The Paycheck Protection Program, or PPP, was first deployed in April 2020 to help small business owners pay employees during the coronavirus pandemic and the ensuing state shutdowns of businesses across the country.

Q2 2020 hedge fund letters, conferences and more

How Small Business Owners Can Benefite From PPP Loans

With PPP loans, small business owners can cover payroll costs as well as other essential expenses such as rent, utilities, or mortgage interest payments. Most importantly, PPP recipients can have their loan converted into a grant once they apply for forgiveness and prove that they used the funds according to government guidelines.

The deadline to apply for new PPP loans is on August 8th. As Congress debates whether, how, and when to deliver new funding or financial resources for small businesses, it’s clear that many business owners will require more help in order to get through this pandemic.

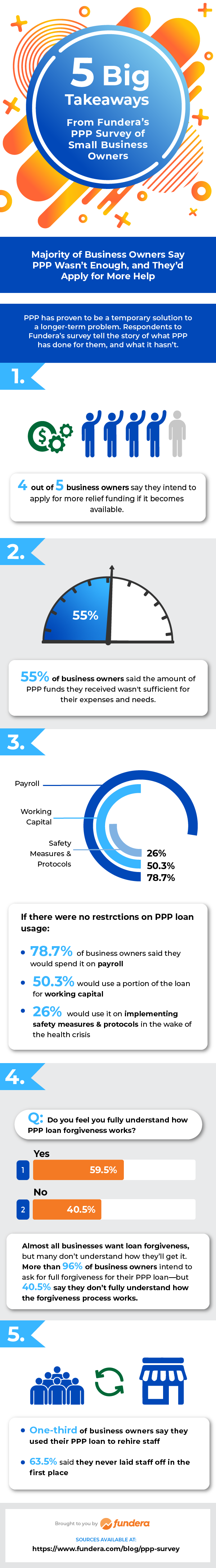

With that in mind, Fundera conducted a survey of small business owners to determine how effective this program has been so far, what they would spend additional funding on, and their outlook on the future. Over 500 small business owners were surveyed.

Results of the survey painted a conflicting picture of how small businesses are faring and how they expect to do in the near future, with or without additional support. Most businesses planned to follow PPP guidelines to receive full forgiveness, though a substantial percentage admitted they were unclear on how to get that forgiveness. Four of five respondents said they’d apply for more funding if it became available, and just over a quarter of them said they’d like to use that money to outfit their businesses with safety measures and protocols. Most businesses, unsurprisingly, are still most concerned with covering their payroll costs.

Here are some key questions and their answers from the survey:

What do you plan to spend your PPP loan on?

- 3% of small business owners surveyed answered they’d spend at least 60% on payroll, and the remainder on rent, utilities, and mortgage interest.

- 40% said they would spend 100% of their loan on payroll.

- 7% said they’d spend less than 60% on payroll, more than 40% on rent, utilities, and mortgage interest.

Do you intend to rehire staff you laid off with your PPP loan?

- 5% of small business owners said no, because they didn’t lay off any staff.

- 6% said yes.

- 9% said no, I laid off staff but do not intend to rehire them in the near future.

What would you choose to spend your PPP loan on if there were no restrictions? (selecting all that apply)

- 7% said payroll, 61.5% said rent, utilities, and mortgage interest.

- 3% said working capital.

- 4% said renovating/expanding their business.

- 26% said implementing safety measures/protocols.

Why did you decide against applying for a PPP loan?

- 3% said the rules around PPP loan forgiveness impacted their decision not to apply.

- 6% said their business was affected by the pandemic but they had enough to survive without the loan.

- 6% said their business was not affected by the coronavirus pandemic.

- 5% selected ‘other,’ meaning their primary reason was not listed.

Do you feel you fully understand how PPP loan forgiveness works?

- 5% said ‘yes.’

- 5% said ‘no.’

Was the amount you received for PPP sufficient for your expenses/needs?

- 56% said ‘no.’

- 44% said ‘yes.’

Do you plan on applying for more relief funding if it becomes available?

- 2% said ‘yes.’

- 8% said ‘no.’

You can read the full article on the PPP survey here which includes the below infographic.

The post PPP Loan Survey Of Business Owners appeared first on ValueWalk.