SAGA Partners commentary for the second quuarter ended June 2020, discussing the theory for market outperformance and the biology of investing.

Q2 2020 hedge fund letters, conferences and more

Annual Meeting & General Update

We typically host our annual meeting around this time of year, but unfortunately we must cancel given the situation with COVID. We love hosting one meeting a year as a way to speak directly with our investors and discuss any questions that might be on their mind. Assuming it is safe to host public gatherings again, we plan on having the “fourth” annual meeting in 2021.

We decided to raise the minimum initial investment for new investors to $200,000. Saga Partners has been fortunate to grow far past our original group of close friends and family, especially in recent quarters. Having a group of investors who align with our philosophy is truly an asset and essential for our long-term success. It is also important to realize there will eventually be capacity constraints in managing the Saga Portfolio, both in size and the number of investors. While we are still pretty far from reaching that point in regard to assets under management (see 3Q19 investor letter), we do not have capacity to manage an infinite number of relationships, so it makes sense to continue raising our minimum investment as we grow. We think it is important to have a direct relationship with each of our investors. While this strategy is less scalable, it ensures all our investors are on the same page.

We are also excited to announce Richard Chu will be joining Saga Partners as an investment analyst starting this August. He will help by supporting Michael and me in researching investment opportunities. Richard is extremely bright and has a strong passion for investing that is hard to find. We are looking forward to working with him as we expect he will be a big asset to the team!

2Q20 Results

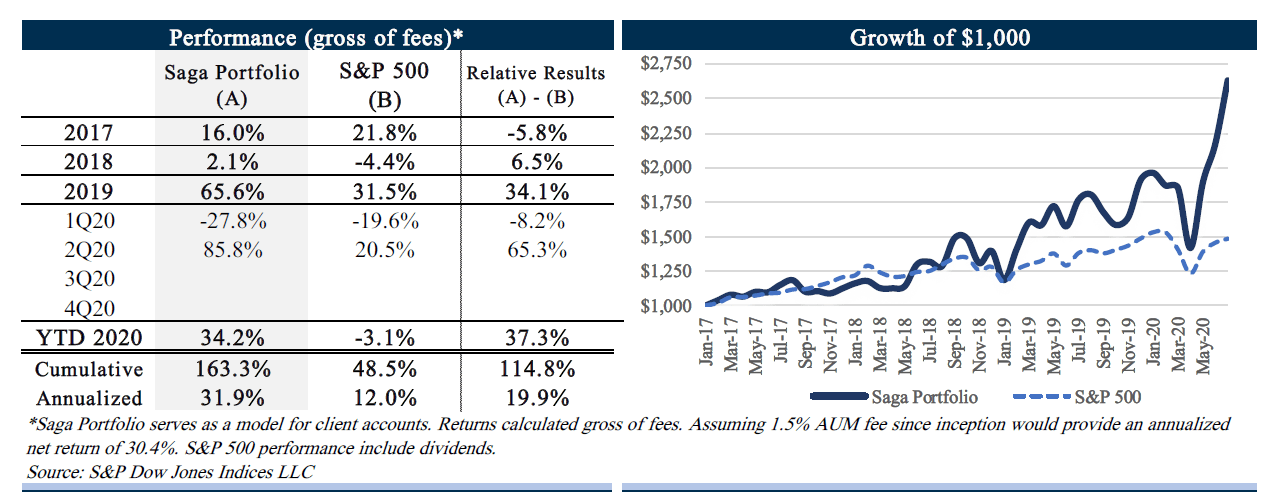

During the second quarter of 2020, the Saga Portfolio (“the Portfolio”) increased 85.8% gross of fees. This compares to the overall increase, including dividends, for the S&P 500 Index of 20.5%.

The cumulative return since inception on January 1, 2017 for the Saga Portfolio is 163.3% gross of fees compared to the S&P 500 Index of 49.9%. The annualized return since inception for the Saga Portfolio is 31.9% gross of fees compared to the S&P 500’s 12.3%. Of course it’s net returns that matter to investors, so please check your individual statements. Assuming a 1.5% AUM fee, the annualized net return since inception is 30.4%.

