed, we have experienced an almost 4 decade bull market in bonds (where yields have gone lower and lower). That trend has been getting more and more stretched and that shows itself in many different areas of the economy.

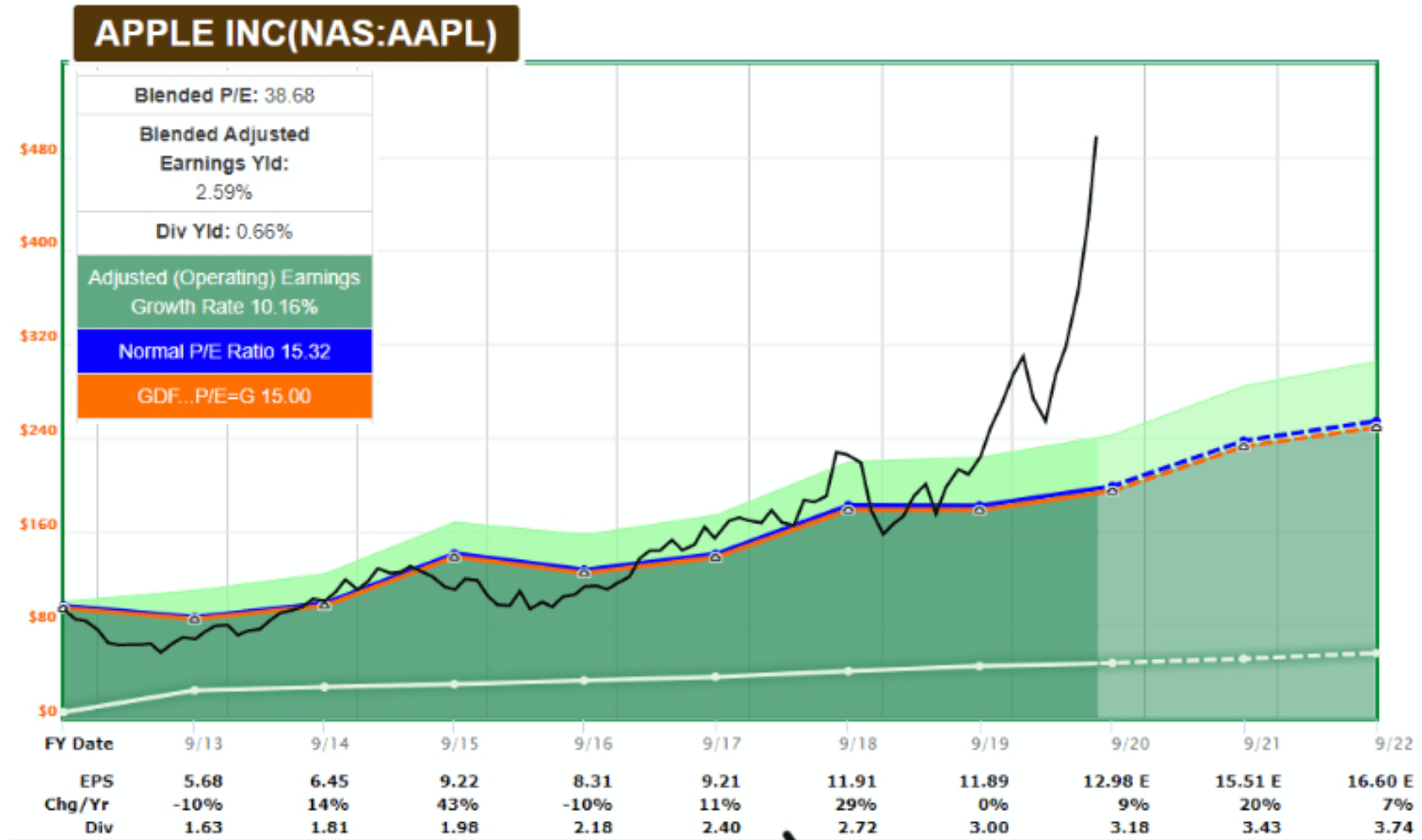

A Look At Apple’s Earnings

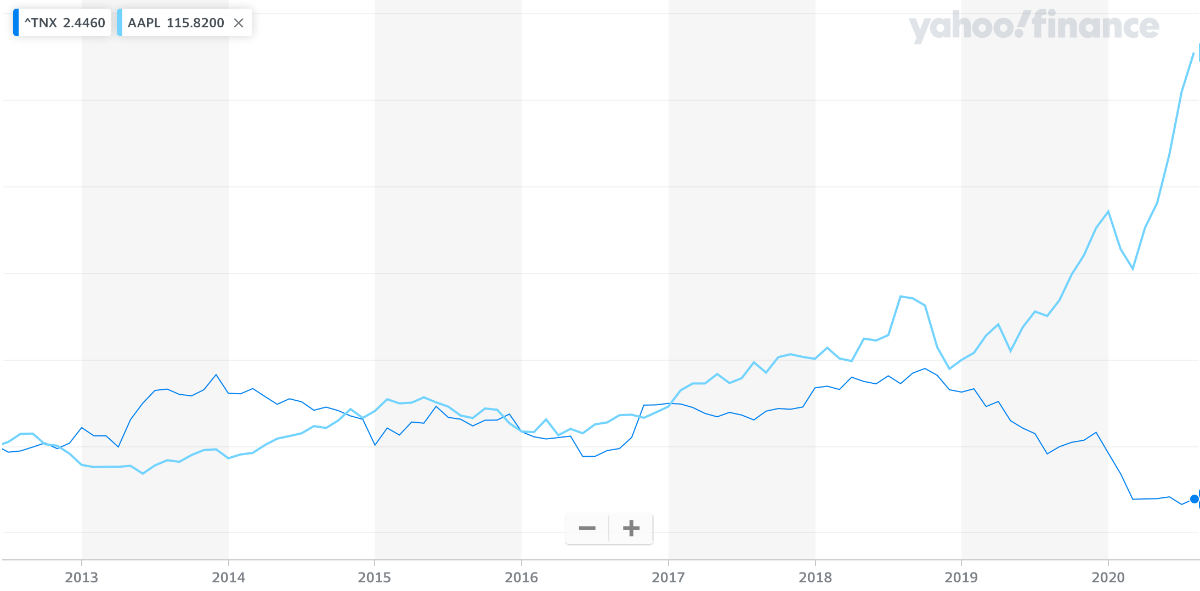

In order to see how this plays out in the real world, let’s look at Apple, Inc as an example. As I have discussed in prior annual letters, I bought Apple when it was trading for around 10-11 times earnings in 2012-2013, for a dividend yield of around 2.4%, and an earnings yield (EPS/share price) of 10%, which was an outstanding bargain at the time. I initiated a position after it announced its first dividend, and I added to it relatively aggressively as it fell 40% in the following year. At the time, the market was scared that it was a “one trick pony” with revenues primarily coming from the iPhone, which was still nascent, and the iPod, which was diminishing in importance. It is worth noting that the ten year treasury yield was over 2% in 2012-2013, and the 30 year treasury yield was well over 3%.

Currently, Apple trades at 35 times earnings, yields a 0.7% dividend, and has an earnings yield of 2.65%. The ten year treasury currently yields 0.63%, and the 30 year treasury yields 1.35%.

We can see how as the ten year treasury yield falls through 2019 into 2020, Apple starts going parabolic. The divergence continues as the yield sinks lower.

