What’s New In Activism – Republic First Fends Off Norcross

Republic First Bancorp Inc (NASDAQ:FRBK) announced a $125-million capital raise in its bid to support the execution of its strategic plan as it continues efforts to fend off a campaign led by dissident George Norcross and his allies.

In a March 10 statement, the lender revealed that Castle Creek Capital would invest $60.7 million to purchase shares at $2.25 apiece, compared with a closing price on Friday of $1.78.

Q4 2022 hedge fund letters, conferences and more

“The capital raise, which follows a strategic review process overseen by the strategic review committee of Republic First’s board of directors, with the assistance of independent advisors, is intended to support the company’s execution of a strategic plan to drive profitability and enhance shareholder value,” the statement advised.

Under the deal, Castle Creek secured the right to appoint a director or an observer to the board and any subsidiary bank board of directors. Cohen Private Ventures also committed to participate in the raise on the same terms for $30 million.

Republic First largely avoided the rout in banking stocks on the Monday following the announcement, declining by just 1.7%.

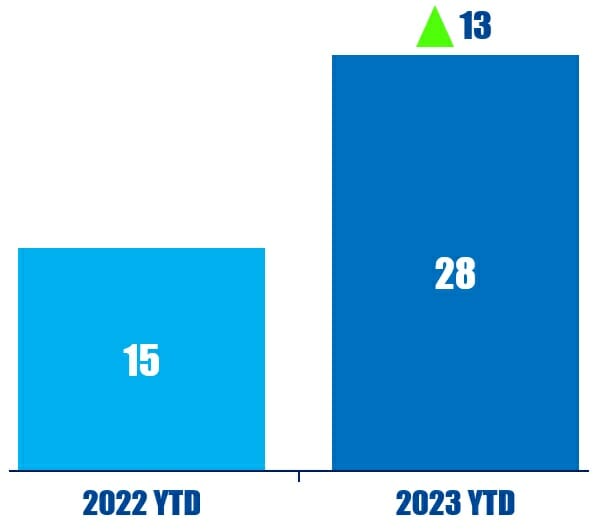

Activism chart of the week

So far this year (as of March 9, 2023), 28 U.S.-based companies have been publicly subjected to a social-related demand. That is compared to 15 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting – Pension Funds Vote Against BP And Shell

Two U.K. pension funds vowed to vote against the reelection of top directors at BP (NYSE:BP) and Shell (NYSE:SHEL) unless the big oil giants improve their commitments to tackling carbon emissions, according to media reports.

Borders to Coast and The Universities Superannuation Scheme are behind the move to accelerate action on climate change action, executives told the Financial Times.

Voting against management is “one of the most influential means of swaying company behavior available to investors,” Colin Baines, stewardship manager at Borders to Coast told the newspaper.

Both BP and Shell have committed to achieve net-zero carbon emissions by 2050. However, their rate of progress has been criticized by climate activists and some investor groups.

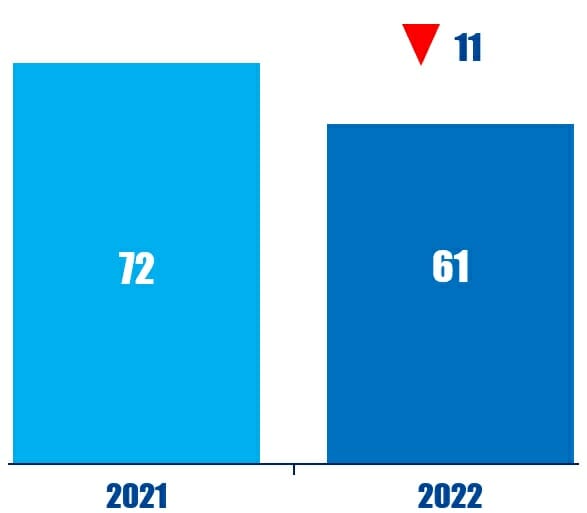

Voting chart of the week

Last year, 61 “say on pay” votes at Russell 3000 companies received 20% or more opposition. That was down from 72 in 2021.

Source: Insightia | Voting

What’s New in Activist Shorts – Viceroy v MPW

Viceroy Research continued to hammer away at Medical Properties Trust (NYSE:MPW), accusing the real estate investment trust of raising debt off balance sheet, disguising borrowings as asset sales, and recording false gains on transactions.

In its latest missive, Viceroy highlighted a March 2022 partnership between MPW and Macquarie Asset Management.

Under the terms of that deal, MPW contributed assets worth $1.1 billion to the joint venture in exchange for an undisclosed cash payment. The joint venture would then raise secured nonrecourse debt with the proceeds going to MPW.

“A closer look at the transaction shows that this ‘sale’ to MPW’s off-balance sheet JV was substantially financed by borrowings, which are also moved off balance sheet,” Viceroy stated.

“This transaction was designed to disguise MPW’s true debt, and provided short-term liquidity to cover MPW dividend payments.”

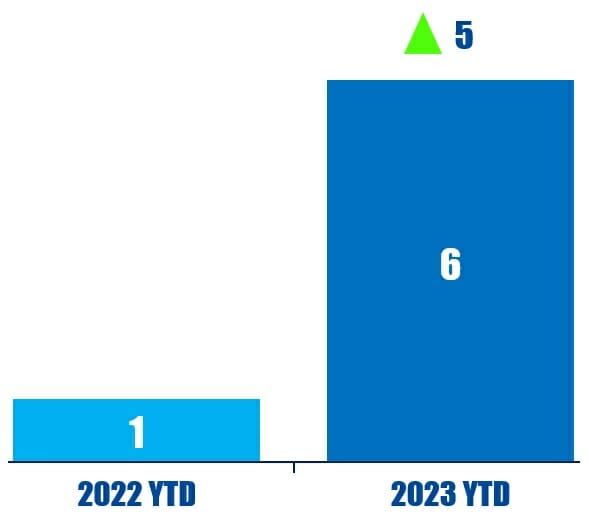

Shorts chart of the week

So far this year (as of March 10, 2023), six industrials companies have been publicly subjected to an activist short campaign, up from one in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week’s quote comes from Blue Orca Capital in a short report on Piedmont Lithium. Read our coverage here.

“Piedmont claims that revenues and profits will flow from Tennessee in 2025, but we believe that is a fantasy.” – Blue Orca Capital