You may have noticed we removed the S&P Small Cap 600 Index as a benchmark. While the Saga Portfolio has mostly invested in small and midcap companies historically, it has no restrictions on the company size, industry, or geography that it can invest in. We invest where we find the best opportunity. There really is no index containing much overlap with the Saga Portfolio. We think comparing our long-term performance to the S&P 500 makes the most sense since it is a decent proxy for total U.S. stock market performance and passive investors can easily invest in a low-cost S&P 500 ETF. Small cap stocks as a category have also significantly underperformed the market since we started managing the Portfolio. The total return of the S&P Small Cap 600 over the last 3.5 years is 4.5% and its annualized return is 1.3%. We doubt that this underperformance will always be the case but comparing the Saga Portfolio’s results to these returns did not provide a lot of insight for investors.

Market Commentary

The last six months have proved humbling to many stock market participants during what was the fastest decline of over 30% in the history of the stock market, quickly followed by one of the fastest recoveries in the history of the stock market. Never have we felt so strongly about our lack of ability to predict short-term market movements.

If we had a share of Tesla stock for every time someone asked us whether stocks have peaked during some point over the last 10 years, we would probably have to close the Saga Portfolio to new investors, at least with where Tesla’s stock price currently trades. That is not to say we have any strong feelings on the value of Tesla. No one knows when the next market crash will occur. We didn’t know in advance about the 10% decline in the first quarter of 2018, the 20% decline in the fourth quarter of 2018, or the 35% decline in March 2020. We were fully invested going into each of these “corrections” and have been able to survive the ups and downs.

Not only did we survive, we benefited from the volatility by allocating more to the investments where the price-to-value became much more attractive. Many believe we are joking when we say we hope the market crashes next month or quarter, even while being fully invested. When feelings of uncertainty and fear are common, the best opportunities present themselves for the truly long-term investor.

However, being greedy when others are fearful is easier said than done. When the rest of the world is yelling fire in the movie theatre, it is hard not to start running for the exits before looking to see if there is actually a fire. You never know what will bring feelings of panic and if you may get swept up in them. Fear followed by a fight or flight response is a natural reaction when you do not know what the health implications may be if you or your loved ones potentially catch a deadly and highly contagious virus, or if grocery stores may run out of food, or if ATMs run out of money. Living through times like this past March can truly test one’s conviction on portfolio holdings, particularly when shares of many companies declined by more than 50% from peak to trough over a very short period.

The biggest risks are the things we don’t even know we don’t know, sometimes referred to as a black swan event. It is hard to prepare for these events. How many anticipated September 11? Now a terrorist attack on U.S. soil is something one considers as a future possibility since it has happened in the relatively recent past. When an unknown shock occurs, there can be a complete collapse of confidence, which is often accompanied by a crash in market prices. As COVID-19 spread across the world, the real economy was frozen in fear for weeks following mandated stay-at-home orders as experts tried to learn about this new virus. How does it spread? How long is the incubation period? What is the mortality rate for different demographics? Answers to these questions are becoming clearer with time, though there is still enormous uncertainty and far more questions than answers.

A very important guide to navigating the chaos over the last six months (both down and back up) was our philosophy to ignore macro forecasts, keep our heads down, and focus on the potential long-term fundamental impact to each of our specific companies based on any new information available. We try to distinguish signal from noise. An earnings decline next year means very little to the total intrinsic value of any company; however, a shift in long-term demand or competitive dynamics may be more significant.

The best thing investors can do to prepare themselves and their portfolio for an unexpected shock is by performing different stress tests on their holdings. What would happen to a company if interest rates and inflation skyrocket, interest rates turn negative and deflation occurs, access to capital markets dries up, a cyber-attack or pandemic happens, or if a war broke out? We will never know if or when these macro events may occur, but it is helpful to think how certain events may impact the fundamentals of a business you plan to own over the next 10 years.

