Last week, I did a part-educational, part-actionable webinar for the virtual money show (link below). My theme was and always is, the Economic Modern Family.

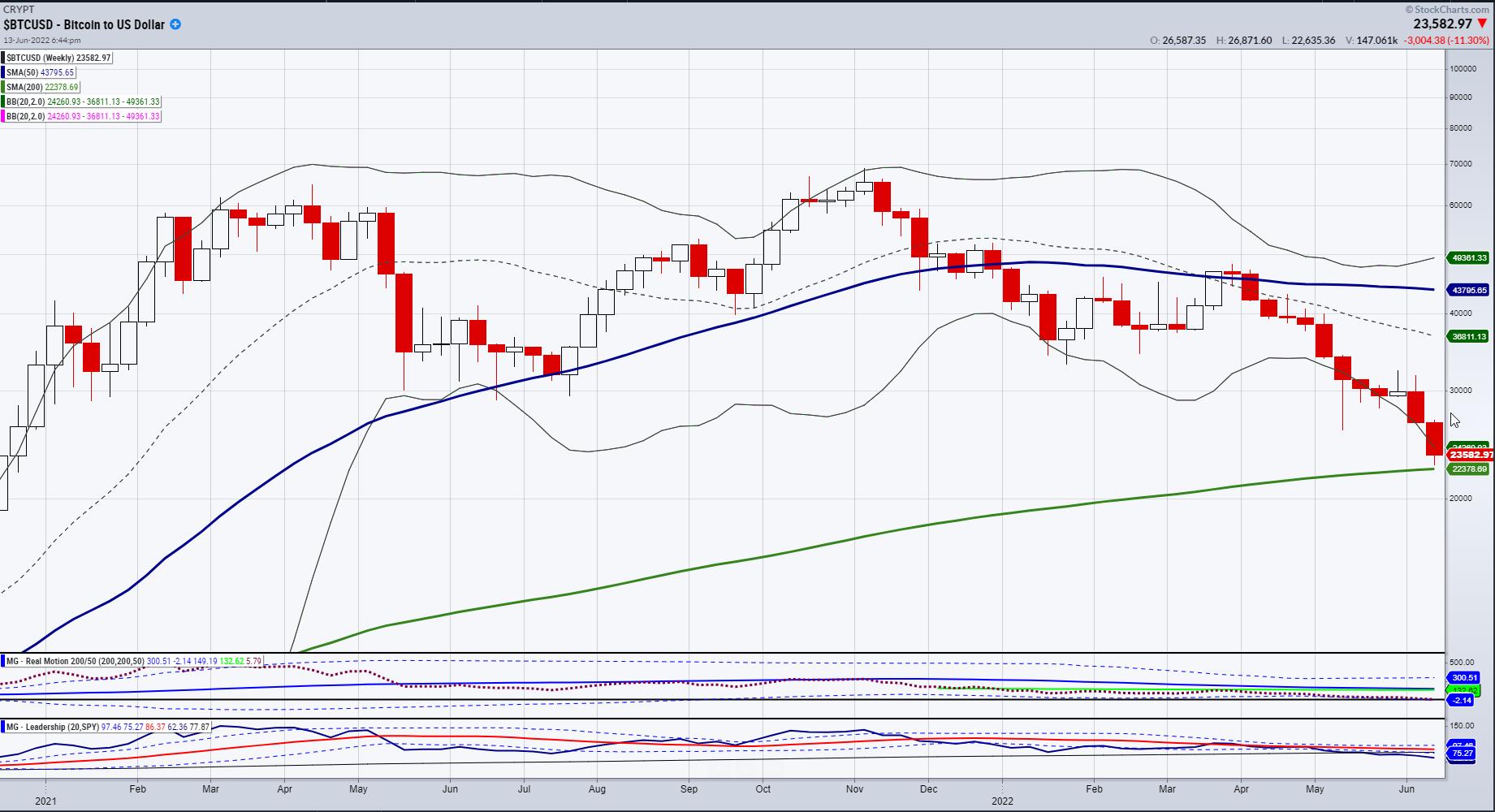

On the weekly charts, some of the members have broken down under their 200-week moving average, while others tested and held it and others have yet to trade near it. Bitcoin is the newest member of the Family, and it, too, held its 200-WMA support zone. This gives us a technical picture that is pretty clear and full of actionable “if this/then that”-type trading scenarios.

What is the Economic Modern Family saying ahead of PPI and the FOMC?