The Federal Reserve, in order to save the economy in March, aggressively injected liquidity in the markets and bought bonds in order to stabilize current financial paradigms. This caused rates to fall to extremely low levels as more bonds were purchased. This has contributed to increasingly warped valuations on already popular stocks. I do like this idea, which others in the financial community have echoed as well, that as bond yields have descended lower and lower, it has spurred investment in companies that could be considered longer/higher duration growth plays. The caveat, of course, is whether some of these companies can really sustain growth rates that the market is pricing in long term. The market often overestimates the growth trajectory of companies. The other caveat is, what happens if rates go higher?

Some would call Apple’s recent move a parabolic mania; others would say it represents a shift from hardware to services, which is higher margin – some would say it’s a bit of both.

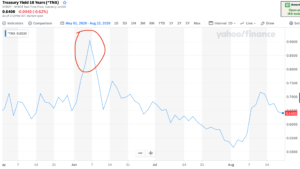

In early June, we did have a taste of what would happen when rates rise. Many stores reopened in early June, and the “reopening trade” came on. Many of our more value oriented positions mightily outperformed during this short time period, until concerns about the worsening of the virus and delayed reopening, as well as other economic concerns, came to fore, which caused yields to retreat again as more economic easing occurred.

First week of June ten year treasury bond yield spike – “Reopening trade”

As an aside, Ned Davis’ conclusion about the energy markets was that there will probably be a recovery when demand recovers. My thoughts on that are, if energy is currently viewed as a short duration asset, it should recover stronger than usual as the real economy recovers and demand improves. Energy has been the worst performing sector since Covid, primarily due to demand reductions especially around jet fuel, industrial uses, and other such areas. But it could end up being the best performing sector when things turn.

Going back to where we are in the economic cycle, if we are indeed at the tail end of a bull market, it makes sense to think that it might be a risky time in some sectors now. Increased retail participation is a known qualification for a possible market bubble, and with people cooped up at home with no sports betting and little else to do, they have jumped into the markets in exceptional volumes since the pandemic began. The data shows record numbers of new brokerage accounts opened this past year. Furthermore, as we can see, glamour stocks and glamour sectors got even hotter since the lockdowns. Tesla, Nvidia, Amazon, Chewy, Shopify, Etsy, and many other “glamour” stocks are trading at extremely high multiples. Some, like Tesla, appear to not have multiples at all – most of their very slim profits come from selling regulatory credits, and they do not as of yet appear to be structurally profitable.

Tesla has been promising “Full Self Driving” for 5 years, and has been taking customers’ money for the service for some time already, but the service as named doesn’t fully exist yet

The Different Market Manias

We have successfully identified several manias in the past – The cannabis sector blew up, and then crashed – Tilray stock reached $176 per share a few years ago; now it is $6.64 per share. Some crypto-related stocks also bubbled up, and have since crashed (it remains to be seen what happens with crypto itself). This is a natural occurrence in markets, made even more possible through large monetary easing by the Fed.

There are, of course, real and fundamental reasons some of these stocks are going up. E-commerce usage has gone up a lot due to quarantines, and the pandemic has indeed accelerated a lot of existing technological trends. Also, the fact is, FANG have shown themselves to be extremely cash rich, robust, and capable businesses (regulatory overhang aside). Even Tesla could have a large future buying base in younger fans who will grow up to view the car as a status symbol. However, the market constantly overshoots and undershoots.