As we look forward, both new and old investors do not benefit from past results. It is future results that matter. Whether our stocks have been rising or falling in the recent past means nothing. What matters is where stocks are trading relative to their intrinsic value and what the expected rate of return is going forward. Obviously the lower the price relative to intrinsic value, the higher the future return. As stock prices fluctuate, we are simply updating our long-term return expectations and allocating capital based on the best opportunities we can find from today’s prices if we held assets over the next 10 years. It is obviously much better to invest new money during a panic and market selloff such as last March; however, we do not possess the foresight to be able to buy in at the bottom tick.

Our job is to analyze the few important factors that will drive value per share many years out, not identifying wiggles on the path along the way. The majority of the investment industry does wiggle guessing. We have learned (from personal experience) that once one tries to dance in and out of the market in an effort to time the next correction based on variables outside one’s control or ability to forecast, it will likely hurt long-term results more than help. You can get lucky from time to time, but luck is not something we want to rely on.

The Theory of Market Outperformance

People use theories to help explain what actions will cause a certain reaction. Science is made up of mental models, rules, and evidence-based theories. The process of building a theory is iterative as people test and refine their ability to predict what actions will cause certain results under certain circumstances. Theories are simply educated guesses. Laws, on the other hand, are absolute truths. They have no exceptions, are rare, and are the foundation for which theories are built upon. Theories are bound to change over time as new evidence is discovered that can better explain a particular phenomenon. The success of a theory is based on the accuracy with which it can predict outcomes across the range of situations in which certain events may occur.

With investing, people are simply trying to allocate dollars today in order to earn more dollars in the future. For any actively managed investment portfolio such as Saga Partners, the goal is to beat the benchmark over the long-term, which in our case is the S&P 500 index. Since anyone is able to invest in the market through a low-cost S&P 500 index ETF, that is our opportunity cost. If we are not able to beat the index, not only are we not providing any value but would be taking value from our investors.

The financial results become pretty material if one can beat the market by a decent margin over a long enough time, though this is no easy task. Few portfolio managers can do it, at least if pursued by conventional means and picking the managers that do is all-the-more challenging. If earning excess returns were so easy then everyone would do it, which then becomes a self-defeating paradox. Essentially, active investment managers believe that pursuing certain actions today (following their thesis) will lead to their desired result: beating the market.

If looking at the spectrum of sciences, the “science of investing” would be considered at the extreme end of the soft sciences. It is a mix of the social sciences: economics and psychology. Economics is the study of the production and consumption of scarce resources, and psychology is the study of social behavior and the human mind. These soft sciences are extensions of biology, the study of living organisms. As we move along the spectrum of sciences, biology begins to move into the hard sciences as it is an extension of chemistry – the study of matter, which in turn is an extension of physics – the basis for all sciences, encompassing the study of the universe.

The softer the science, the more difficult it is to recreate controlled experiments where past results can be replicated with confidence and where cause and effect relationships can be depended on to persist. Ironically, soft sciences are harder to model than the hard sciences.

The science of successful investing is so difficult to break down into verifiable and repeatable theses because of the reflexive nature of the market. The Santa Fe Institute popularized the term for markets as adaptive complex machines. They are constantly changing, recalibrating, and trying to snuff out any inefficiencies.

In a reflexive adaptive system like the market, a certain modeled forecast can alter the actual outcome itself. If a model expected oil prices to rise next week, that very knowledge could move the price up today in anticipation of the modeled outcome. Furthermore, if everyone thought oil demand would go up next week, it could move the price of oil up in anticipation of the greater demand, which could then lower future demand and lower the price to some calculated equilibrium.

