The graph above shows the percentage of months in which sectors have outperformed the S&P 500 in the past*. The data go back 20 years except for XLC and XLRE as these sectors were only introduced more recently and the historical data does not go back that far (back filled).

*For most sectors data go back 20 years

Seasonal Over- / Under-Performance

It is a chart that I show at the start or shortly before a new month begins in my weekly show Sector Spotlight.

For the coming month of September there are a few interesting observations to make.

On the positive side, two sectors stand out. Communication Services at 67 and Industrials at 70. This means that historically, 67% or 70% of the months of September have lead to an outperformance over SPY. These are interesting number that are worth a further investigation.

On the negative side we see 35% for Materials and 40% for Utilities. These are also interesting numbers because 35% or 40% of historical outperformance means 65% or 60% of historical UNDERperformance and that is also a meaningful number.

Combining With RRG

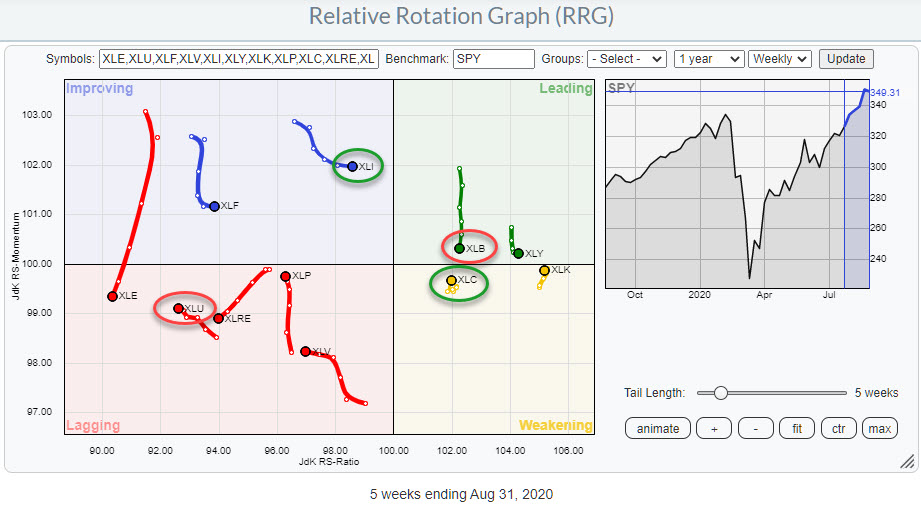

Knowing these numbers can give us some additional information when we look at the Relative Rotation Graph for US sectors.

The RRG shows the current positions for all sectors. I have circled XLI and XLC green as their seasonality suggests a good performance relative to SPY in coming weeks and I have circled XLB and XLU red as their seasonality suggests a weak performance against SPY in coming weeks.

The RRG below isolates and zooms in on these four sectors.

XLI and XLC look strong

Looking at the development and the trajectory of these tails, XLC looks strong. The sector crossed over from improving into leading mid-February and remained inside the leading quadrant until late July when XLC dropped into the weakening quadrant.

Over the last 4-5 weeks the RRG-Velocity (distances between the observations) started to decrease and eventually turned back up and is now heading towards the leading quadrant again. This sort of rotation is typical for the second leg in a relative uptrend that is already underway.

So the positive rotation for this tail lines up pretty good with the expected outperformance for XLC in coming month.

The tail on XLI is also looking pretty good but is still inside the improving quadrant. The slight loss of relative momentum has recently leveled off and XLI has started to move higher on the RS-Ratio scale again. Hence this improvement also aligns with the positive expectation for the Industrials sector based on Seasonality.

XLU and XLB looking weak

On the weak side the XLU tail has started to head lower on the RS-Ratio scale after a few weeks of improving RS-Momentum. With the sector so deep inside the lagging quadrant and now heading lower on the RS-Ratio scale again, the weak expectation based on its seasonal performance aligns with the trajectory of the tail.

Finally the Materials sector. On the RRG, the XLB tail is still inside the leading quadrant but moving almost straight down for a few weeks already, suggesting that there is more relative weakness ahead for this sector. This expectation aligns with the weak expectation from a seasonal perspective.

This leaves us with four sectors, two strong and two weak, which’ RRG-tails more or less align with the expected over- or underperformance based on their seasonal pattern.

The RRG above shows the daily tails for these four sectors.

The tails for XLB and XLU confirm the weakness that was visible on the weekly RRG. For XLC, the daily tail confirms the positive rotation that is underway for this sector on the weekly scale.

XLI, on this daily RRG, is rapidly heading towards the lagging quadrant which contradicts the improvement that is visible on the weekly chart. These conflicting rotations make the positive outlook for XLI somewhat unreliable. It is still possible for XLI to turn back up and start heading towards leading, either still inside weakening or just after entering lagging, but the rotations and the outlook are definitely not as strong as for XLC.

The Historical Average Return vs SPY

Finally we can look at the average historical over- or under-performance per month.

The image above shows the historical average over- or underperformance vs SPY.

The average relative performance for XLC is 0.5% over SPY, this aligns with the expectation for an outperformance over SPY in coming month and this is backed up by a strong rotation on the weekly (and daily) RRG.

The expected outperformance for XLI is, only, 0.1%. So even although XLI managed to outperform SPY 70% of the time, it was only by a thin margin. Combining that with the conflicting rotations on the weekly and daily RRGs leads me to the conclusion that the outlook for XLI is not so reliable.

For XLU the historical average performance is +1% over SPY, this does not match well with the observation that XLU has underperformed SPY 60% of the time. The conclusion has to be that during the 40% of outperformance the performance was exceptionally strong. So strong that it manages to beat the 60% of underperformance.

All in all these contradicting seasonal observations do not match well with the weak rotational pattern that is visible on the RRG.

Finally the Materials sector. An expected -1.4% underperformance vs SPY matches the expected underperformance (65% of the time). The weekly tail inside leading but rapidly deteriorating, and the daily tail already well inside the lagging quadrant confirm or align with the weak expectations based on seasonality.

Materials

The RS-Line of XLB has just broken below a short term rising support line confirming weakness. Price support is expected just above $ 60, the former resistance, now support, level of the 2018 and 2019 peaks.

Communication Services

The RS-Line for XLC moved in an ascending triangle like pattern after breaking out of the range a few weeks ago. An upward break out of this consolidation pattern in relative strength will fuel a further rotation into the leading quadrant.

Based on the above it looks like we can expect an outperformance over SPY for XLC and an underperformance for XLB in coming month.

#StaySafe, –Julius