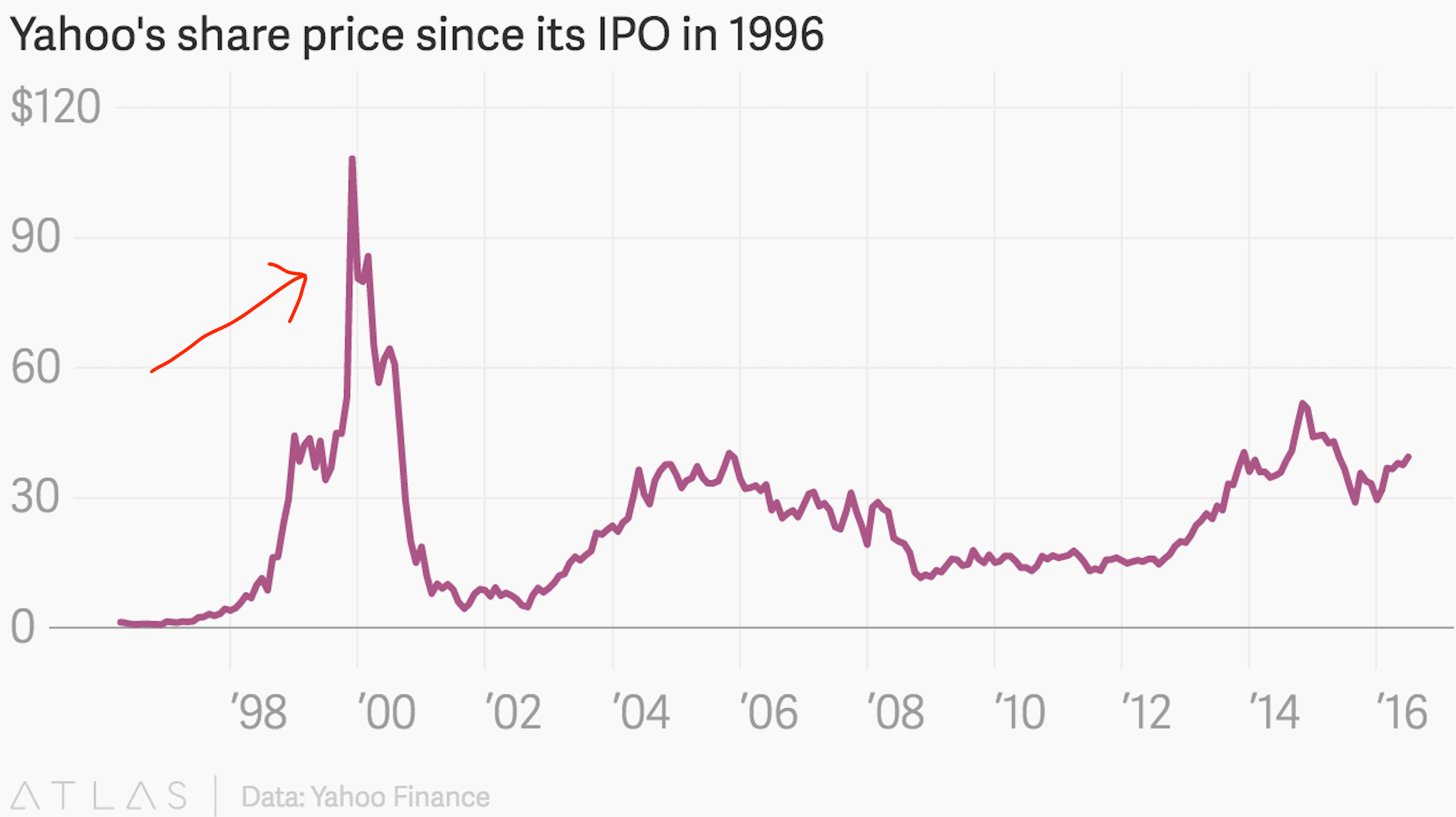

These dynamics are compounded by the rise in passive investing, which allows money to be funneled into large percentages of stock in the index, and for now that looks like the big getting bigger. This is reminiscent of 1999, as desired tech stocks went up much higher than normal, because of high insider ownership, where much of the float was locked up, and incremental investment pushed stock prices much higher than normal. Qualcomm, for instance, which many of us own, went from $3 per share to $87 per share from 1998-1999. Everyone knew their technology would be ubiquitous and crucial in future technology applications. However, the market was a bit premature in predicting proper growth rates and accurate valuation, and overshot. The share price of Qualcomm went down to $13 in 2002, and did not exceed the prior highs of 1999 until 20 years later.