Compare this to another complex, though non-reflexive system, such as weather forecasting. If a meteorologist’s model expects a 75% chance of rain tomorrow, the simple fact of knowing the model’s forecast will not impact the actual outcome itself. In an adaptive complex market, prices are generated by traders’ expectations, but these expectations are formed on anticipations of others’ expectations which then devolves into a game of mass psychology. This circular logic can become convoluted but is important to appreciate. If a verifiable and repeatable formula to beat the market did exist, its very existence would inevitably lead to its own failure.

This brings us to the ultimate question, is it even possible for an investment manager to beat the market over the long-term? Are markets perfectly efficient and is it even worth attempting to try to beat it? While the data supports the fact that the majority of professional money managers do not beat the market over the long-term, there are clear examples of a small number (very small number) of active portfolio managers with excellent public track records that consistently delivered excess returns over multiple market cycles and whose success cannot be explained away by mere luck.

While there is not a perfect overlap in investing style or philosophy, there are common patterns amongst these outliers, such as:

- Long-term oriented – They made decisions that led to optimal results over the long-term regardless of what short-term results would look like. For example, an investment manager who has career risk may not buy a controversial stock because of current negative sentiment or short-term issues a company is facing. To these managers, it might not matter if a stock has strong long-term prospects if they believed it would not perform over the next year.

- Ability to concentrate in their best ideas – Pareto’s 80/20 principle applies to many parts of life and investing is one of them. Research has shown that only a few companies provide the majority of value creation and the best performing portfolios earned most of their returns from just a few positions. This is the case even in widely diversified indices such as the S&P 500. Using a baseball analogy, the frequency of correctness does not really matter in investing (batting average). What matters is how much money you make when you are right versus how much money you lose when you are wrong (slugging percentage). For those who are in the business of analyzing businesses, waiting for the rare “fat pitch down the middle” where the odds are heavily weighted in their favor is a surer way to outperform than diversifying among many less exciting opportunities.

- Independent thinking – Outperforming the market requires having a point of view that is different from the market. Successful managers were able to form their own expectations for the future fundamentals of a company and acted when this view differed significantly from what was baked into the market price of the stock. This is easier said than done since it takes a lot of psychological fortitude to bet against the crowd, especially when the crowd is usually right.

- Ability to adapt and learn as the environment changes – What has worked in the past may not necessarily work in the future. Since markets can evolve over time, the best investors were able to adjust as market conditions changed. They recognized when certain theories no longer applied and adjusted to the new environment as needed.

Alternatively, it is almost easier to look at the many examples of portfolios that have underperformed the market and try to avoid the qualities that have often led to undesired results. Some of these qualities included:

- Short-term thinking – Few managers would ever claim to manage their portfolio for the short-term since it is long-term results that matter. Signs a manager may be more short-term oriented include trying to time the market, buying in and out of many different companies leading to high portfolio turnover, or window-dressing the portfolio at the end of a reporting period to remove potentially controversial positions.

- Over-diversified – Diversification is a great way to make sure that no single position has a big impact on total portfolio results. It is a hedge against being wrong or right. As mentioned earlier, returns are not equally distributed and it is hard to find the few ideas that do outperform. Diversification into a basket of stocks is likely to provide average results at best and likely below average when considering management fees.

- Use leverage – The use of leverage, particularly when investing in marketable securities, has probably led to more train wrecks in investment management than any other single variable. When volatility is low, confidence is high, and borrowing is cheap, investors can turn to leverage to boost performance. The key to a successful long-term investing record is to be able to survive the chaos that will inevitably occur along the journey. That means avoiding catastrophic risk. You never want to be a forced seller at fire sale prices.

- Misaligned incentives – There are agency costs when owners of investment firms and those managing the funds have incentives that do not align with maximizing investor returns. Owners of investment firms are incentivized to maximize profits by growing fee income. This conflict can express itself in several different ways. Firms try to grow assets to a point that limits investing opportunities and therefore potential future returns. Firms often start multiple fund strategies and will sell the one that works or what is hot while closing the strategies that end up not working. Marketing may be prioritized to raise assets, which can conflict with the investing process by trying to make a product sellable rather than doing what makes the most sense. There is also portfolio manager career risk where they are judged by shorter-term results so they may over-diversify and try to minimize benchmark tracking error as noted above.

