If you’ve followed my work, you know three things. First, I’m one of the few analysts that kept my long-term secular bull market call intact despite the pandemic-induced selloff back in March. Second, while my big picture view is firmly bullish, my primary focus is on the short- to intermediate-term as I’m a short-term trader. Third, we’re about to enter the only calendar month (September) where the S&P 500 has not risen more often than it’s fallen over the past 7 decades. I’m generally very upbeat about the stock market’s prospects and I continue to be very upbeat longer-term. In the very near-term, however, I’m seeing one MAJOR warning sign and I’m building a significant cash position as a result – just to be safe. The end of calendar months tends to start a week to ten day period of bullishness, so I realize we could still see higher prices in the week ahead, but I’d make sure stops are in place in the event short-term selling takes over.

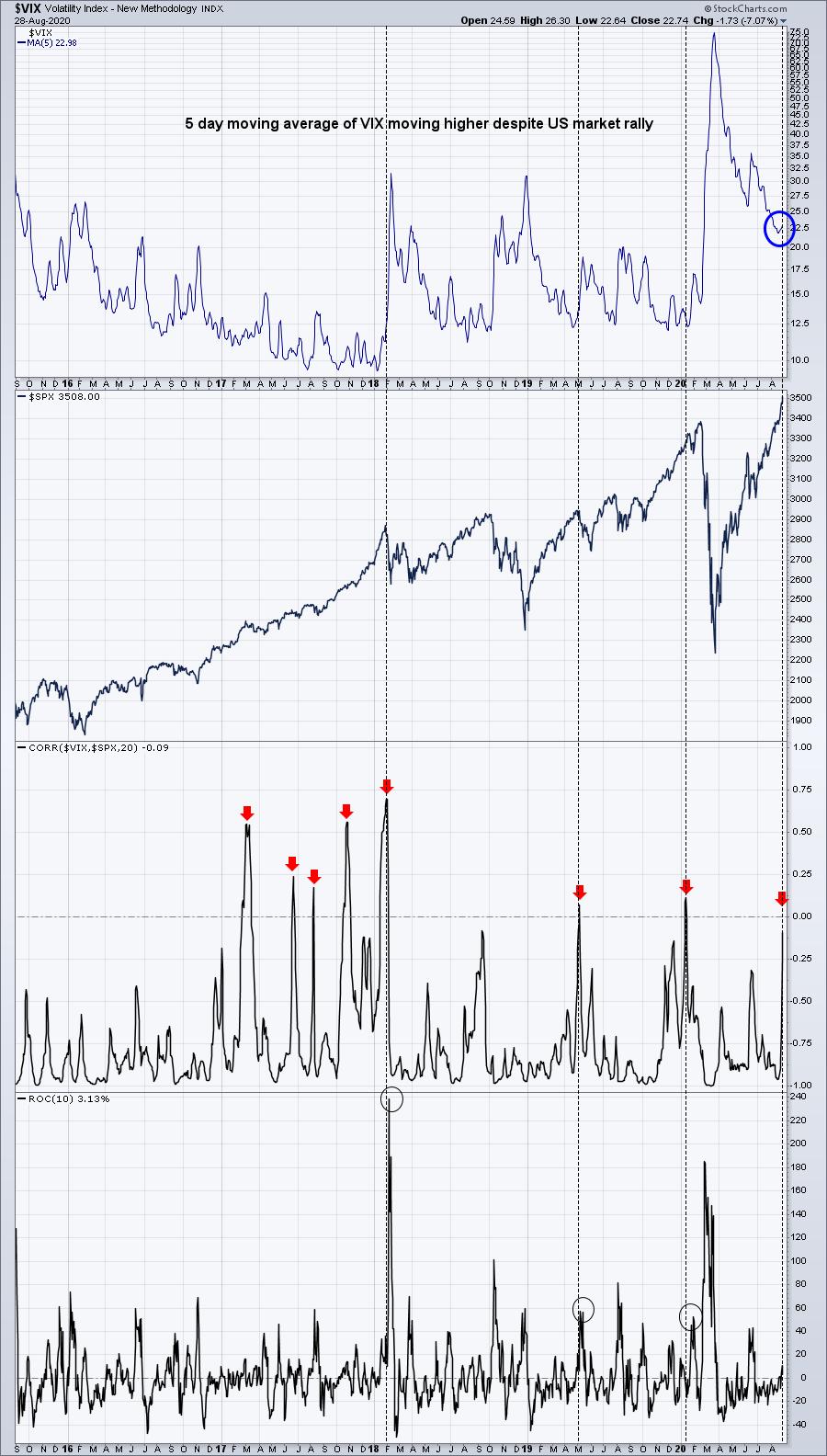

As prices keep rolling higher day after day, traders continue to grow more and more optimistic, resulting in an almost euphoric state currently. Typically, as stock prices rise, fear dissipates. When fear rises to coincide with a rising equity market, that’s when we’ve had issues historically. Let me paint you a picture in the form of a chart of the Volatility Index ($VIX):

The normal relationship between the VIX and the S&P 500 is one that’s inverse. When stock prices rise, the VIX typically falls. When stock prices fall, the VIX generally rises. The expectation then is to see the correlation of these two in negative, or inverse, territory. That’s not what we’re seeing right now, however, and that’s worrisome. It’s telling us that the market is growing more and more nervous with every upside move. The last two times we’ve seen this correlation cross the centerline and move into positive territory, big selloffs ensued. Don’t misinterpret what I’m saying, though. While I believe we could see a short-term selling event rather soon, I remain steadfastly bullish in the long-term. I completely believe we’re in a secular bull market and will remain in one for the next decade or longer. We’ll have corrections and even the occasional cyclical bear market that lasts a few months, but I firmly expect to see the uptrend since the March 2009 low continue for quite some time.

In our free EB Digest newsletter on Monday, I plan to share a short-term downside target on the S&P 500 for our EarningsBeats.com community based on this latest development on sentiment. If you’d like to receive that target and join the thousands of traders in our community, you can sign up HERE.

Happy trading!

Tom