We can see a lot of excitement in Yahoo’s share price in 1999, leading up to its inclusion in the S&P500 index

Another symptom of bubble behavior is the large number of SPACs (Special Purpose Acquisition Company) we are seeing listing on the public markets these days. SPACs are “pre-revenue”, meaning they are completely unproven entities. Investors are committing capital to these vehicles without even seeing any financial statements or evidence that they are even a business at all.

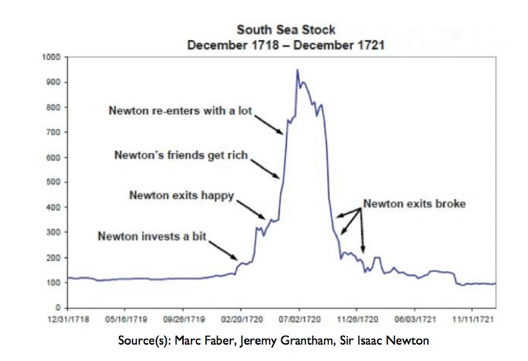

Very smart people have tried to take advantage of bubbles over the years and have failed – Sir Isaac Newton, one of the most influential mathematicians of all time, lost a lot of money on the South Sea Bubble in the 1700s.

The graphic about monetary expansion shown in the “Bear Market Playbook” letter was very revealing, and I am so happy and grateful that I incorporated that research into my macro views. As we know, the Fed has pumped more money than the economy lost from missing economic activity in the past months, causing excess liquidity to slosh around in the markets. They have clearly expressed the desire to let the economy “run hot” and even exceed their desired benchmark of 2% inflation in order to compensate for the lack of inflation in the past decade. This is probably done on purpose in order to help inflate our way out of the large debt we have incurred, similar to after World War 2, when rates remained low but inflation was very high. This ended up reducing US debt.

When this inflationary turn might occur is very hard to predict. But many experts that I admire and respect, and even some I don’t, seem to be converging on this idea that the next decade might be more inflationary than the market expects – not necessarily 1930’s Weimar Germany-style hyperinflation, but even a more normalized rate, and ensuing possible rate hikes, would be more than the market expects. Japan has had rates lower for longer, and the market may imagine a similar dynamic for the US – but Japan is different in that their economy is not as large and diversified as the United States’, and their demographics skew older with less of a young labor force than ours.

A very sensible catalyst to real-economy growth would be an eventual infrastructure stimulus, which would probably come next year, whether the Red Team or the Blue Team wins the upcoming election in November.

The Dollar Losing Its Strength

Furthermore, with the dollar going lower due to the US debt added, commodities now have room to go higher (there is typically an inverse relationship between dollar/commodity strength, for a number of various reasons). Commodity bull markets in the past have been led by precious metals – and we have just seen that recently in a powerful move up in gold and silver.

Again, the timing is very hard to call, especially as “passive investing” takes more and more share of the global market (passive investing just means that people pay money to Vanguard and Blackrock to pay any price for a bundle of stocks, and when they redeem, to sell for any price) and fund flows continue to expand market valuations, in my opinion somewhat irrationally. We can’t exactly know when those dynamics will end and when momentum wanes and market leadership changes.

1999 is a decent comparison for some areas of the market today, especially in some SaaS (software as a service) stocks where the competition is crowded, but companies are valued as being the next possible winner in the space. But another comparison some savvy investors use to the current market environment, where only a number of stocks are being enthusiastically bought by the markets, is the “Nifty Fifty” group of stocks in the 1960s. The “Nifty Fifty” were stocks which had very bright futures and that was recognized by the markets, and were recognized as “must-haves” at any price. People consistently bid the prices of these stocks higher and higher over the years. Many of them are companies we own now, such as Disney, McDonald’s, and Coca Cola. Vitaliy Katsenelson, a value investor and fund manager, recently pointed out that just like people currently claim that tech companies deserve higher multiples because of less capital intensity and more intangible value on the balance sheet, so too, companies like McDonald’s were also considered “asset-lite” businesses back then, due to how they franchise most of their establishments out to others who take on a lot of the financial responsibility.