One way to avoid some of these agency costs is only paying for value-adding results through performance fees. Performance fees make sense as long as they don’t become excessive. The best way to align a portfolio manager with their investors and what we do at Saga Partners is for the manager to have the majority of their net worth invested in the same strategy they manage. This is also something we look for in the management teams of our portfolio companies.

While forming Saga Partners – both the structure of the firm and our investing philosophy – it became clear what the few but particularly important ingredients were to significantly increase our probability of achieving excess returns over the long-term. These include thinking long-term and independently, an ability to focus on our highest conviction ideas, ensuring all of our investors are aligned with our philosophy, and not restricting ourselves to a specific niche so we have the ability to invest where we believe the best opportunities present themselves.

Over the last few years, we have had the benefit of speaking with several portfolio managers who share a similar “investing thesis” and structured their firms and philosophies in a similar manner. While each manager may think a little differently, they have what we believe are the important principles. There is no way to know with certainty whether one will outperform going forward, even if a manager has a very successful 10+ year track record. However, we believe those managers who follow these important factors have a high probability for success, which is why we manage the Saga Portfolio in the way that we do.

There are examples of certain investors who have been successful following technical analysis, highly diversifying, and making macro-forecasts. Jim Simons with the Medallion Fund at Renaissance Technologies is one of the more well-known success stories. However, long-term track records for these investment managers are few and far between and patterns among the successful are spotty at best, often clouded by black box algorithms that make little sense to outsiders. Even Simons says that they must constantly update and adapt their models with new data as the environment changes.

It is important to note there are many different ways to skin a cat. There is not necessarily a right or wrong way to manage an investment portfolio that will guarantee success. However one decides to invest their saved capital, it should align with their goals, time horizon, and level of comfort with concentration and the price volatility they may face along the journey.

Despite what may be most suitable for a certain investor, we do expect the majority of conventional big money management firms with highly diversified mutual funds that hug their benchmarks to underperform long-term. It will not be surprising to continue to see more assets move from these products into low-cost passive indices over time. Our investment theory and philosophy are simply what we believe to be the best way to earn excess returns with our own money and for those who want to invest alongside us.

The Biology of Investing

Since we are discussing our Theory of Market Outperformance being a combination of the social soft sciences, it is helpful to understand the context this theory is built upon. When we looked across the economy, it seemed to resemble an ecosystem that might occur in nature. There are a few very large companies, an enormous number of very small ones, and all of those in between interacting in a complex web of Darwinian natural selection. We did not formally crystallize this concept until we finally discovered Brian Arthur’s work from the Santa Fe Institute. He was way ahead of us, clearly illustrating this idea in his 1997 book, The Economy as an Evolving Complex System.

Arthur said it best:

“An economy is like an ecosystem, in which the struggle for existence causes businesses and products to compete and to change. Markets work not because they are efficient, but because they are effective, because they provide solutions to problems that face customers. And the beauty of commerce is that when it works it rewards people for solving other people’s problems. It is best understood as an evolutionary system, constantly creating and trying out new solutions to problems in a similar way to how evolution works in nature. Some solutions are “fitter” than others. The fittest survive and propagate. The unfit die.”

There is no such thing as a perfect market, an equilibrium, or an end state. It is similar to how the climate changes as an ice age comes and goes. One species of tree that may be better suited for the new climate may replace another in a particular forest; it is in a state of constant change. One tree is not necessarily stronger or smarter than the other, it just may be better suited for a given climate. As investor biologists, we are trying to make hypotheses as to which species of companies are likely to do better in the future than what is reflected in current expectations based on how the economic climate develops.

