A steep and broad decline in corporate growth might have been expected. It is the shape, timing and magnitude of the recovery that is the critical issue. With so many companies in steep declines with big drops in the frequency of improvement of both sales growth and profit margins there is no evidence.

Q2 2020 hedge fund letters, conferences and more

Last quarter’s evidence of an improvement in the basic industry and energy sector has evaporated. The recent rally has many basic industrial shares trading at premium prices and providing an excellent opportunity to sell.

Index investing is more dangerous than ever. It is so important to make the shift to active management now. Empower yourself with data and analytics that can and has identified every market peak and trough in the past 50 years. Otos is a machine-learning artificial intelligence entity that supports all aspects of investment decision-making. Visit Otos.io for more information on how Otos communicates changing fundamentals attributes with the MoneyTree avatar (See Quidel’s MoneyTree below).

Own only stocks of companies with exceptional attributes. Recent share price weakness in technology and healthcare has turned up some bargains. Such as Quidel Corporation, which is demonstrating a quality pattern with strong fundamentals.

Quidel Corporation $161.190 BUY this rich company getting better

Quidel Corporation (NASDAQ:QDEL) has been a profitable company with persistently high cash return on total capital of 14.0% on average over the past 7 years. Over the long term the shares of Quidel Corporation have advanced by 501% relative to the broad market index.

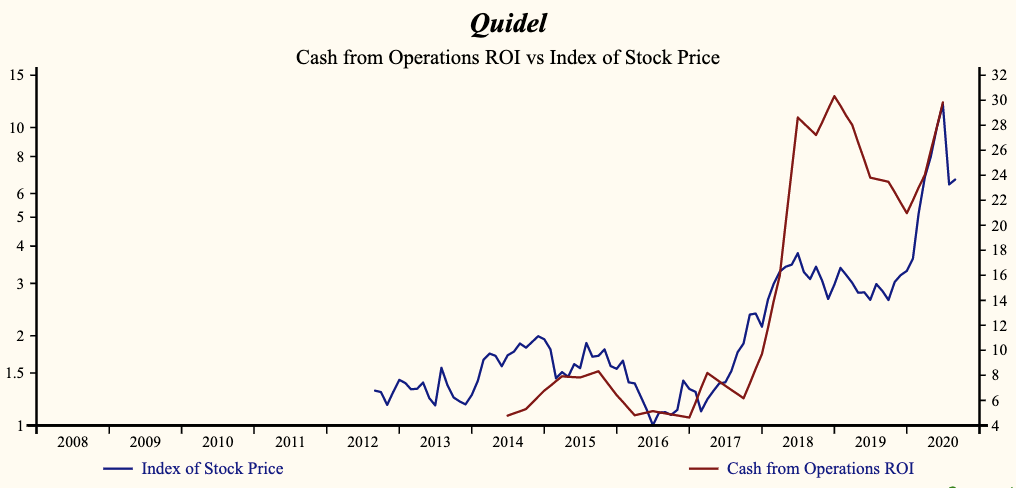

The shares have been highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash-Operating Activities ROI which has been 78% correlated with the share price.

Currently, sales growth is 27.4% which is low in the record of the company but higher than the long-term growth record and higher than last quarter.

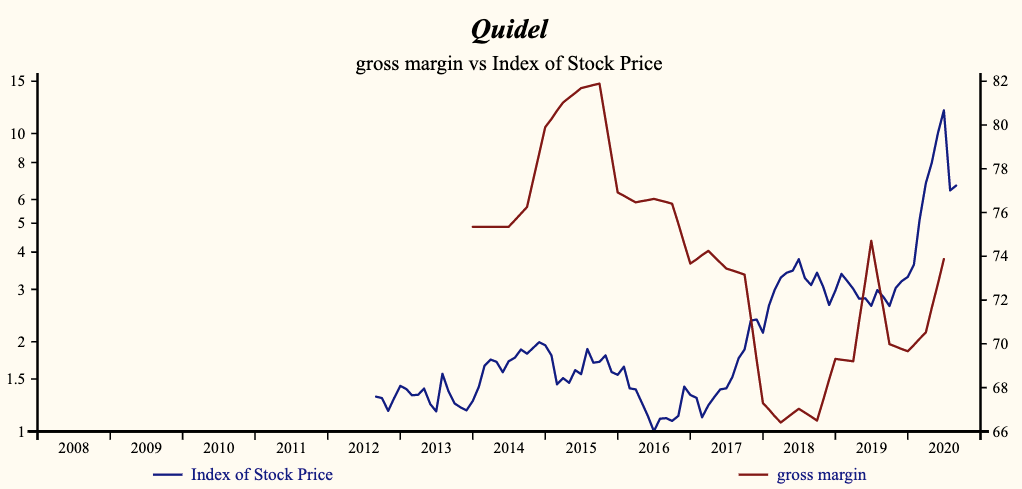

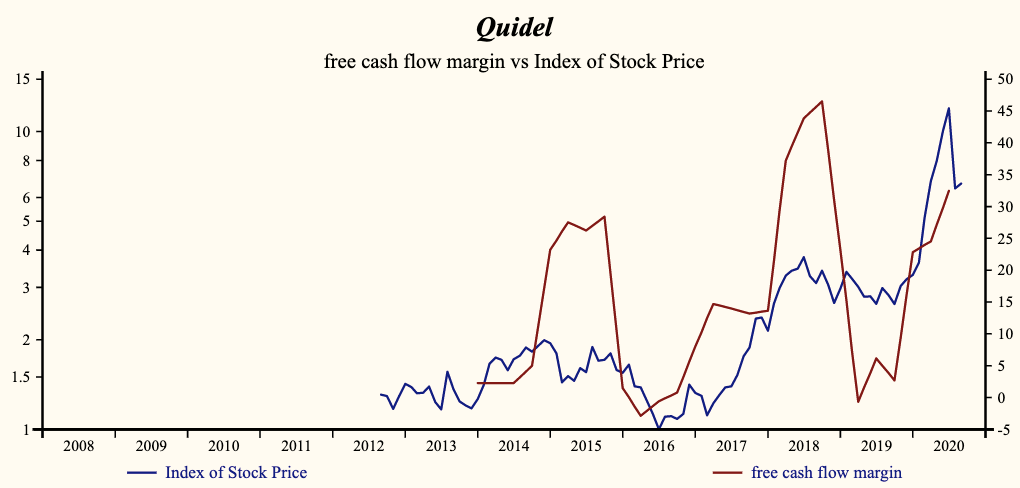

The company is recording a low but rising gross profit margin for the second consecutive quarter. Costs have been falling steadily as seen by continuous reductions in SG&A Expenses. Expense reductions are not limitless however the company continues to manage further cost containment. The stronger profit margins and continuous reduction in costs has been supporting cash flow and EBITDA growth and ultimately pushing Free Cash Flow growth to new heights.

More recently, the shares of Quidel Corporation have advanced by 121% since the October, 2019 low. The shares are trading at lower-end of the volatility range in a 11-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

Imagine the stock market as a large greenhouse. Each stock is a plant in a pot. At the front of the greenhouse is a small group of very tall plants with large green globes and all in full bloom. These plants look healthy and sit in solid golden pots. Those are the pick of the crop!

The post Quidel Corporation: Looking for Healthcare Bargains appeared first on ValueWalk.