YOLO Softbank! News broke this week that the colorful CEO of Softbank, Masayoshi Son, has been betting big on US technology companies. According to the Wall Street Journal, Softbank’s Masa used $4Billion to buy options in US technology stocks on behalf of the Japanese telecom conglomerate.

Q2 2020 hedge fund letters, conferences and more

Softbank Buys Short-Dated Options On Tech Stocks

While the details of the trades are still speculative, AFAIK, the most popular narrative is that Softbank bought $4B of short-dated options on tech stocks, which meant that the options dealers who sold those call options had to hedge. The dealers would start by buying a small amount of the underlying stock in the market in case the stock rose above strike price and they were forced to pay out on to the option buyer. But the more the stock moved up, the more the dealer bought in order to add to their hedge.

Now add in Wallstreetbets (WSB) traders. WSB traders are all about options. They tend to use Robinhood and other online brokers to make aggressive bets using options. YOLO- you only live once- is the tagline of these traders. Go big or go home.

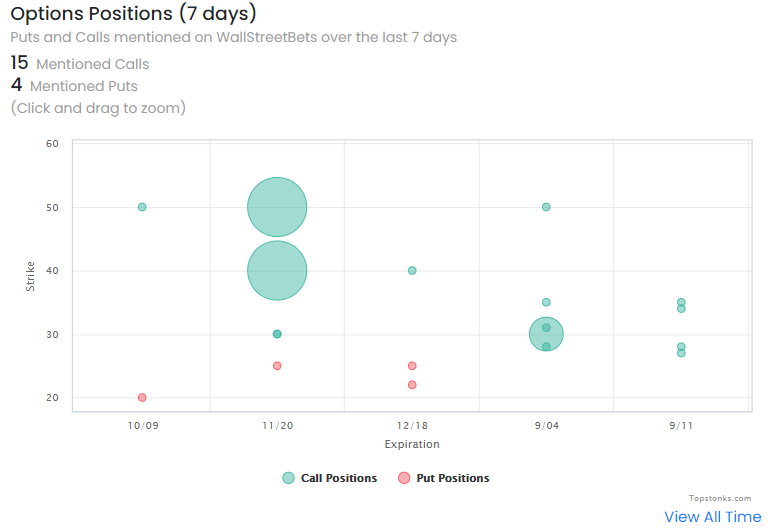

They are a peculiar animal and TopStonks.com is a 50,000 foot view into that zoo. We gather data on what they are talking about and how they are positioning. We saw that they kept increasing their bets and were making more bullish (calls) bets than bearish (puts) bets. While we don’t know the size of the bets (in $), we could assume that more call bets in a rising market would precipitate larger call bets as they keep “winning.”

In late March the Fed and Treasury stepped in to support the distressed market and decimated economy. Since then, the direction has been dependably up. Nobody on WSB thinks Fed Chair Jerome Powell, or JPow as they affectionately call him, will allow the market to go down.

Panbic Buying Has Thrown Off Spread Traders

Softbank buying combined with retail trader’s religious belief in JPow’s printer has fueled extreme moves in many of the most popular tech companies. The panic buying has likely thrown off the largest player in the market: spread traders. Spread traders play the relative differences between options of different dates and strike prices, as well as between the options and the underlying stocks that they may already own. We can’t begin to understand what exactly is going on here except to say that the YOLO bets by Softbank and WSB/Robinhood could be throwing off several spread trade strategies.

At TopStonks, we observed a change around August 28th as the conversation switched away from stonks (in WSB slang) and to hedging instruments like Macro ETFs and volatility indexes. We highlighted the strange phenomena of $VXX buzz (and the price) increasing while the market goes up- a major divergence is recent market history as they usually move in opposite directions. We attributed this to some nervous hedging around the JPow speech at Jackson Hole 2020. But we saw the surge in buzz on Macro and Volatility ETFs continue the following Monday and highlighted it again. Something was throwing the options market off, creating urgency among traders.

By Tuesday the formerly reliable pattern of volatility up, stock market down had resumed. Where do we go from here? We’re going to keep tracking the buzz on wallstreetbets (and 4Chan), as well as the options volume and positioning (see VXX above). Topstonks is a good tool, but there are no silver bullets. We recommend combining our data with your own technical analysis and intuition in order to avoid wiping out while surfing the hype stonks waves.

The post Softbank buys $4B of short-dated options on tech stocks appeared first on ValueWalk.