We find the analogy of companies being species of animals and their DNA being made up of different technologies that help them perform different tasks the environment demands from them very helpful as we try to understand the investing ecosystem. The economist Joseph Schumpeter coined the term “creative destruction” in 1942 as the key to economic progress. Businesses are in a continual struggle for existence as innovators look for ways to outwit their rivals by doing things better or cheaper and in doing so improve the living standards of consumers.

Dollars in the economy are what energy or food is to an ecosystem and customers determine where those dollars are allocated (who gets fed) through their buying or abstention from buying. The true bosses in a market economy are the consumers. Customers determine a company’s very existence, what should be produced, and in what quantity and quality. They are demanding bosses who will forever want better products or services that are cheaper and more convenient. As soon as something is offered to them that provides greater value, they will “hire” the better product or service and “fire” the one with less.

Understanding the birth, growth and inevitable death of companies is the essence of investing and capital allocation. Geoffrey West in his book Scale writes:

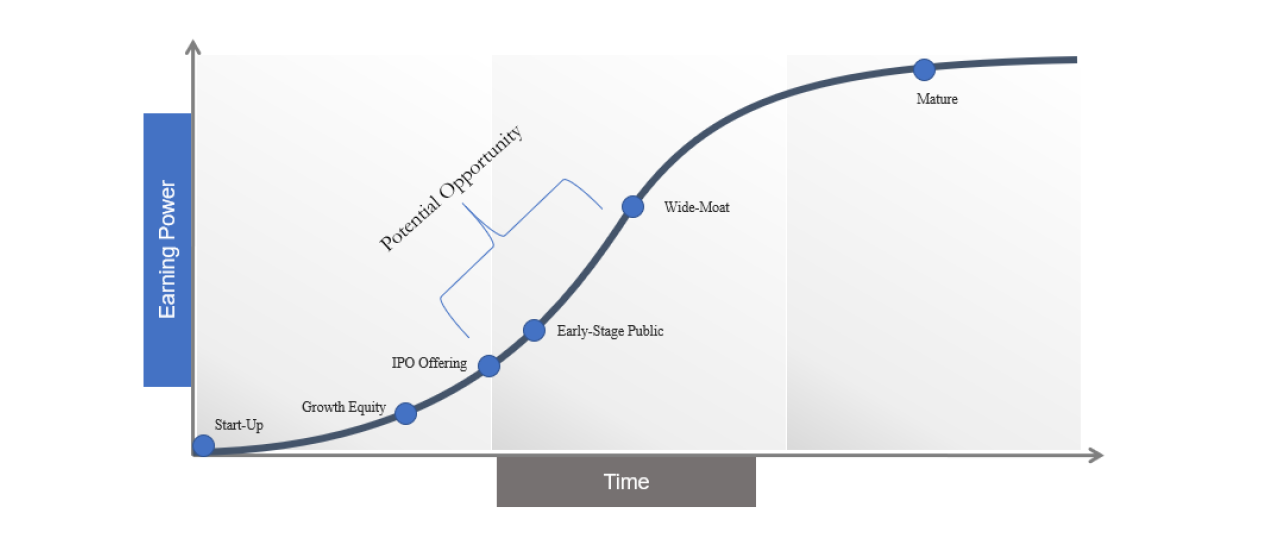

“The idealized growth curve of companies has characteristics in common with classic sigmoidal growth (S-shaped growth curve) in biology in that it starts out relatively rapidly but slows down as companies become larger and maintenance expenses transition to becoming linear…a crucial aspect of the scaling of companies is that many of their key metrics scale sub linearly…this leads to bounded growth and a finite life span. Sublinear scaling therefore suggests that companies eventually stop growing and ultimately die.”

Public data shows that almost half of companies following their IPO disappear in less than ten years. Fewer than 5% of companies remain “alive” after thirty years, and almost 100% die within 50 years. This means the Googles, Amazons, and Microsofts of the world may look invincible now but will inevitably fade away with time. Their mortality as a result of creative destruction is an important ingredient for generating new innovation and rising standards of living. This is the underlying force of the free market system and is important to remember when trying to analyze the long-term durability of different species of companies within the economy.