After being awarded higher and higher share prices, ultimately during the next bear market in the early 1970s, they fell. Hard.

From their highs, Coca Cola fell 69%, McDonald’s fell 72%, and Disney fell 87% (!). It took the Nifty Fifty over a decade to surpass their prior highs. Most of them remained excellent companies, and even provided very good long term returns. But overpaying for them ended up being painful for a long stretch. Valuation matters over the long run.

Another obvious comparison between current market conditions and the Nifty Fifty is, these high flyers’ valuations were also crushed by higher than expected inflation, which occurred due to energy prices going a lot higher in a short period of time. We may be entering a similar environment down the line, as due to Covid-19, there has been reduced energy investment and capital expenditures. This could result in shortages, and prices would need to go back up in order to justify further investment in the sector. Energy is currently a despised sector, now fallen to around 2.8% of the S&P 500, from over 10% of it in the past. When that changes, we could see a reversion. The Fed wants inflation, energy will probably be undersupplied down the line, rates may go up, infrastructure stimulus will probably be implemented to pass the baton from central bank financial stimulus to fiscal stimulus, and we could end up with a regime change in the market – one which favors value, cyclicals, financials, industrials and energy.

Portfolio Activity

I would now like to share with you some of what we are doing now, all of that said. We trimmed a little bit of our retail exposure, as a nod to how E-Commerce has rapidly advanced from 17% or so of total retail sales, to possibly as much as over 30% of sales. While this leaves the remaining 60-70% of US retail sales transacted in brick and mortar stores, there will be some shriveling at the margins and I reduced some of our exposure. I am still bullish (positive) on the survivors and consolidators, as people still love to get out and shop.

