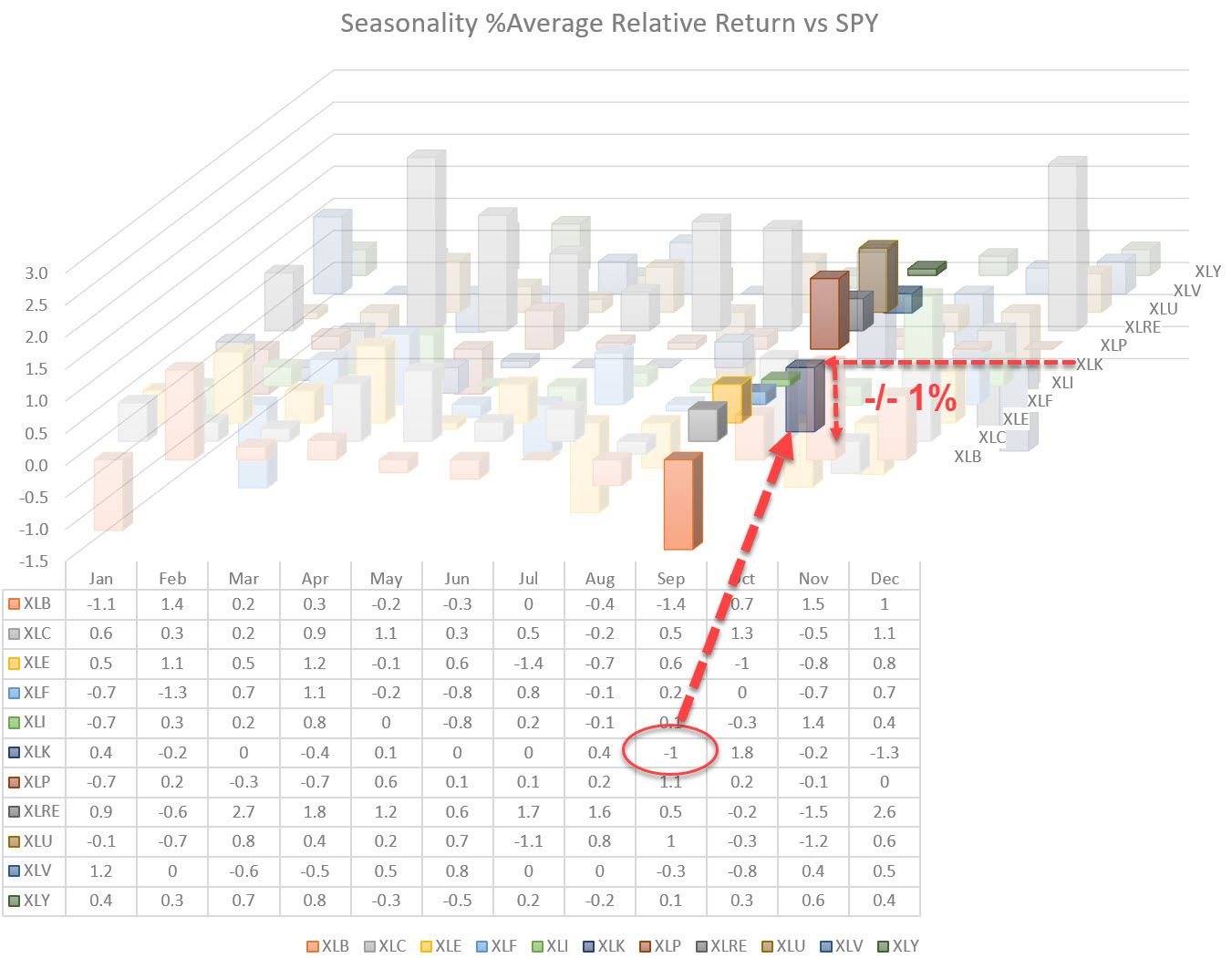

Last Tuesday in Sector Spotlight as well as in my last article in the RRG-blog I discussed seasonality for US sectors.

While going over the table showing the average returns per sector per month, my eye fell on another number.. Minus one percent (-1%) for the Technology sector. This is interesting as the seasonal over-/under-performance shows 45%. Which means that technology has outperformed SPY only 45% of the time in the past.

Usually I do not pay too much attention to seasonality figures between 40-60 as they are too much of a coin toss. But the combination of 45% outperformance and a minus 1% historical underperformance for the month.

Despite the fact that the percentage of time XLK outperformed SPY is only 45% we have to conclude that during the 55% of the time when XLK is UNDERperforming SPY the amount of underperformance is significant because the -1% is the combined result of ALL history, not only the months of underperformance.

The image below shows the image with the seasonality for SPY over the last 20-years.

This is also an interesting image.

65% of the time SPY closed higher in the month of September.. BUT… the average return for September is Minus 0.3% (-0.3%). So when SPY goes down in September it goes down (much) more than when it goes up.

So all in all we have a situation where September is not a particularly good month for SPY, nor for Technology (XLK). But not particularly bad either.

The average returns, however, for both SPY and XLK are negative.

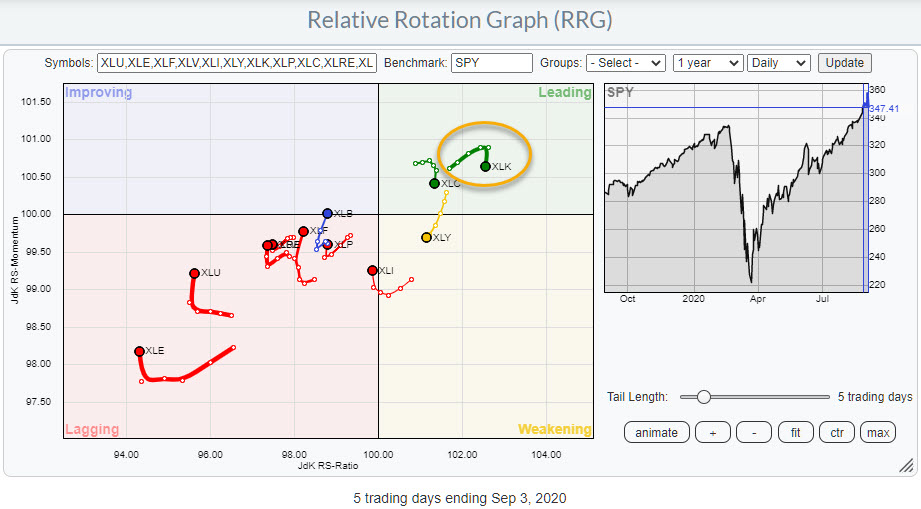

The image below shows the daily RRG for US sectors

What we see here is that the tail on XLK has started to roll over today. This snapshot was taken around noon with XLK down around 5%.

If this is the prelude to a weak month for both SPY and XLK we could be in for a bit of a ride in coming weeks.

The good news is that seasonality for October shows, strong, improvement for both SPY and XLK with an expected return of +1.8% for technology and 1.3% for SPY and 68% of the time an outperformance for XLK over SPY.

My regular blog is the RRG Chartsblog. If you would like to receive a notification when a new article is published there, simply “Subscribe” with your email address.