Where Market Inefficiencies Have Transpired

An important characteristic of the market is its relentless determination to seek out mispriced securities and revalue them to a fairer price. A certain investment approach that proves to be successful may work for a while, but it is reasonable to expect the market will eventually catch on and a new approach may be needed.

This pattern has occurred in various ways over past decades. Ben Graham’s net-nets, companies selling below their net working capital, is a good example. Clearly, buying a basket of average companies selling below their net liquid assets on their balance sheet will likely provide attractive returns. Another approach that has worked was buying a basket of low-multiple stocks with the expectation that multiples would revert to their long-term mean. While either of these strategies may have generally worked at certain times in the past, it is important to understand why they worked. They did not work because they followed a simple set of rules or a preordained formula for success. They worked because investors paid a price for an asset that was below the net cash that would be taken out of the company during its remaining life. That is the key to value investing.

The market continues to get smarter over time. Ben Graham’s net-nets or undervalued high-quality companies selling for low multiples grew harder to find as information became more ubiquitous. In today’s world, low-multiple stocks can be deceivingly attractive. A business that sells for 5x earnings but never returns those earnings to shareholders because management continually allocates cash flow to low returning opportunities, may leave an investor with nothing, regardless of its P/E ratio. You may find yourself holding a stock that is perpetually “undervalued” wondering where the accrual GAAP earnings are going.

One area that has historically been a good place to find undervalued investments has been in the category of high-quality “compounders.” These are companies that can reinvest earnings at high returns for a long time. They have developed a better mousetrap and are able to keep their flywheel spinning by copying their formula of success better than less advantaged competitors. Apple, Amazon, Berkshire Hathaway, Walmart, Nike, McDonalds, and Costco are just a few well-known examples where investors could have invested early in their life cycle and significantly outperformed the market. Of course, it all looks obvious with the help of hindsight.

Charlie Munger called this type of investing “surfing”, comparing it to when a surfer catches a wave and then just stays there for a long time. He uses the example of National Cash Register in the early 1900s. National Cash Register had the best distribution system, patents, and the ability to continue developing the product as technology improved. Munger said any “well-educated orangutan” could see that buying into a partnership with National Cash Register in the early days was a no-brainer.

Many investors pass on some of the best companies with the brightest futures because they always look “expensive” relative to recent fundamentals. It is not until reinvestment opportunities dry up, growth slows, margins expand, and valuation multiples come down that low-multiple investors will finally get comfortable owning these companies at which time future returns will likely be less substantial. One of the most common investment mistakes has been reluctance to pay up for a really outstanding business with a bright future or to continue to buy it at higher prices.

The market typically values companies on the not unreasonable expectation that most excess returns will regress to a mean due to competitive forces. However, there are a few companies that are able to defend against competition and earn excess returns on invested capital longer than the market expects or prices into current valuations. In the book 7 Powers, Hamilton Helmer does a terrific job categorizing these advantages as: scale economies, network effects, counter-positioning, switching costs, branding, cornered resource, and process power. That is one of the reasons why well-known businesses such as Walmart, McDonalds, Apple, Google, or a more current example like Facebook, can be undervalued for long periods of time and produce extraordinary returns.

As mentioned earlier, Pareto’s Principle applies to many things in life and the value creation of companies within an economy is no exception. Returns are not equally distributed among every investable company. Extraordinary returns flow to a tiny fraction of the companies in existence; 80% of the value often comes from 20% of companies over the long-term, and you can reapply the 80/20 rule within the 20% of companies that generate the most value. The biggest error an investor could make is selling one of these rare compounders during the early stages of their growth. The opportunity costs would have been far greater than the amount lost investing in a company that goes bankrupt. We wonder if selling a company like The Trade Desk today would be the equivalent to selling Amazon in 2003 or Google in 2006?