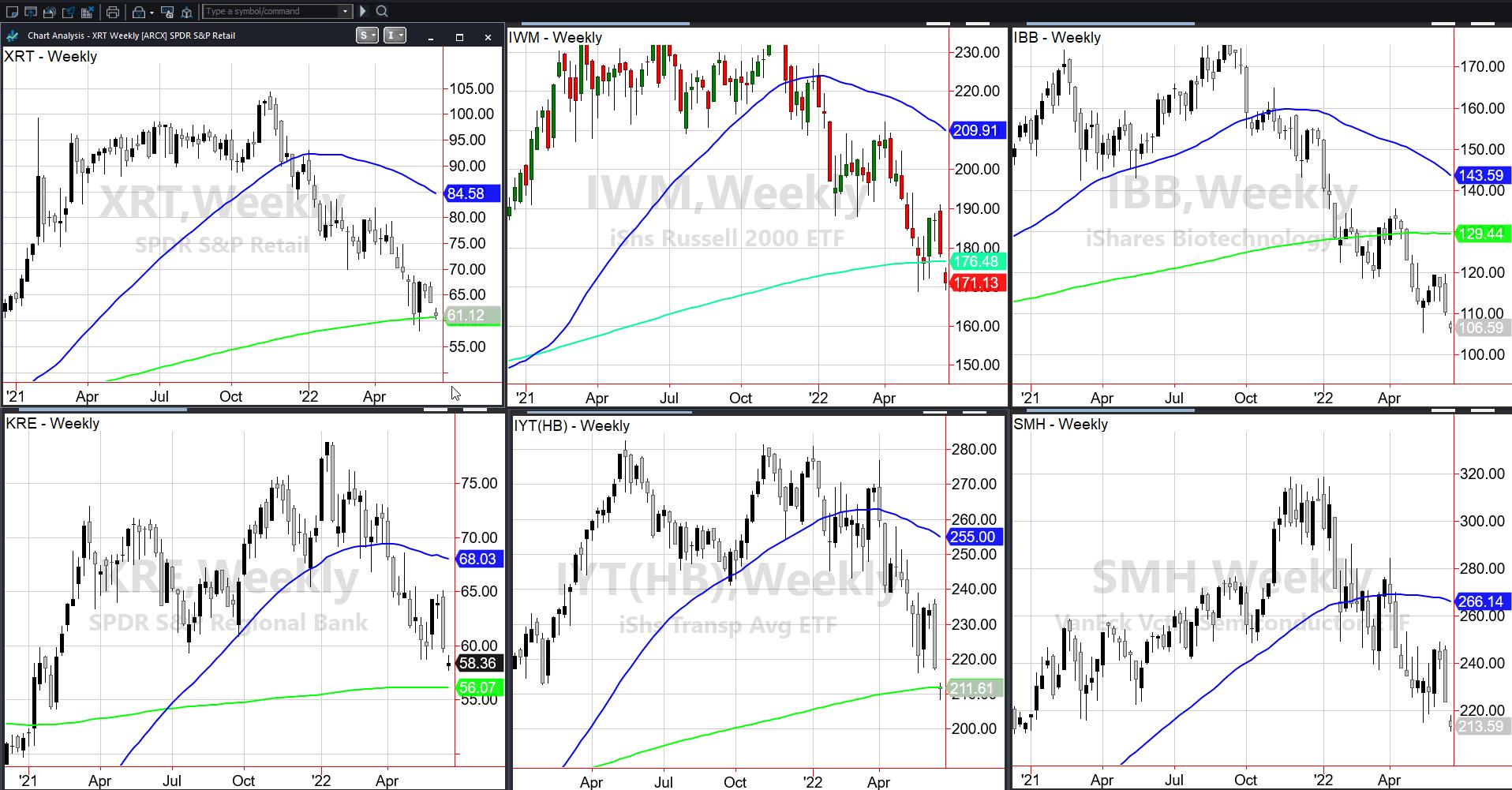

The weekly charts of the Russell 2000 (IWM), Retail (XRT), Biotech (IBB), Semiconductors (SMH), Regional Banks (KRE) and Transportation (IYT) vary. Then add the Bitcoin chart and you can see that the 200-WMA is either widely respected or decidedly rejected.

The most interesting chart just might be Bitcoin, as it popped about $1000 off the 200-WMA while the Russell 2000 broke decidedly below it. What could that mean?

Bitcoin’s dominance in the crypto space keeps rising while the price liquidated on the heels of Celsius. In the past, the rising dominance has pointed to a tradeable low in Bitcoin. More importantly for right now, if BTC has any influence or can turn out as a reliable market indicator, it behooves us to watch that 200-WMA. Can it continue to hold and, if so, is that an overall sigh of relief for the stock market?

That is where we look to the rest of the Family. Interestingly, XRT is holding its 200-WMA. Meanwhile, IYT, on the demand side, broke the 200-WMA. And KRE plus SMH are still a distance away — we can call it relative strength in banks and semis at this point.

Biotech has declined harder than any of the others. If it closes out the week above 105.39, perhaps that will be a good place to look for a bounce. In the meanwhile, if we focus on XRT or the retail side of the economy, nobody can argue with the price weakness or abysmal consumer confidence statistic. However, the fact that XRT is currently outpacing IWM could be something.

A lot will depend on the CPI and the FOMC. But, for now, perhaps we can draw some parallel between Bitcoin and the consumer. And perhaps we can continue some level of patience to see if both break the 200-WMA this week for more pain, or if they hold and point to a bear market rally — or another opportunity to trade the trading for some quick profits.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Watch Mish cover her Economic Family on the Money Show!

You can also watch Mish’s clip on Bloomberg Markets Today, where she discusses what she sees going forward concerning inflation, recession, the Fed and the market.

Jared Blikre and Mish sit down to discuss her history, investing and the future in this video from Yahoo Finance!

And finally, I will be on live with Benzinga’s #PreMarket Prep Show June 14th at 8:35 AM EDT.

ETF Summary

- S&P 500 (SPY): 380 now pivotal resistance with 360 next support.

- Russell 2000 (IWM): 168.90 May low so will see if it can hold.

- Dow (DIA): 306.28 May low pivotal support at 294.

- Nasdaq (QQQ): 263 the 200-WMA with280.21 resistance.

- KRE (Regional Banks): 56 the 200-WMA.

- SMH (Semiconductors): 195 some minor support with 220 resistance.

- IYT (Transportation): 211.87 the 200-WMA to get back above.

- IBB (Biotechnology): 105.39 pivotal area.

- XRT (Retail): 60.62 the important 200-WMA support line.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education