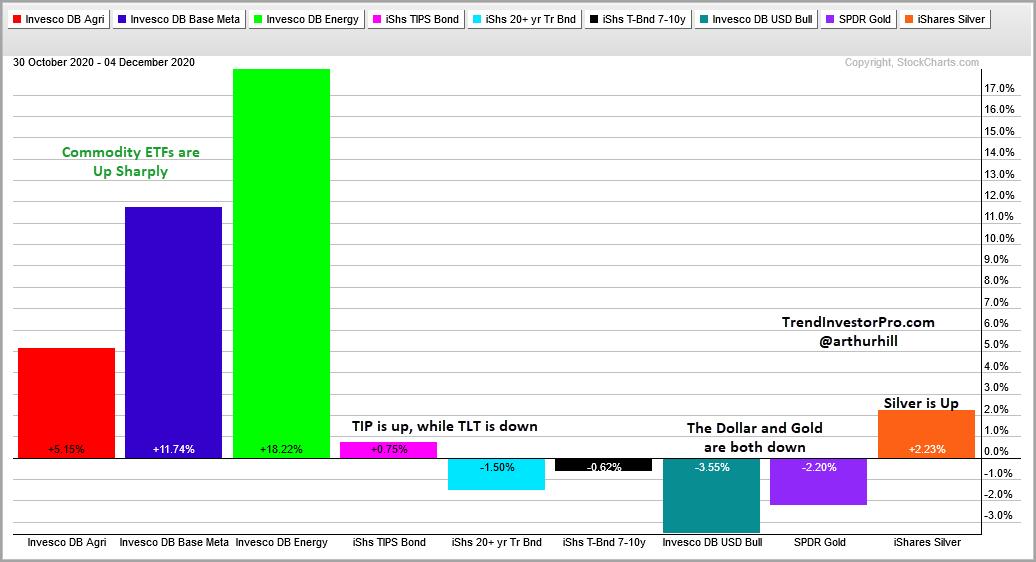

There was a serious shift over the last five weeks as commodities surged, bonds fell and the Dollar recorded new lows. There were also some noticeable divergences as the Inflation-Indexed Bond ETF (TIP) edged higher and the 20+ Yr Treasury Bond ETF (TLT) moved lower. This divergence is only five weeks old, but it does suggest a whiff of inflationary pressures in the air.

There was a serious shift over the last five weeks as commodities surged, bonds fell and the Dollar recorded new lows. There were also some noticeable divergences as the Inflation-Indexed Bond ETF (TIP) edged higher and the 20+ Yr Treasury Bond ETF (TLT) moved lower. This divergence is only five weeks old, but it does suggest a whiff of inflationary pressures in the air.

The PerfChart above shows TIP with a .75% gain since October 30th and TLT with a 1.5% loss. We can also see the commodity ETFs surging with the DB Agriculture ETF (DBA) gaining 5%, the DB Base Metals ETF (DBB) advancing 12% and the DB Energy ETF (DBE) surging 18%. Meanwhile, the Gold SPDR (GLD) does not care about a falling Dollar or rising commodity prices…yet.

There is also an interesting short-term divergence between gold and silver. GLD is down 2.2% the last five weeks, but the Silver ETF (SLV) is up 2.2%. Perhaps the industrial side of silver is starting to shine. The price chart is also shaping up bullish as a key outside reversal formed this week and RSI bounced near 50.

A KEY outside reversal forms when the open is below the low of the prior bar and the close is above the high. This shows a serious shift driven by strong buying pressure after a weak open. RSI tends to range from 40 to 80 in uptrends and this makes the 40-50 zone support for momentum. The key outside reversal and momentum support zone mean we should be on alert for a follow through breakout.

Looking for more trend analysis and bullish setups for ETFs? This weekend we identified six ETFs with short-term bullish continuation patterns, two with medium-term bullish continuation patterns and two mean-reversion setups. Each week TrendInvestorPro offers a comprehensive pattern and setup report with annotated charts as well as a ranking report that tracks trend and mean-reversion signals for over 100 ETFs.

Click here to take your analysis to the next level!

——————————————————-