For manufacturing, the March Dallas and Richmond Fed surveys will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.

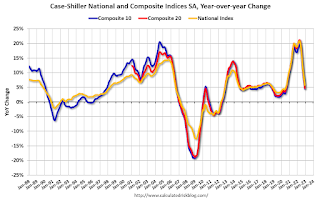

This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.5% year-over-year increase in the Comp 20 index for January, down from 4.6% YoY in December.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 3.0% decrease in the index.

8:30 AM, Gross Domestic Product, 4th Quarter and Year 2022 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 2.7% annualized in Q4, unchanged from the second estimate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 196 thousand initial claims, up from 191 thousand last week.

8:30 AM ET: Personal Income and Outlays for February. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 5.1% YoY, and core PCE prices up 4.7% YoY.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 43.6, unchanged from 43.6 in February.

10:00 AM: University of Michigan’s Consumer sentiment index (Final for March). The consensus is for a reading of 63.4.