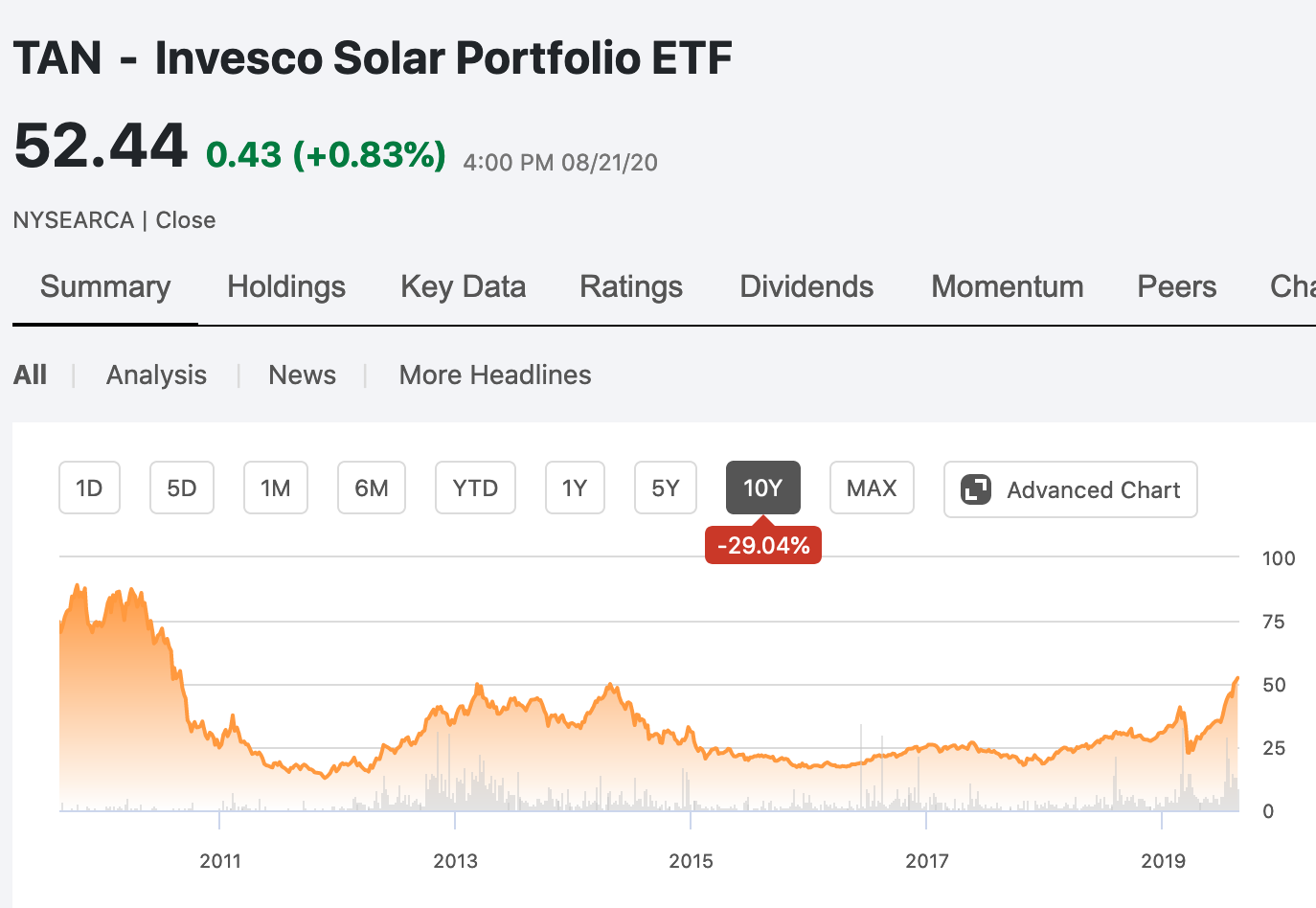

We also have been buying some solar energy indices as an energy and election hedge. There are very few dividend paying solar energy companies, and they will probably end up growing through more investment in the space. Solar provided only 2% of US energy in 2019. If they get to 8%, that is two doublings. Of course, renewables are lower margin businesses, but regulatory demands will probably boost investment and usage. We can enjoy some of that in the coming decade. This past decade, the solar index went exactly nowhere. Completely dead money for a decade. Poor execution, Chinese oversupply, and other factors caused this. However, more consolidation and regulatory subsidy in the space will probably improve profitability, not to mention some decoupling from China that is taking place which may reduce oversupply and increase profitability in some of the domestic players.

The ten year total return in this solar energy index has been -29%, a negative return for the decade. This could change in the next decade.

We have also been selectively adding commodity producers, small and moderate positions, in the areas of agriculture and even metals and mining. They are trading at very depressed levels, and if we are indeed going into a commodity bull market eventually, these should do very well and pay us dividends to boot.

You will notice I also initiated a rare position solely intended for capital gains. It is an insurer called Brighthouse Financial. It is trading at a mere fraction of its book value. If rates go higher, it should go higher as well.

I wanted to end with a quote from an investor who had been through 1999. He recently wrote (1):

“…If you remember 1999/2000, if you didn’t own the bubble stocks, you actually did really well throughout the 2000-2002 bear market. It is very possible that this will happen again. Many of the frothy names can have large declines, maybe the S&P 500 index even goes down 50% or more, and people who didn’t own the most expensive stocks might actually still do well. So, don’t let people scare you out of the market with this talk of market P/E’s. If you are happy with what you own and how they are valued, hold on and things should be fine (like it was in 1999/2000). “

