S&P 500 Friday‘s session reversed the upswing so much that it calls into question the Q4 rally as having started already. Given Friday‘s slide through both 3,640s and 3,625, Thursday‘s intraday reversal must be chalked down to pre-CPI positioning, short squeeze and options activity.

It would be insightful to recap last two days so as to view them in conjuction, so let‘s start with Thursday:

(…) strongly rallied after a precipitous drop to 3,500s on CPI data coming in predictably above expectations. I looked for high inflation data, and especially high core CPI data, and these played into the hawkish Fed expectations, further strengthening them as the short end of the curve reveals.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The selling pressure though stalled, and the modest rebound that could have rolled over in the 3,560s as I indicated was a good place for it to happen, didn‘t materialize. The sellers were swiftly overpowered, and an hour later I declared that attempt as failed, with buyers moving in quickly.

Two hours after that, I talked bullish bias into the closing bell, aftermarket and premarket. S&P 500 has made good progress since, reaching 70+ points higher after the original bullish call.

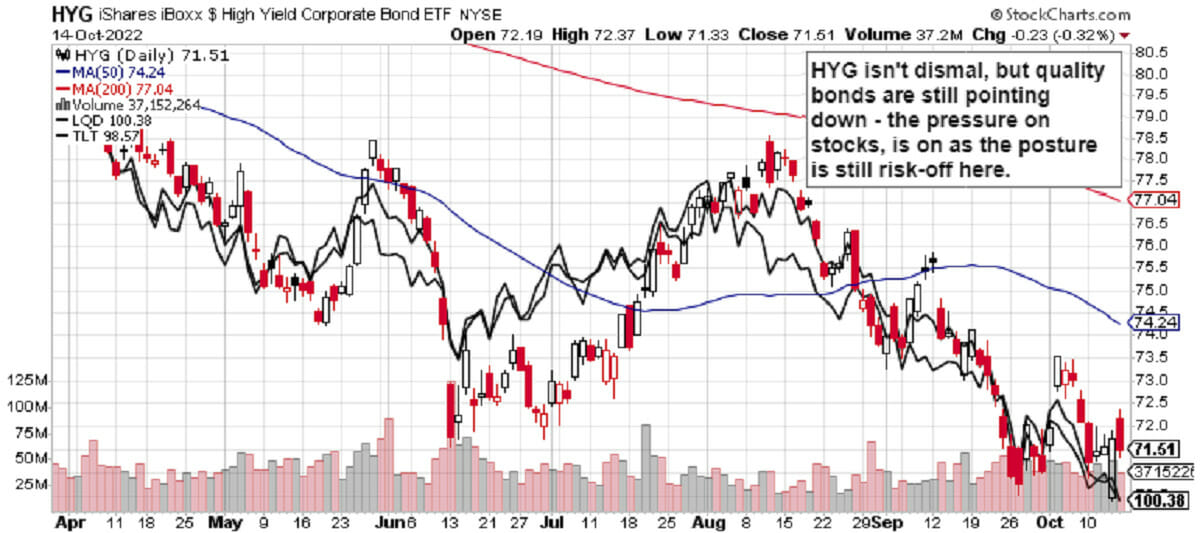

The ease with which supports Friday had been broken through, that HYG wasn‘t able to defend high ground better, and that the long end of the curve hasn‘t yet stabilized, speaks for more downside this week – before the rebound off even more oversold levels happens.

The question is how deep we then have to go still.

My opinion is less than 5% from Friday‘s close, but probably somewhat below, meaning that 3,500s would be broken after all.

I‘m not raising the S&P 500 earnings per share, and the picture valuations and earnings downgrades ahead paint.

Consumer is still doing relatively fine, the real economy hasn‘t dipped into a serious recession, and there are still some bright spots in earnings ahead – the tech midcaps seem to be improving, financials didn‘t have a poor week – but above all, healthcare isn‘t looking bad at all.

Energy stocks are still on fire, and will be even more. It would be the defensives (utilities and consumer staples) together with communications, that would be lagging ahead.

As Thursday‘s technical posture disappointed in bringing about more than a fleeting turnaround, what could prove to be such a catalyst fundamentally? Fed pivot or pause? Not near in the least. Job market data leading to speculation of a Fed pause?

Wordy language that gives a dint of pivot hope without actually uttering any (Brainard or even Yellen‘s question to the financial sector)? Possibly, but not enough. Focus on slowing real economy as opposed to inflation? Yes, this is a very likely, favorite pick of mine.

Precious metals and commodities are in the process of turning, and out of them all, I am of course still most bullish oil, followed by silver (due to outperform in the not too distand future) and copper.

As Friday‘s performance including in cryptos shows though, the path ahead isn‘t all clear (just look at gold and miners approaching Sep lows – nominal and real rates are biting), and the dollar I have called as not to have topped, clearly hasn‘t topped – and will continue placing pressure on real assets as well.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox.

Plenty gets addressed there, but the analyses (whether short or long format, depending on market action) over email are the bedrock, so make sure you‘re signed up for the free newsletter and that you have Twitter notifications turned on so as not to miss any tweets or replies intraday.

S&P 500 and Nasdaq Outlook

S&P 500 looks set to revisit Thursday‘s lows, and more – no matter the quite fine earnings last week from PEP or more than a couple of financials. While soft landing is out of the window, hard landing isn‘t here yet, and market breadth readings are quite extreme.

Credit Markets

Even though HYG may easily attack Friday‘s open, it isn‘t likely out of the woods yet. Unless quality debt instruments stabilize, stock market rallies are suspect.

The upcoming Q4 one would be accompanied by a decent retreat in yields, which would mirror the shift in focus from inflation to recession that I called above as the most likely turnaround catalyst.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica’s Stock Signals presenting stocks and bonds only.

Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves on top of my extra Twitter feed tips. Thanks for subscribing & all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor.

Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.