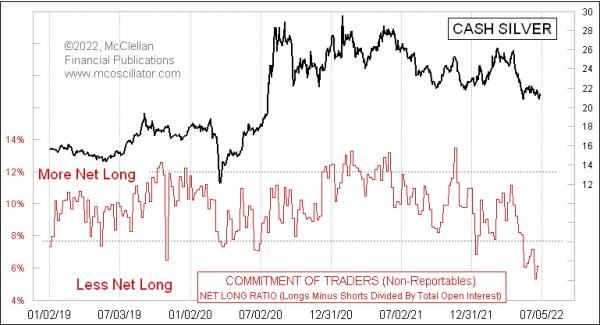

Pessimism is taking over the silver futures market, at least among the small speculators.

In the weekly Commitment Of Traders (COT) Report, published by the CFTC every Friday, traders are broken down into 3 categories:

- Commercial traders, who use the subject commodity in their trade or business

- Non-commercial traders, who are large speculators

- Non-reportable traders, the small speculators

The latter are referred to as “non-reportable” traders because their position sizes are small enough that the CFTC figures they are not worth being reported individually. The CFTC wants to know how many contracts JP Morgan or Goldman Sachs might own, but they don’t care as much about a small trader with a handful of contracts. But those small position non-reportable traders are very interesting to me, because they tend to pretty reliably be the hot money, and the dumb money, especially when they get to a large skewed position one way or the other. This week’s chart reveals that they just recently moved to their smallest net long position as a group in several years.

Readers should understand that these small position traders are nearly always net long as a group to varying degrees. There was only one week in all of the history of COT Report data (since 1986) when they were net short as a group, which was at the historic price bottom back in 2001. So the analytical game consists of evaluating their current position relative to recent values.

That message right now is that these small position traders are feeling pretty pessimistic about silver’s prospects. And when they get to feeling that way, that is a pretty good indication of a bottoming condition for silver prices. Then, as prices eventually rise and these traders start wanting to own silver futures again in a big way, they can help show us a topping condition. But that is not what we are seeing now. Right now, they are at their most pessimistic state in years.