I recently rode on the Rocky Mountaineer train through the Canadian rockies. This article is another in the series from the railway track point of view. The potash business is one of those businesses that relies on the railway.

I want to focus on the potash companies this week. First of all, it is important to realize how big a train full of potash is. The legal limit is 12000 feet, or over two miles.

Potash Train

Potash is one of those products that the general public doesn’t know. However, it is a product widely used in agriculture to help enhance the soil.

Looking through the potash companies, the charts are starting to break out.

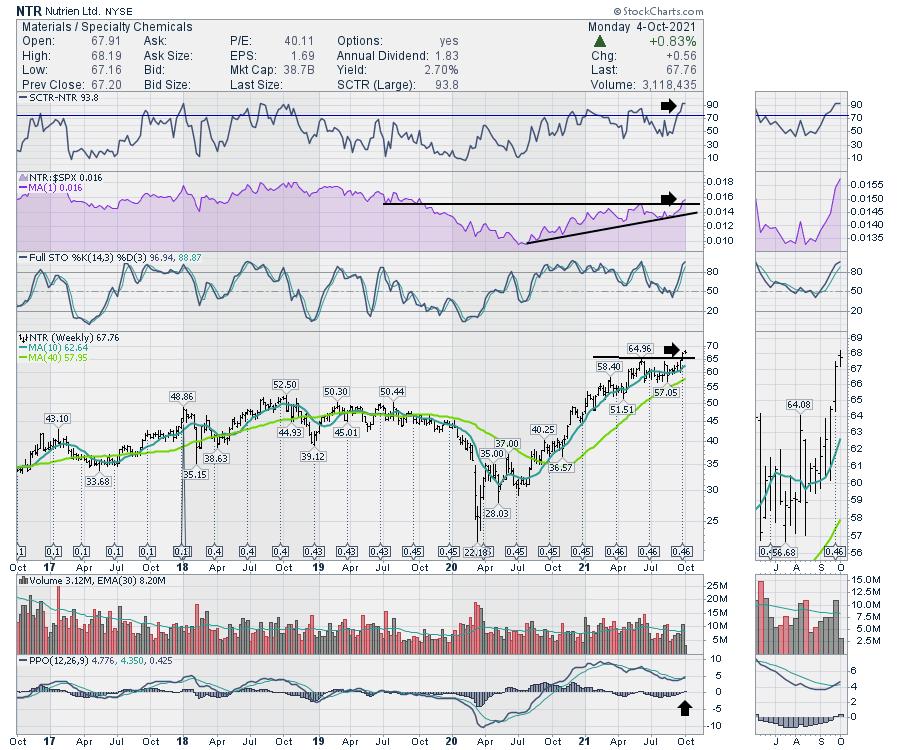

Starting with Nutrein (NTR, NTR.TO). Nutrein is breaking out to new highs as crops around the world are struggling. I couldn’t get a better buy signal. The relative strength in purple is breaking out to the upside as price breaks out to all time highs. The PPO is turning up with a buy signal this week. The chart looks great.

