Jubilant stock bulls stampede over the Fed’s predictably dovish messaging – not that the central bank had (m)any other real options to begin with. The rip your face off rally that I called for a few days ago, goes on to the dismay of the bears. I told you that calling the tops is a fool’s errand in the current environment – and as safe as catching a falling knife during sharp downturns.

Q2 2020 hedge fund letters, conferences and more

Talking downturn, when have we seen one lately in stocks actually? The news of a new California lockdown weeks ago – that was a memorable moment coinciding with a weaker patch in the S&P 500.

It was 8 days ago, when I put corona into proper perspective, making clear also on July 20 that life hasn’t stopped even during the really deadly Spanish flu. The real economy is nothing that you can flip off and on with a switch – the consequences for the job market, small and medium businesses, and consumer confidence to name but a few, are far reaching.

Raise your hands if you remember the resignation and apology of top lockdown advocate, Neil Fergusson. Or what Fauci used to say. Such steps are the key risk for the stock bulls – so, I mention them, because they have the very real power to crash the economy, and the stock market rally with it.

Thus, I see Biden’s readiness to go down the lockdown route again as having the potential to usher in the autumn storms in stocks – especially should he really wish to debate Trump, which not even Nancy Pelosi is inclined to see happening. That’s a subtle indication to me that the stock rally has the power to go on without being thrown out of the kilter considerably.

The markets are moving on the Fed momentum, on the U.S. – China phase one trade deal progress, and on the slow but steady pace of real economy recovery.

Let’s see those reflected in the charts.

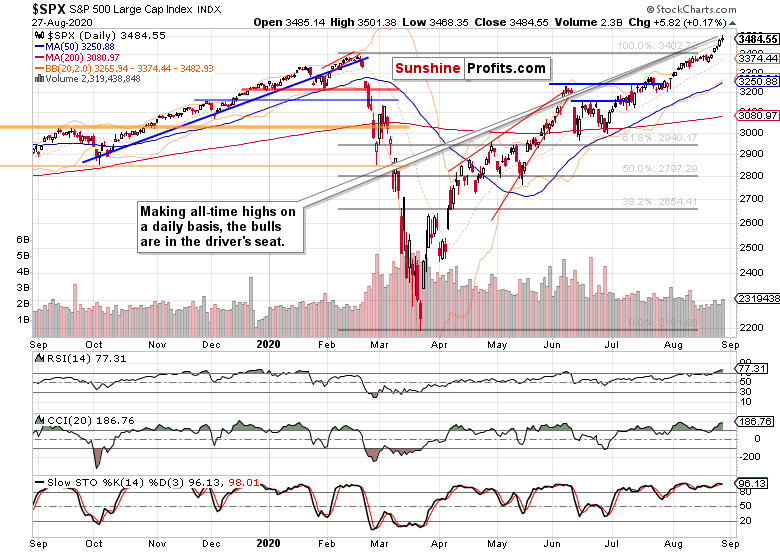

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Such were my yesterday’s observations:

(…) The breakout is now confirmed as the bears haven’t really appeared yesterday either. Even though the volume is relatively low, it doesn’t detract from the rally’s credibility in my eyes – it serves to merely make it less credible for some, while the stock upswing goes on. Until it doesn’t, naturally.

But can I call for a top with a straight face, given the price action in stocks? No, the trend remains up – there is no sign of its reversal.

You won’t hear any top calling from me today either, but the prominent upper knot and rising volume illustrate the battle that the stock bulls had to fight yesterday. I wouldn’t be too surprised if the rally consolidated its recent sharp gains. As Mark Twain would say, any talk of an S&P 500 top though, would be premature.

The Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) still paint a picture of short-term caution (please see this and many more charts at my home site), but the bulls have repelled the below scenario I saw early yesterday as likely to materialize:

(…) the two daily upper knots are short-term concerning to me. I wouldn’t be all too surprised if the bears stepped in on an intraday basis at least.