While many may believe it is meaningless to forecast beyond two or three years since it is impossible to know what a company will earn that far out, the distant future is when a substantial percentage of the cash flows contributing to a company’s intrinsic value take place. This is particularly true for younger companies that have established themselves as category leaders and must invest heavily in the foreseeable future to take advantage of the opportunity. If the market is overlooking these potentially significant cash flows, that is where the opportunity may be.

It is important to consider that companies earlier in their life cycle with high growth rates will likely have financials that do not look as flawless as more mature wide-moat companies with high margins. Financials will likely show accounting losses and cash outflows as a young company invests heavily to develop their products and capture market share. Counterintuitively, rising margins can even be a bad sign since it might signal the company has fewer reinvestment opportunities. To help peel back the onion, analyzing a company’s unit economics on growing sales is the key to understanding whether the return on incremental investment is attractive and whether fixed costs will be able to scale. The best opportunities are often in businesses that grow stronger with size as unit economics continue to improve.

Any great growth company is going to look expensive, perhaps excessively expensive relative to current fundamentals earlier in their life cycle. What multiple to current income or book value would you be willing to pay for a 10% ownership stake in the lifetime future income of an extremely bright, motivated, and hard-working college student studying software engineering today?

While investing in earlier stage high-quality compounders has been an attractive area to earn excess returns in recent decades, that does not necessarily mean it will always be the case. The market can fully discount an emerging company with a very bright future. That may very well be the case for certain companies in today’s market. A great company may not necessarily be a great investment if the current price already reflects its strong future, just like a bad company can be a good investment if the price is right. It all goes back to the Law of Investing: what cash you pay today for the future cash flows you will receive for owning an asset.

Portfolio Update

While we do not want to rely on luck when investing, we understand it plays a role when working with probabilistic future outcomes. As COVID-19 and social distancing became the new norm, many of our portfolio companies are the lucky few in the economy that are actually benefiting from this unfortunate situation.

Most of our companies already had long-term secular demand tailwinds, however COVID-19 significantly accelerated the demand for their services which is now more appropriately reflected in their rising stock prices. Therefore, we must attribute a portion of the Saga Portfolio’s year-to-date performance to a world we did not forecast. In other words, we were lucky. After a long enough time, good and bad luck should eventually balance each other out. Following such recent strong performance, it is important to not take full credit for something we did not predict and believe we are smarter than we really are.

The extreme volatility of the market over the last six months and shifts in underlying demand provided rare opportunities to allocate the Portfolio to amazing companies at very attractive prices. During the first quarter we were fortunate to have the opportunity to add Wix and Alteryx to the Portfolio and then Livongo during the second quarter. We sold Linamar in order to take advantage of these very attractive opportunities. Linamar is a great company that we expect to perform well in the future, however when weighing the long-term expected returns of all available opportunities, we decided to reallocate capital accordingly.

We usually go into more detail about new portfolio holdings, however, given the growing word count of this letter we decided to post research on each new holding in the next quarter. They will be posted on our website www.sagapartners.com.

Conclusion

Going through times like the last six months really makes us appreciate the fantastic group of investors that have joined the Saga family. Having investors that have confidence in us to make the right decisions for the long-term is a true asset. We always love growing with investors that align with Saga’s philosophy. The only sales or marketing we pursue to grow Saga Partners is through writing these letters and our research. Our best source of new investors has been through referrals from existing investors. If you know someone that may potentially be interested in a strategy like the Saga Portfolio, please forward on our information!

Unless we go through another once in a ten-year market crash sometime during the next quarter, we will begin providing semi-annual letters going forward. An updated fact sheet will still be sent out each quarter and we will be posting research notes on our newer holdings.

As always, please reach out if you have any questions or comments, we are always happy to hear from you!

Sincerely,

Joe Frankenfield, CFA

The post SAGA Partners 2Q20 Commentary: The Theory of Market Outperformance appeared first on ValueWalk.