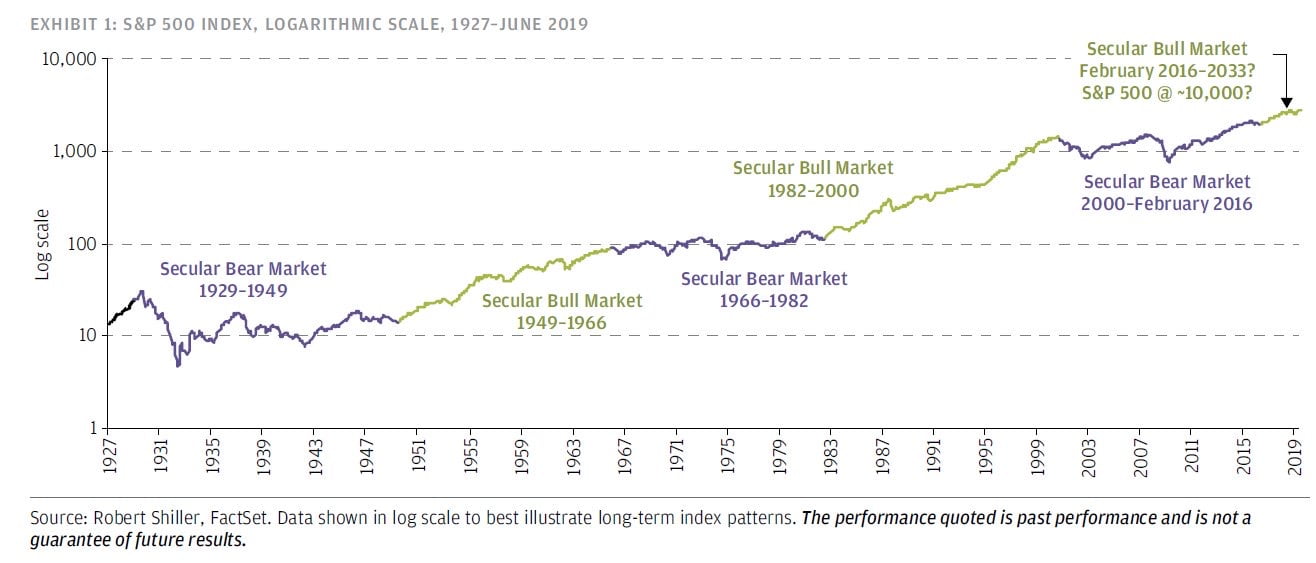

However, the following graphic was recently shared by my friend Dividend Growth Investor on his Twitter account, and could serve as a more positive counterpoint to the gloomier scenario above.

We could actually be in the early stages of a new secular bull market, which goes to show you that the best strategy is probably to keep investing in attractively valued companies that have good corporate cultures for the long run

Lastly, I wanted to share some very good news. Interactive Brokers enabled us to flip a switch and change to their “Lite” version, which eliminates all trading fees, and especially those pesky minimum monthly commissions for accounts under $100k. I am pleased to announce that there are NO trading fees, and NO MORE monthly minimum commissions from Interactive Brokers. I am thrilled about that.

That is the update for now. I wanted to give some context, historical and otherwise, on this very interesting market we are currently involved in. I will write much more detail in the next annual update published in early 2021.

Since Covid, value type stocks have suffered one of their worst drawdowns compared to growth/glamour in a long, long, long time. However, that is usually the time to hold tight, and even add more value, as many seasoned investors have seen this before, and anticipate a reversion to the mean down the line. Value tends to perform best over long periods of time, but sometimes, investors must deal with long drawdowns. It makes sense that in this once-in-a-century pandemic, the market may be scared that things have changed forever. Reality, though, is usually more nuanced. By staying as disciplined and consistent as we can, we will hopefully be set up to enjoy the value premium when it finally returns, collecting and reinvesting our dividends on the way.

Thank you as always for your continued business.

Sincerely,

Joe Ferris

Summer Fields Investments, LLC

[1] https://brooklyninvestor.blogspot.com/2020/08/tsunami-etc.html

The post Summer Fields Investments 2Q20 Commentary appeared first on ValueWalk.