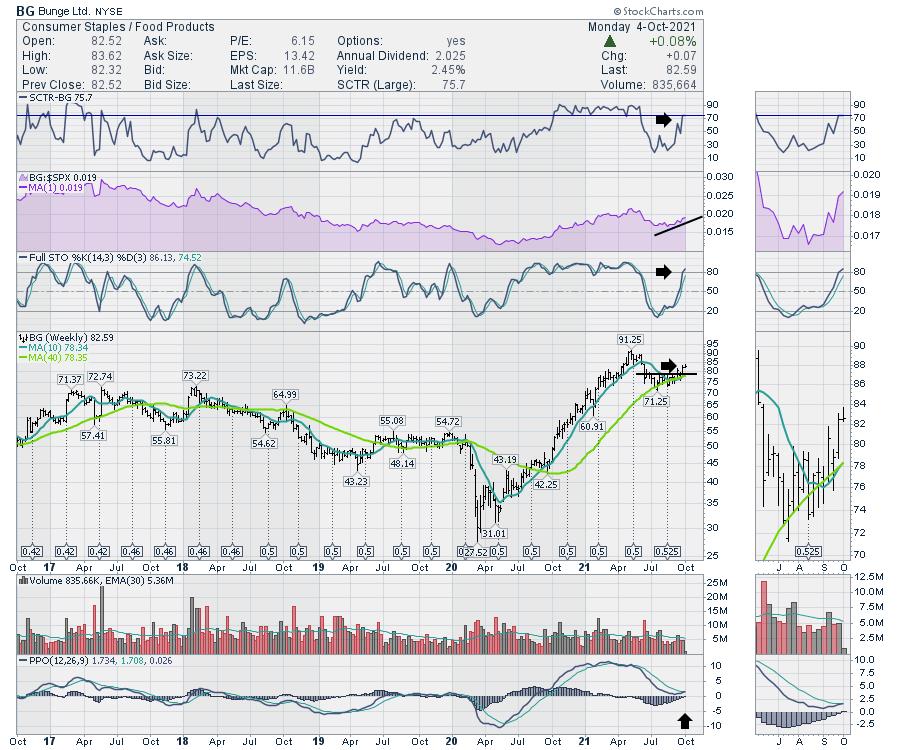

Bunge is also turning up but has not moved to new highs yet. The relative strength is starting to turn up. The stock SCTR comparing it to peers is moving into the top quartile. That is bullish when the stock resumes outperforming. We would like to see it continue to outperform. This stock is also giving us a buy signal on the PPO this week.

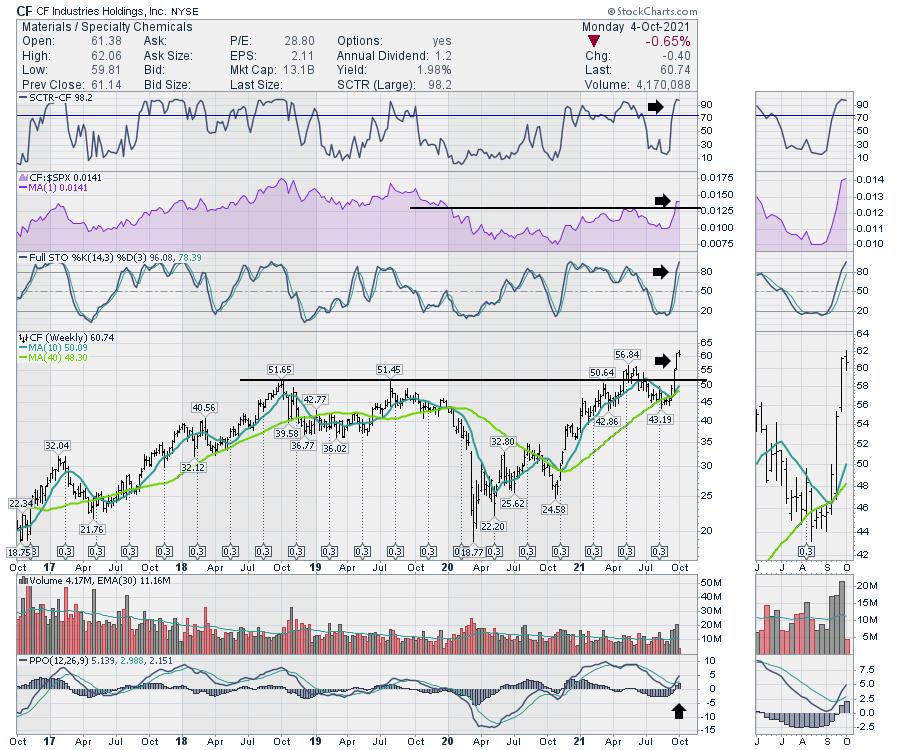

Another Potash stock is breaking out on a buy signal as well. CF is blowing through to new all-time highs. The volume is soaring on the break out. The relative strength is breaking out to new 2-year highs. But this stock also has a PPO turning up, giving us a buy signal.

So another commodity rolls down the rails, and it is obviously in demand. Three of the players in the commodity are breaking out on buy signals. I like it when the industry turns up as a group. This one looks like it has a lot more room to run in my opinion.