The S&P 500 extended gains yesterday, and don’t appear to be topping out today. With new all-time highs being made again, it’s hard to turn bearish at this juncture as most of the charts I’m looking it, aren’t flashing newly arriving signs of danger.

Q2 2020 hedge fund letters, conferences and more

And as regards non-confirmations, they can go on for longer than most traders can remain solvent, if I take liberty and paraphrase the point about market irrationality. And it sure seems irrational to quite a few, given the state of the real economy’s disconnect from the stock market.

But my purpose is to read and trade the stock market, and present you my view of the outlook based on the extensive radar screen I consult daily. Keenly watching the rationale for an upside move’s potential while first of all mindful of the risk per (open) trade. That’s the only way to keep adding to the profitable tally over weeks and months.

Such were my yesterday’s notes as to non-confirmations, and correction vs. higher prices scenarios:

(…) Non-confirmations can drag on for a long time without ushering in a meaningful correction. They can get less pronounced by a prolonged sideways move in prices. Alternatively, a sharp and temporary correction can arrive with little fanfare. Which way do I see things turning out over the coming weeks?

Wednesday’s correction attempt failed without much in terms of a follow-up. That’s a point for a continued slow grind higher, or for a sideways consolidation as minimum. In other words, the correction isn’t likely arriving very soon – but over the coming weeks, it most probably will. The outlook for days just ahead, looks rather bright to me.

Let check again whether this theory holds water.

S&P 500 in the Short-Run

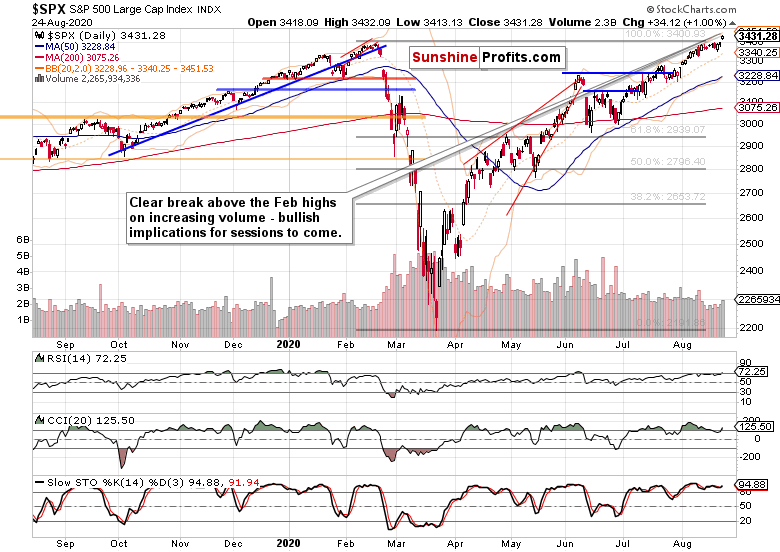

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The bulls are back in the driving seat, and ever more solidly so. Volume is returning, which supports the clear breakout above the Feb highs hypothesis. By clear, I mean a slow or not so slow, rip your face off rally.

How much did the credit markets support the upswing?

