Periodically, I provide a sample of my Daily Market Report that I provide to our EarningsBeats.com members every day. Below is yesterday’s DMR, where I’ve pointed out key possible breakouts in two critical areas – retail (XRT) and renewable energy ($DWCREE). In addition, I felt JKS was setting up nicely into its earnings report with a lot of bad news priced into the entire renewable energy group. Today, JKS is up 11% just hours after they reported solid revenue and EPS beats. If you’d like to try our service, there’s a no-cost, 30-day trial. CLICK HERE to get your trial started!

Guest Appearance – Your Daily 5

I appeared on StockCharts TV’s “Your Daily 5” on Wednesday and provided 5 companies that I believe are poised to have strong pre-earnings advances. A couple have already begun. If you’d like to check out the video (10 minutes in length), you’ll find it HERE.

Executive Market Summary

- Futures were very strong in overnight action and our major indices gapped higher at the opening bell

- The NASDAQ has shown relative strength since that opening bell as communication services (XLC, +0.90%), consumer discretionary (XLY, +0.88%), and technology (XLK, +0.82%) leads the way

- Automobiles ($DJUSAU, +4.62%) and renewable energy ($DWCREE, +4.45%) are two solid performing industry groups powering the XLY and XLK, respectively

- Nike (NKE, +0.23%) reports its quarterly results after the bell today; NKE represents roughly 4.2% of the XLY

- The 10-year treasury yield ($TNX) is relatively flat today as cryptocurrencies show some strength

- Crude oil (WTIC, -0.19%) hasn’t seen many down days lately, but thus far, today is one of them

- Caterpillar (CAT, +3.61%) is the best performing Dow Jones component today, furthering its recent bounce from very oversold conditions

Market Outlook

The NASDAQ broke out of its bullish ascending triangle continuation pattern to the upside this week as relative strength begins to turn back to technology and consumer discretionary. Within that latter group, retail stocks (XRT) could really power this sector higher. Like the NASDAQ, I see a bullish ascending triangle pattern in play here as well:

The XRT appears poised to make a big upside move, in my opinion. It’s currently residing at the breakout level and its daily PPO is starting to turn higher from centerline support. I fully expect to see this breakout and, when it occurs, I’d look for a sustainable period of rising price.

Sector/Industry Focus

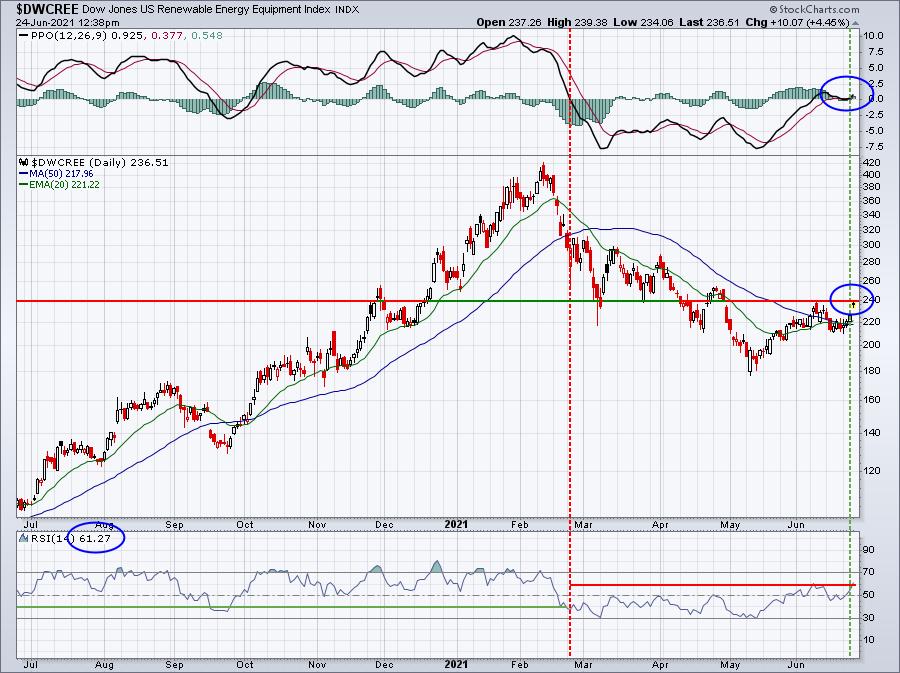

Renewable energy ($DWCREE, +4.45%) has been on the improve recently and I’ve written about it. It’s trying to take another step forward today and break above its earlier June high. This certainly appears to be the beginning of an uptrend and we know how quickly these stocks can move. Here’s the latest potential short-term technical breakout:

The daily PPO is turning back up off of centerline support and the RSI has slightly pierced 60 resistance. What we need now is a price breakout to confirm these two secondary bullish signals. 237.36 is the high candle body during June, while there’s also gap resistance of 241.49 from April 29th that needs to be cleared as well. If both of these levels are taken out, I believe it’ll be full speed ahead for the volatile renewables.

ChartLists/Strategies

Looking specifically at growth stocks that could surge in a big way, here are two possibilities:

JKS:

I’m going to start with the riskiest…..and it’s VERY risky. JKS reports earnings Friday morning and should be considered by only those willing to take on HUGE risk. The potential return is huge as well, but don’t ignore the possible downside with any earnings disappointments. The reason I like JKS is (1) renewable energy seems to now be benefiting from market rotation, which hasn’t happened in months, and (2) PLUG recently missed its earnings estimate and soared anyway, a possible signal that the worst is built into these stock prices right now. Here’s the current look at the JKS chart:

AMBA:

Semiconductors ($DJUSSC, +1.44%) are looking to breakout to an all-time high at today’s close. AMBA is a stock in this industry that’s been consolidating in a bullish inverse head & shoulders continuation pattern. A breakout above neckline resistance on increasing volume would be an excellent signal that it’s heading higher:

The daily PPO looks to be strengthening, so a breakout would really add to this bullish picture. Again, rising volume to accompany the breakout would also be quite bullish.

Earnings Reports

Here are the key earnings reports for the next two days, featuring stocks with market caps of more than $10 billion. I also include a few select companies with market caps below $10 billion. Finally, any portfolio stocks that will be reporting results are highlighted in BOLD. If you decide to hold a stock into earnings, please understand the significant short-term risk that you are taking. Please be sure to check for earnings dates for any companies you own or are considering owning.

Thursday, June 24:

NKE, ACN, FDX, DRI, BB, SNX, WOR, PRGS, MEI, RAD

Friday, June 25:

PAYX, KMX, JOBS, JKS

Economic Reports

May durable goods: +2.3% (actual) vs. +2.0% (estimate)

May durable goods ex-transports: +0.3% (actual) vs. +0.7% (estimate)

Q1 GDP (Final Estimate): 6.4% (actual) vs. 6.4% (estimate)

Initial jobless claims: 411,000 (actual) vs. 380,000 (estimate)

May wholesale inventories: +1.1% (actual) vs. +0.4% (estimate)

Happy trading!

Tom