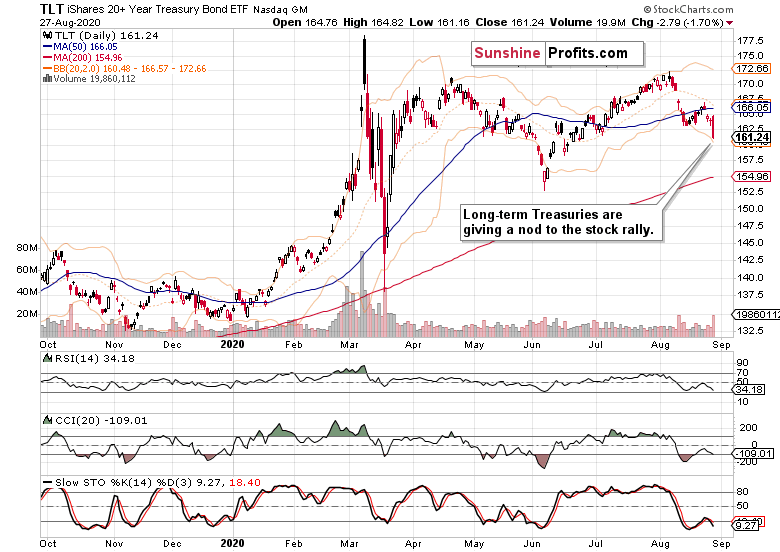

Investment grade corporate bonds (LQD ETF) declined on yesterday’s Fed relaxing its approach towards inflation, and so did long-term Treasuries (TLT ETF). It’s risk-on as evidenced by the steep rise in the high yield corporate bonds to all bonds (PHB:$DJCB) ratio, now that the economy recovery story joins hands with bondholders demanding higher rates to make up for higher expected inflation.

Stock bulls needn’t worry though, because that kind of inflation with the power to break the bulls’ backs, isn’t here yet. For now, stocks can go on defying gravity, and becoming ever more extended relative to the HYG:SHY ratio. Greed is on, there are plenty of bears to throw in the towel, and the put/call ratio can still decline some more.

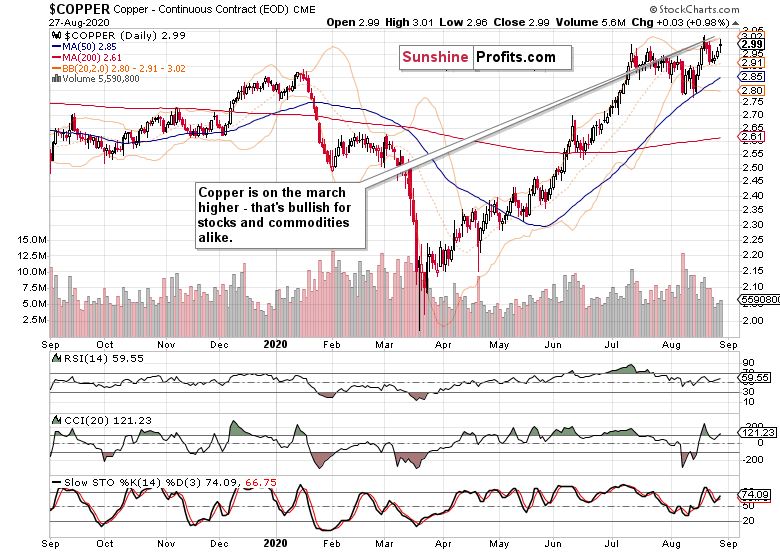

Copper, Gold and Oil

Copper is at it again – the metal with the PhD. in economics, keeps rising after almost verifying its breakout above the bullish flag. I understand that as another point for the economic recovery.

Gold gyrated on the day, and shows absolutely no signs of a systemic stress. I read yesterday’s volume spike as rather a sign of accumulation than distribution, and look for the Fed news to translate into a well-bid king of metals. Such love slash inflation trade would reflect well on stocks too.

Oil ($WTIC) isn’t breaking down right now, and its mostly sideways moves indicate to me that demand isn’t disappearing. In other words, the markets see no immediate real-economy challenge just ahead, and there isn’t enough inflation to bring about a spike in commodities ($CRB) just yet. That’s good for the stock bulls, as we’re still in the early stages of inflation when most benefit and precious few pay.

Summary

Summing up, the S&P 500 keeps extending gains, and so does the tech sector regardless of its daily indecision. Yesterday’s volatility spike gave way to improving market breadth indicators, and most asset classes are reacting as expected during an economic recovery and a new Fed tailwind. It’s risk-on, and stocks still stand to benefit broadly, and be rewarded for withstanding any short-term rickety ride that inevitably accompanies the bullish short- and medium-term outlook that I’ll discuss on Monday.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter – it’s absolutely free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

All essays, research and information found above represent analyses and opinions of Monica Kingsley and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Monica Kingsley and her associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Ms. Kingsley is not a Registered Securities Advisor. By reading Monica Kingsley’s reports you fully agree that she will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Monica Kingsley, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

The post Stock Bulls Are Heading for Another Weekly Gain appeared first on ValueWalk.