The Credit Markets’ Point of View

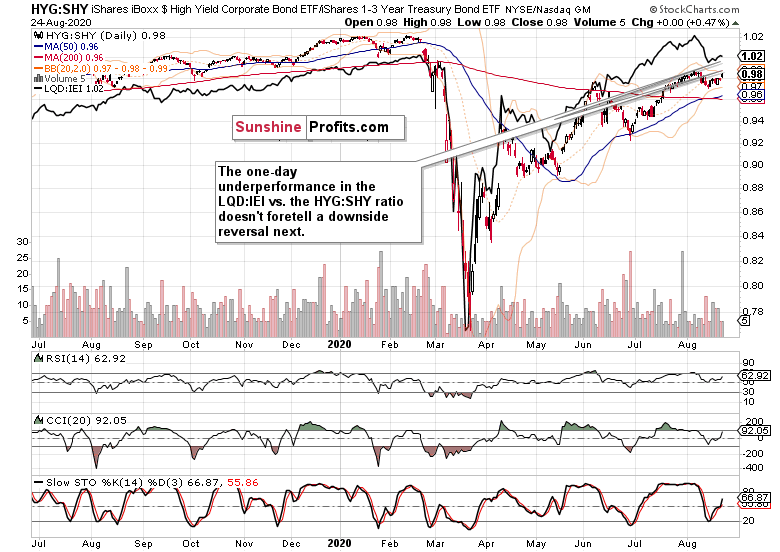

High yield corporate bonds (HYG ETF) are coming back to life in what’s likely to turn out as a start of the next upleg (please see this and many more charts at my home site). It’s true that investment grade corporate bonds (LQD ETF) declined yesterday, but I see that in no way as a start of their downleg. In other words, a non-confirmation of no more than a very brief shelf life, no obstacle for the HYG ETF to move higher next.

I take it as both high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) largely pointing higher and confirming each other’s moves. The longer they keep the sideways-to-bullish bias, the better the likelihood of their renewed, strong move higher in earnest, and by extension, for stocks too.

Yes, stocks are ever more extended relative to the HYG:SHY ratio, but the latter is at least moving higher in unison now. Stocks are getting my benefit of the doubt, and riding the upswing with a reasonably tight stop-loss is my preferred course of action in these circumstances.

S&P 500 Market Breadth, Smallcaps and Tech

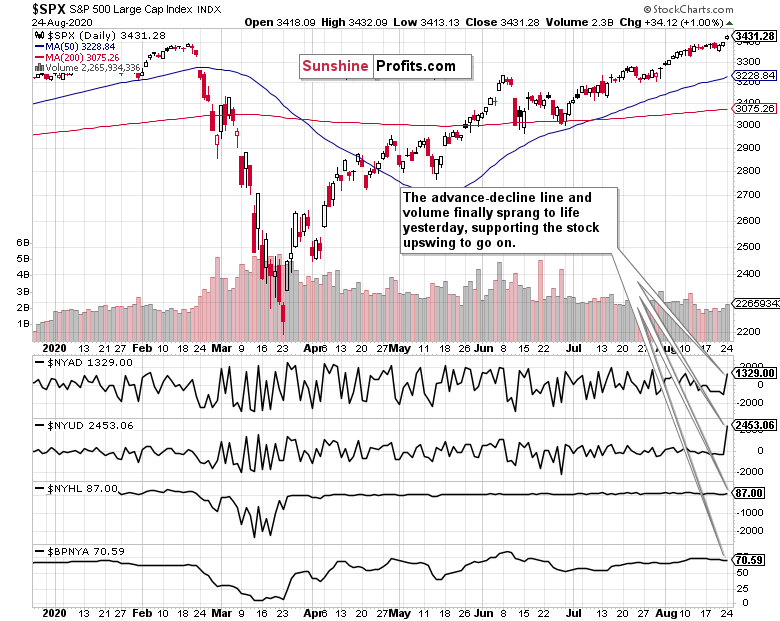

Finally, there’s a solid upswing in the advance-decline line. The weak performance of recent days seems over, and the broader the advance, the better for the health of the unfolding S&P 500 move higher.

The Russell 2000 continues lagging the S&P 500, but is at least moving higher too. As we have seen previously, such underperformance is not necessarily an obstacle for the 500-strong index to go up, especially given the technology prominence in its weighting.

Technology (XLK ETF) continues its smashing ride, and semiconductors (XSD ETF) leaping higher yesterday, support its upswing to go on. Needless to say, that’s broadly positive for the S&P 500.

The S&P 500’s Extended Gains – Summary

Summing up, the S&P 500 extended gains on Monday, and looks set to do the same also today. Volatility keeps moving generally lower over the past weeks, and doesn’t appear ready to bounce in the immediate future. Put/call ratio is tentatively declining again, and sentiment is moving into extreme greed. How long will the current upswing last before taking a breather?

One isn’t on the very horizon, so let’s keep riding the upswing as the path of least resistance still points higher.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter – it’s absolutely free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

All essays, research and information found above represent analyses and opinions of Monica Kingsley and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Monica Kingsley and her associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Ms. Kingsley is not a Registered Securities Advisor. By reading Monica Kingsley’s reports you fully agree that she will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Monica Kingsley, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

The post S&P 500 Goes All In for Higher Stock Prices appeared first on ValueWalk.